If you are an Asian person living in the United States, you know the importance of filing your taxes correctly. One of the most important forms that you need to fill out is the W-9 form. This form is used by your employer or the person you are doing business with to obtain your taxpayer identification number (TIN) for tax reporting purposes. It is important to get this form right because if you don’t, it can lead to tax problems down the line.

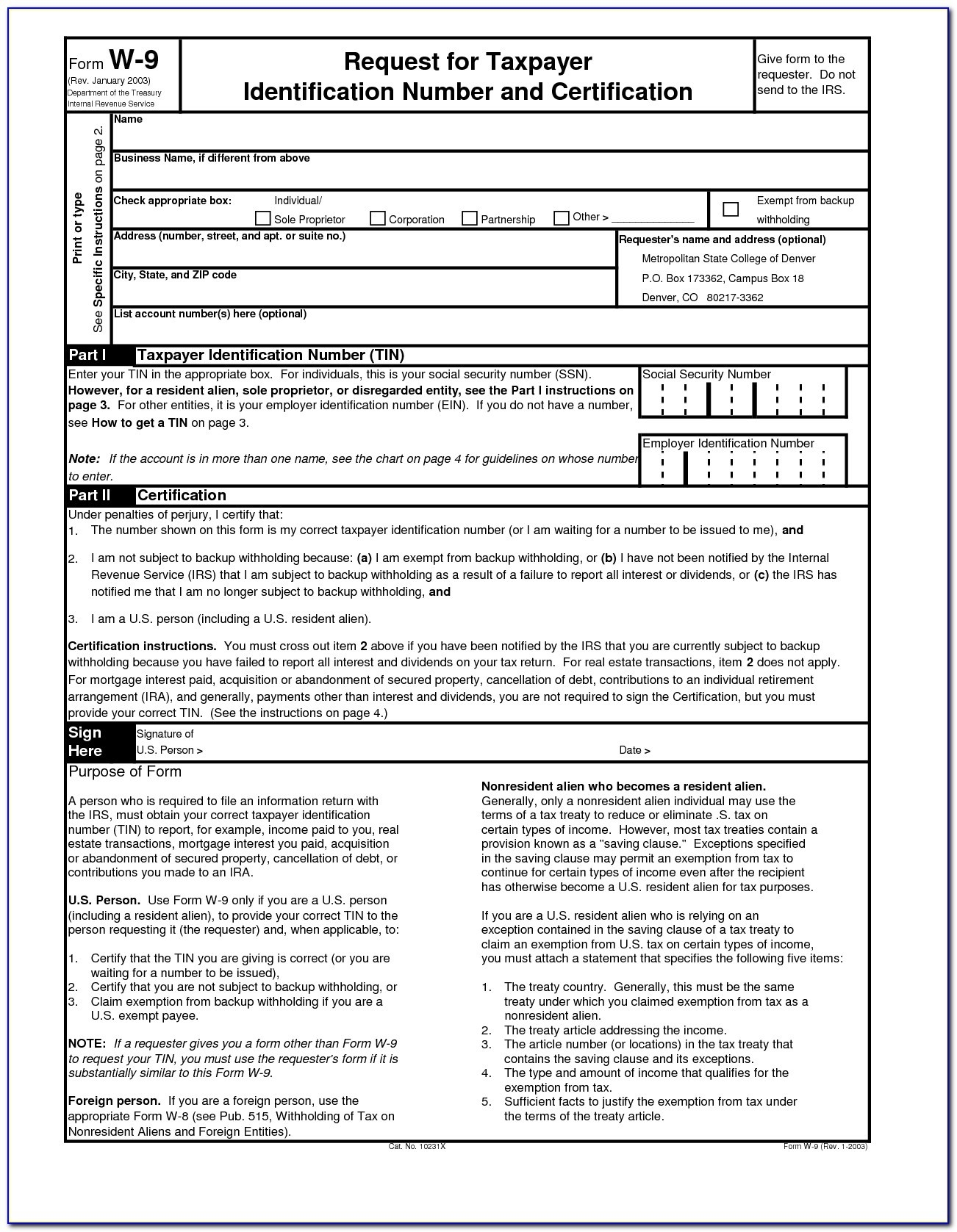

Blank W9 2020 Printable Pdf

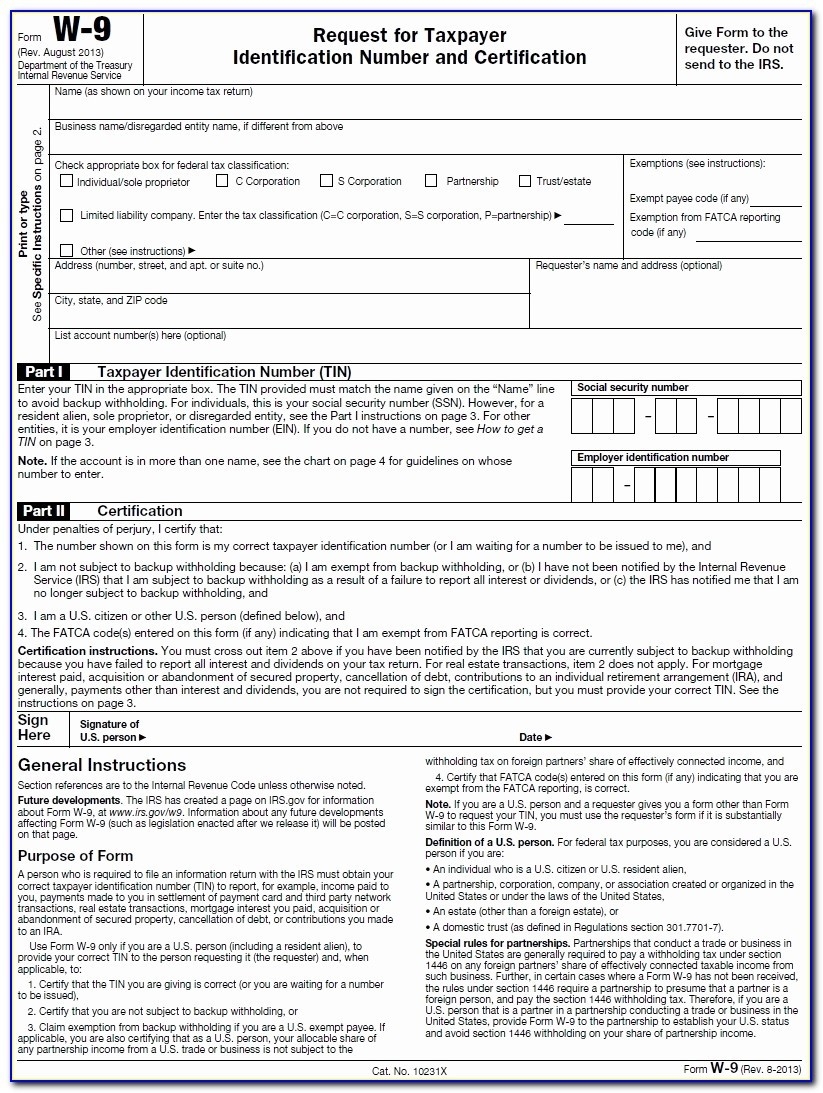

The W-9 form requires you to provide your name, address, and TIN. If you are a sole proprietor, your TIN is your Social Security number. If you are a corporation, partnership, or LLC, your TIN is your employer identification number (EIN).

The W-9 form requires you to provide your name, address, and TIN. If you are a sole proprietor, your TIN is your Social Security number. If you are a corporation, partnership, or LLC, your TIN is your employer identification number (EIN).

It is important that you provide accurate information on your W-9 form because if you don’t, it can lead to penalties and interest charges from the IRS. The person or entity that is paying you will use the information on your W-9 form to send you a 1099-MISC form, which shows how much money they paid you during the year.

