Are you looking for 2022 W4 Form that you can print at home? Look no further because we have gathered the top 10 W4 printable forms for 2022! These forms are essential for anyone who is employed in the United States and wants to file their taxes accurately. Let’s take a closer look at each form.

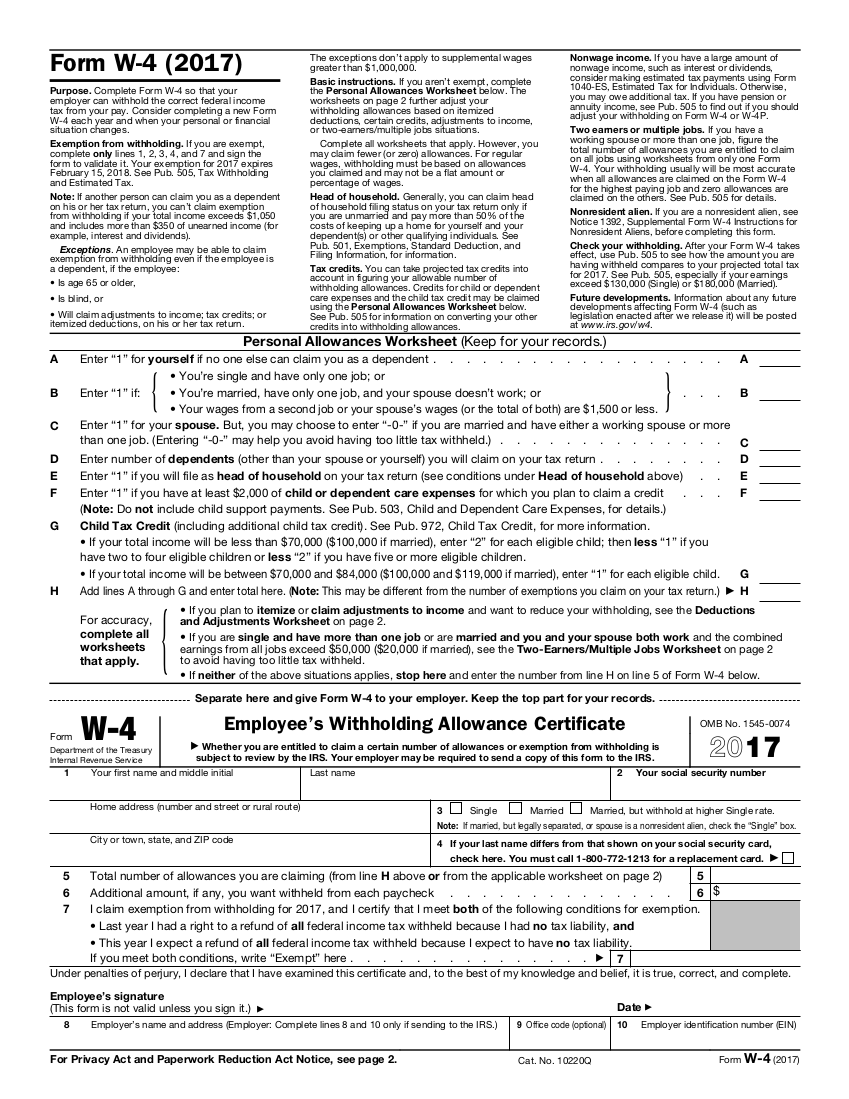

Form W4 2017 Printable - 2022 W4 Form

The Form W4 2017 Printable is one of the most popular W4 forms that is still in use today. It is a straightforward form that only requires your personal information, number of allowances, and any additional income. This form is ideal for those who want to claim the same exemptions as they did in 2017.

The Form W4 2017 Printable is one of the most popular W4 forms that is still in use today. It is a straightforward form that only requires your personal information, number of allowances, and any additional income. This form is ideal for those who want to claim the same exemptions as they did in 2017.

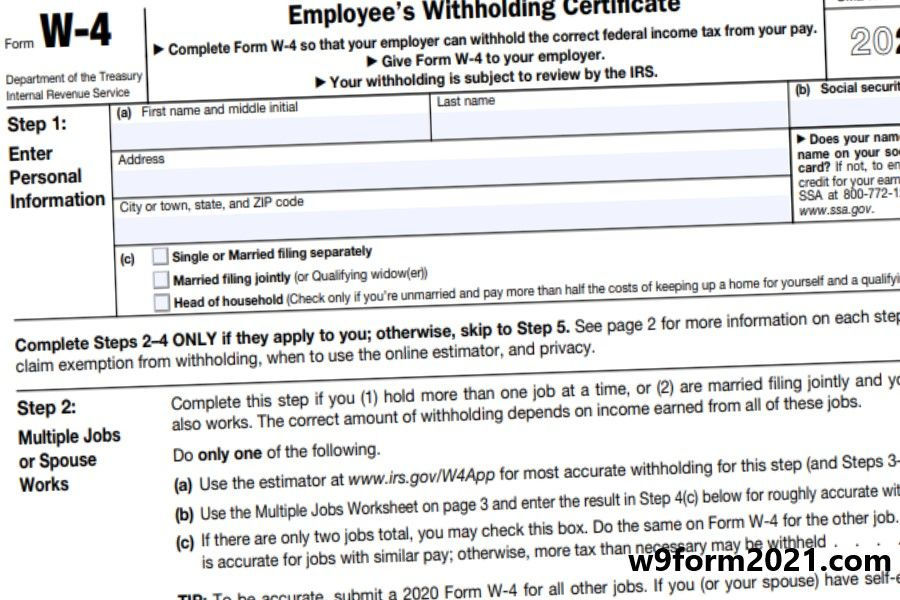

Printable W-4 Form 2022 - W4 Form 2022 Printable

The Printable W-4 Form 2022 is an updated version of the W4 form that includes the latest tax information. It is an easy-to-use form that requires your personal information, filing status, dependents, and any deductions or credits. This form is perfect for those who want to ensure that they are claiming the correct number of exemptions.

