Have you ever heard of a W-9 form? If not, don’t worry - you’re not alone. Fortunately, it’s relatively straightforward to fill out a W-9 form, and in this post, we’ll cover everything you need to know to get it done.

What is a W-9 Form?

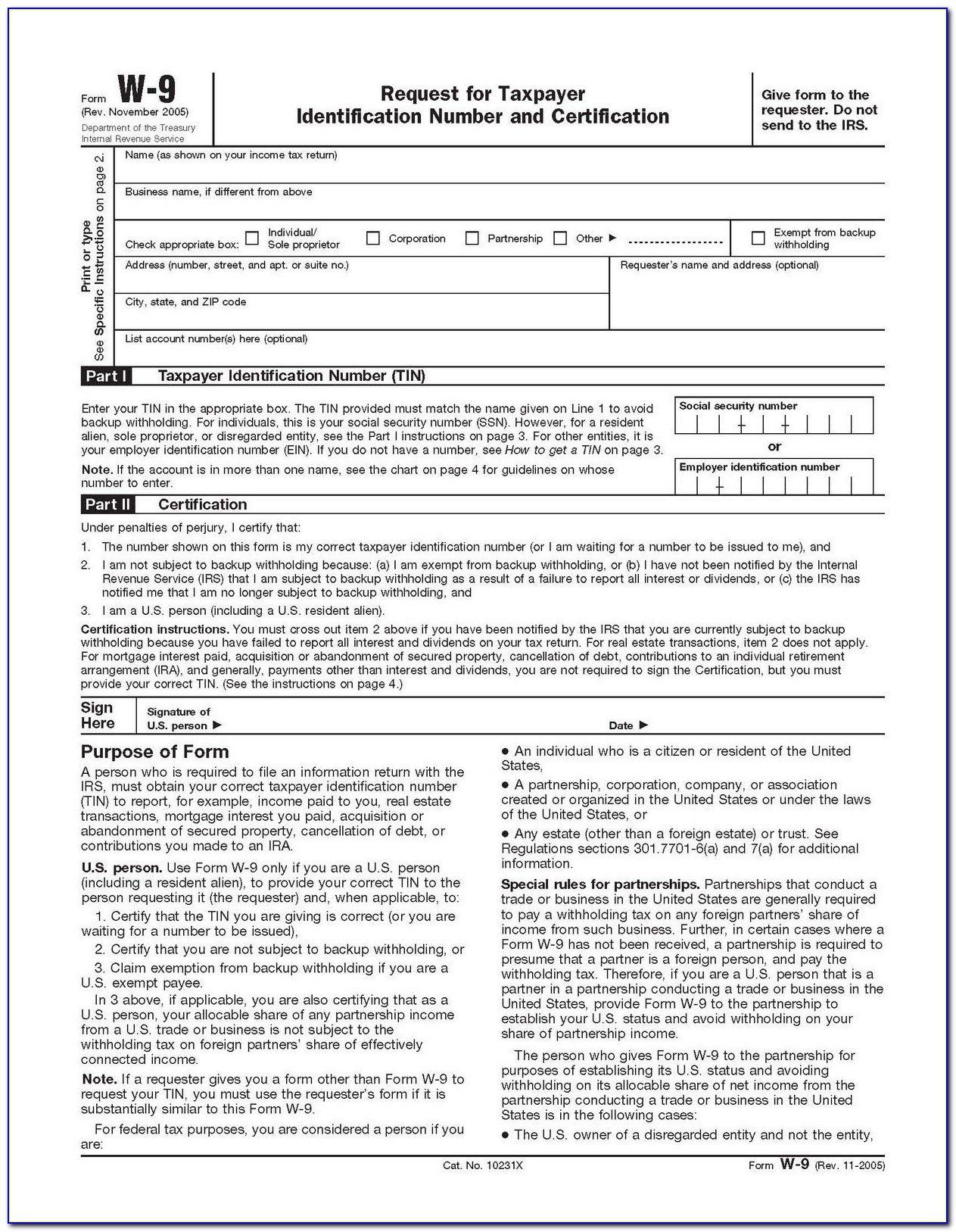

A W-9 form is a tax form used in the United States to request information from individuals who are being paid for work done as independent contractors or freelancers. This information is used to fill out IRS Form 1099-MISC, which reports income earned by the individual to the IRS.

Why Do You Need to Fill Out a W-9 Form?

If you’re being paid as an independent contractor or freelancer, filling out a W-9 form is a necessary step to ensure that your taxes are paid correctly. The person or company paying you is required to report the income they pay you to the IRS, and they must have accurate information to do so.

How to Fill Out a W-9 Form

Now that you understand the importance of the W-9 form, let’s look at how to fill one out. The form itself is relatively straightforward and can be completed in a matter of minutes. Here are the steps:

Step 1: Provide Your Name and Address

The first section of the W-9 form asks for your name and address. This information should match the name and address that the IRS has on file for you. If you’ve recently moved or changed your name, you may need to update your information with the IRS.

### Step 2: Provide Your Taxpayer Identification Number (TIN)

### Step 2: Provide Your Taxpayer Identification Number (TIN)

The second section of the form asks for your TIN. This could be your Social Security number (SSN) or an individual taxpayer identification number (ITIN) if you’re not eligible for an SSN. If you don’t have a TIN or don’t know what it is, you’ll need to apply for one from the IRS before completing the W-9 form.

Step 3: Provide Your Entity Classification

The third section of the form asks for your entity classification. This refers to the type of business entity you are, such as a sole proprietor, partnership, or corporation. If you’re not sure what your entity classification is, you may want to consider consulting with a tax professional.

Step 4: Sign and Date the Form

The last section of the form requires your signature, date, and certification that the information you’ve provided is correct. Once you’ve filled out the form, you should sign and date it, then provide it to the person or company that is paying you.

Submitting Your W-9 Form

Once you’ve filled out your W-9 form, you should submit it to the person or company that is paying you. They may ask you to provide a physical copy of the form, or they may accept an electronic version. Either way, it’s essential to keep a copy of the form for your records.

Final Thoughts

Although filling out a W-9 form may seem intimidating at first, it’s a necessary step to ensure that your taxes are reported correctly. By following the steps outlined in this post, you should be able to fill out the form quickly and easily, allowing you to focus on the work you love doing without worrying about the paperwork. And, if you need additional assistance, don’t hesitate to consult with a tax professional who can help you navigate the process.