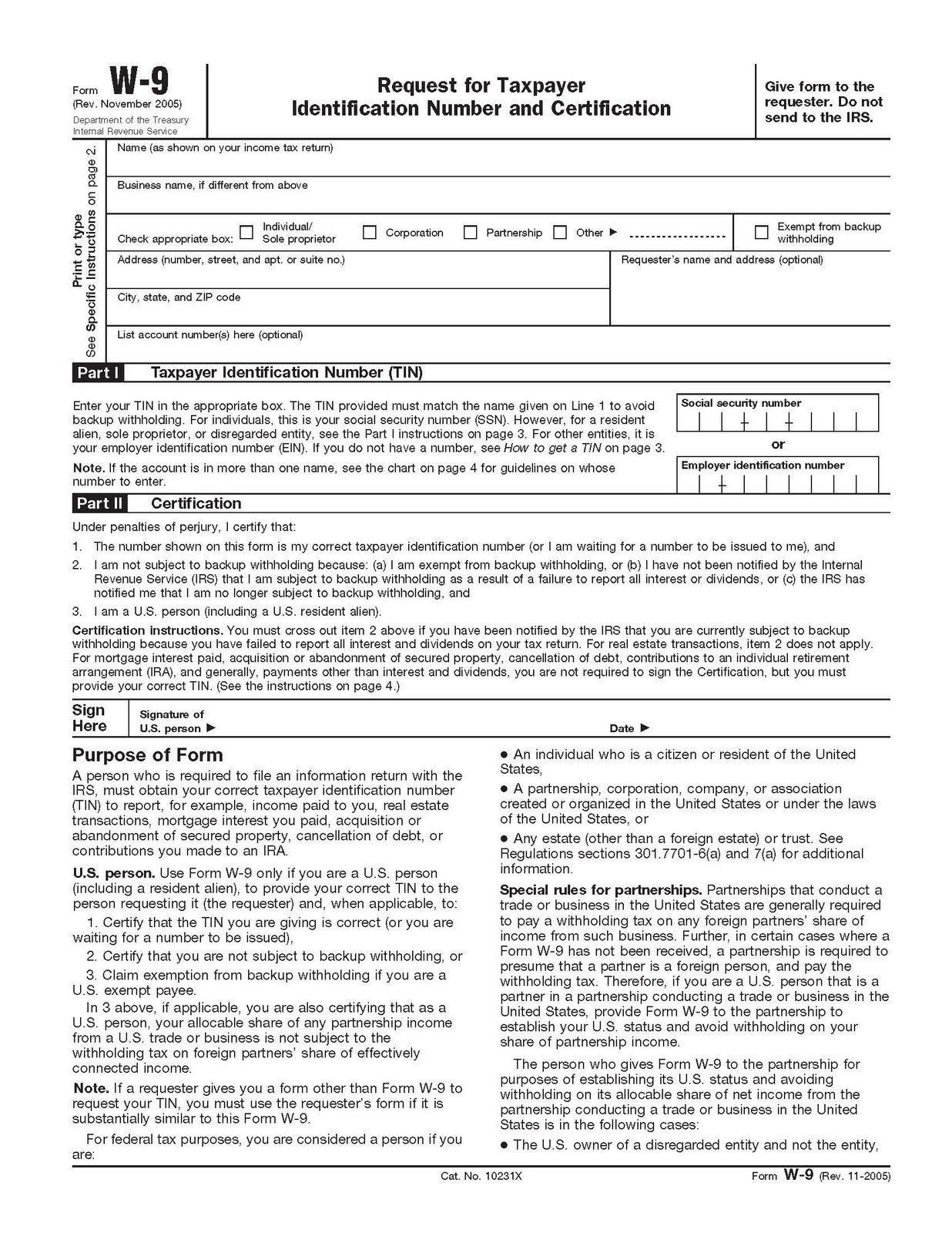

How to Fill out a W-9 2019

Filling out a W-9 form is relatively easy. First, you need to provide your name and address in the appropriate boxes at the top of the form. Then, you need to provide your TIN in the box labeled “Social security number or employer identification number.”

Filling out a W-9 form is relatively easy. First, you need to provide your name and address in the appropriate boxes at the top of the form. Then, you need to provide your TIN in the box labeled “Social security number or employer identification number.”

If you are an individual, you only need to fill out those sections of the form. If you are a corporation, partnership, or LLC, you will also need to provide your business name in the appropriate box.

Blank W 9 Form 2021

Once you have filled out the form, you need to sign and date it. You are certifying that the information you have provided is true and correct to the best of your knowledge. Once you have completed the form, you should keep a copy for your own records and give the original to the person or entity that is paying you.

Once you have filled out the form, you need to sign and date it. You are certifying that the information you have provided is true and correct to the best of your knowledge. Once you have completed the form, you should keep a copy for your own records and give the original to the person or entity that is paying you.