The Printable W-4 Form 2022 is an updated version of the W4 form that includes the latest tax information. It is an easy-to-use form that requires your personal information, filing status, dependents, and any deductions or credits. This form is perfect for those who want to ensure that they are claiming the correct number of exemptions.

2022 Form W-4 - IRS Tax Forms - W4 Form 2022 Printable

The 2022 Form W-4 is the latest version of the W4 form that is designed to provide accurate withholding for your taxes. It is a comprehensive form that requires your personal information, filing status, dependents, and any deductions or credits. This form is ideal for those who want to ensure that they are withholding the correct amount from their paycheck.

The 2022 Form W-4 is the latest version of the W4 form that is designed to provide accurate withholding for your taxes. It is a comprehensive form that requires your personal information, filing status, dependents, and any deductions or credits. This form is ideal for those who want to ensure that they are withholding the correct amount from their paycheck.

2022 Federal W4 Form To Print - W4 Form 2022 Printable

The 2022 Federal W4 Form is a vital document for anyone who is employed in the United States. It is a comprehensive form that requires your personal information, filing status, dependents, and any deductions or credits. This form is perfect for those who want to make sure that they are withholding the correct amount from their paycheck.

The 2022 Federal W4 Form is a vital document for anyone who is employed in the United States. It is a comprehensive form that requires your personal information, filing status, dependents, and any deductions or credits. This form is perfect for those who want to make sure that they are withholding the correct amount from their paycheck.

W4 Form 2022 Printable, FAQ, How to Fill Out - Ultimate Guide

The W4 Form 2022 Printable is a comprehensive form that can be used by anyone who is employed in the United States. It requires your personal information, filing status, dependents, and any deductions or credits. This form is perfect for those who want to ensure that they are withholding the right amount from their paycheck. Be sure to check out our FAQ and Ultimate Guide for tips on how to fill out the form correctly.

The W4 Form 2022 Printable is a comprehensive form that can be used by anyone who is employed in the United States. It requires your personal information, filing status, dependents, and any deductions or credits. This form is perfect for those who want to ensure that they are withholding the right amount from their paycheck. Be sure to check out our FAQ and Ultimate Guide for tips on how to fill out the form correctly.

Federal W-4 2022 - W4 Form 2022 Printable

The Federal W-4 2022 is an essential document for anyone who is employed in the United States. It is a comprehensive form that requires your personal information, filing status, dependents, and any deductions or credits. This form is perfect for those who want to make sure that they are withholding the correct amount from their paycheck.

The Federal W-4 2022 is an essential document for anyone who is employed in the United States. It is a comprehensive form that requires your personal information, filing status, dependents, and any deductions or credits. This form is perfect for those who want to make sure that they are withholding the correct amount from their paycheck.

Wisconsin Revenue 2021 W-4 Printable - 2022 W4 Form

The Wisconsin Revenue 2021 W-4 Printable is a comprehensive form that is designed specifically for Wisconsin residents. It requires your personal information, filing status, dependents, and any deductions or credits. This form is perfect for Wisconsin residents who want to make sure that they are withholding the correct amount from their paycheck.

The Wisconsin Revenue 2021 W-4 Printable is a comprehensive form that is designed specifically for Wisconsin residents. It requires your personal information, filing status, dependents, and any deductions or credits. This form is perfect for Wisconsin residents who want to make sure that they are withholding the correct amount from their paycheck.

Printable W4 2022 - W4 Form 2022 Printable

The Printable W4 2022 is an easy-to-use form that requires your personal information, filing status, dependents, and any deductions or credits. This form is perfect for those who want to ensure that they are withholding the right amount from their paycheck. It is available in both English and Spanish, making it accessible to more people.

The Printable W4 2022 is an easy-to-use form that requires your personal information, filing status, dependents, and any deductions or credits. This form is perfect for those who want to ensure that they are withholding the right amount from their paycheck. It is available in both English and Spanish, making it accessible to more people.

W4 Printable Forms 2022 Printable – Explained! - 2022 W-4 Form

W4 Printable Forms 2022 Printable is a comprehensive guide that explains the different W4 forms and how to fill them out correctly. It covers everything from your personal information to your filing status, dependents, and deductions. This guide is perfect for anyone who wants to file their taxes accurately.

W4 Printable Forms 2022 Printable is a comprehensive guide that explains the different W4 forms and how to fill them out correctly. It covers everything from your personal information to your filing status, dependents, and deductions. This guide is perfect for anyone who wants to file their taxes accurately.

2022 W4 Form Printable IRS - W4 Form 2022 Printable

The 2022 W4 Form Printable IRS is the latest version of the form that is designed to provide accurate withholding for your taxes. It is a comprehensive form that requires your personal information, filing status, dependents, and any deductions or credits. This form is ideal for those who want to ensure that they are withholding the correct amount from their paycheck.

The 2022 W4 Form Printable IRS is the latest version of the form that is designed to provide accurate withholding for your taxes. It is a comprehensive form that requires your personal information, filing status, dependents, and any deductions or credits. This form is ideal for those who want to ensure that they are withholding the correct amount from their paycheck.

Overall, these top 10 forms are an excellent resource for anyone who wants to file their taxes accurately. Whether you are self-employed or employed by a company, it is essential to complete the correct W4 form to ensure that you are not overpaying or underpaying taxes. Be sure to choose the form that is right for you and follow the instructions carefully to ensure that your taxes are filed correctly.