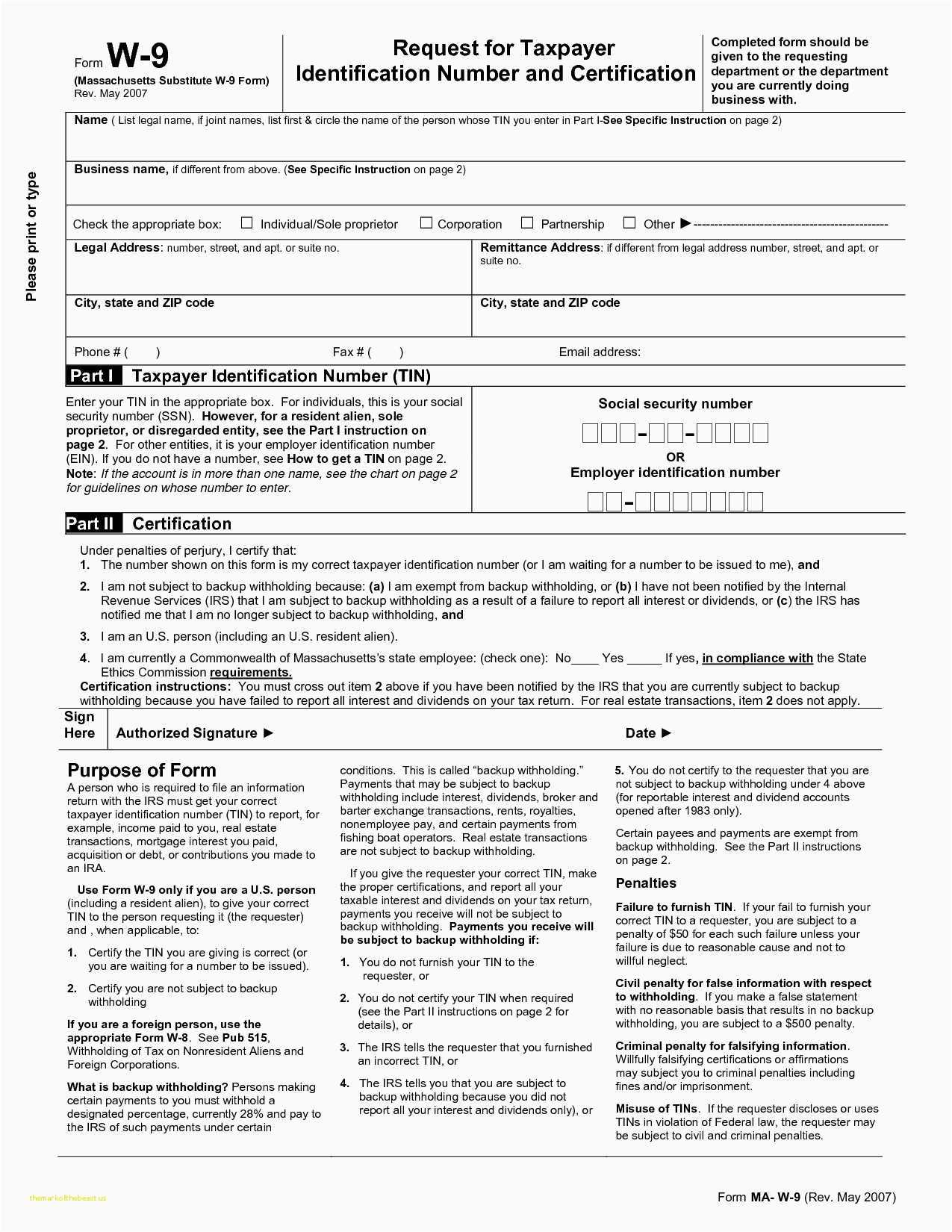

W-9 Form 2019 Printable - IRS W-9 Tax Blank in PDF

It is important to note that you do not have to provide a W-9 form to everyone who pays you. You only need to provide a W-9 form to people who will be issuing you a 1099-MISC form. For example, if you are a freelancer and you provide services to a company, and they pay you less than $600 during the year, they do not need to issue you a 1099-MISC form, and you do not need to provide them with a W-9 form.

It is important to note that you do not have to provide a W-9 form to everyone who pays you. You only need to provide a W-9 form to people who will be issuing you a 1099-MISC form. For example, if you are a freelancer and you provide services to a company, and they pay you less than $600 during the year, they do not need to issue you a 1099-MISC form, and you do not need to provide them with a W-9 form.

However, if the company pays you $600 or more during the year, they will need to issue you a 1099-MISC form, and you will need to provide them with a W-9 form.

W-9 Form 2019 Printable - Irs W-9 Tax Blank In Pdf - Free Printable W9

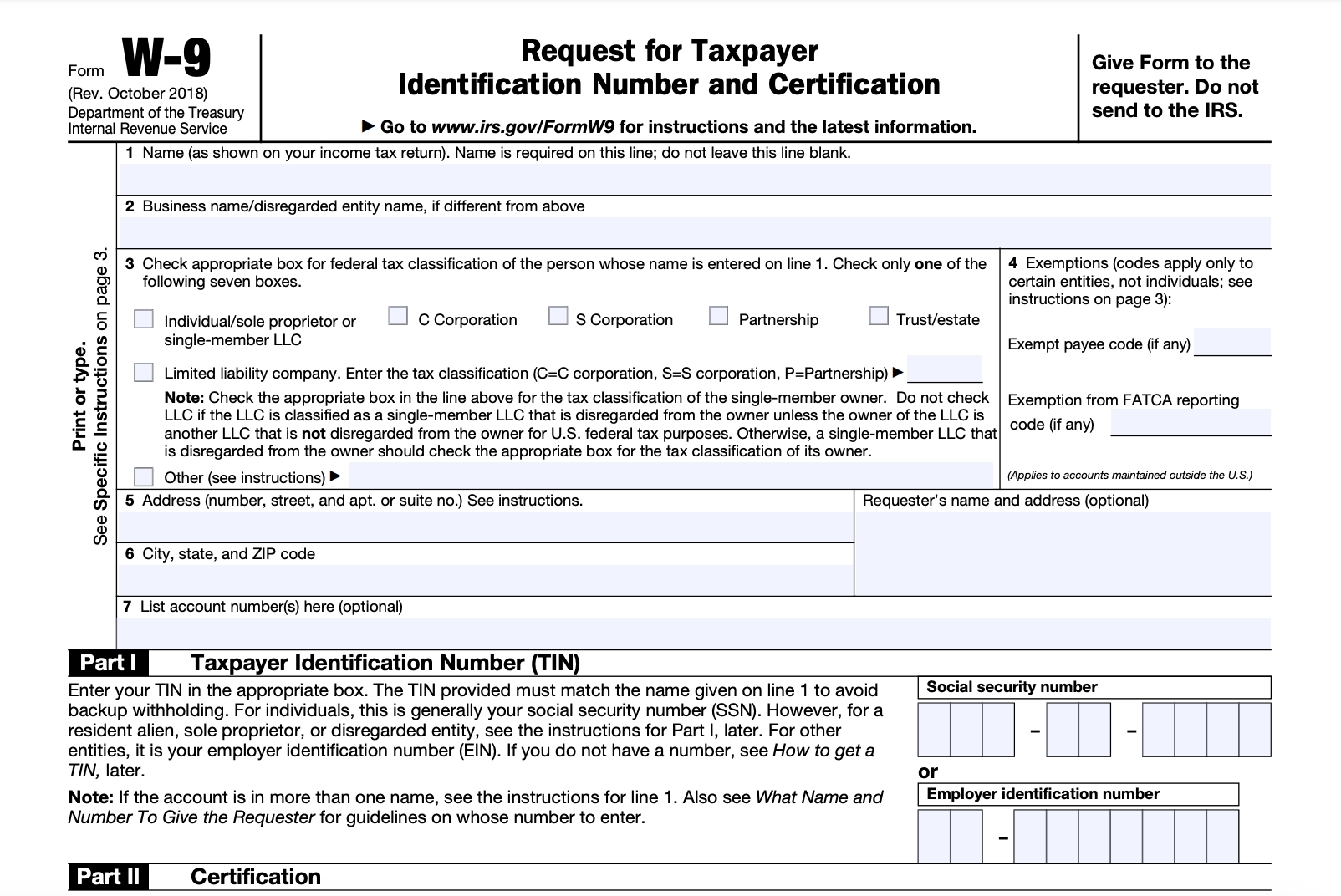

If you are an independent contractor, it is especially important that you provide accurate information on your W-9 form. The person or entity that is paying you will use the information on your W-9 form to issue you a 1099-MISC form.

If you are an independent contractor, it is especially important that you provide accurate information on your W-9 form. The person or entity that is paying you will use the information on your W-9 form to issue you a 1099-MISC form.

If the information on your W-9 form is incorrect, it can lead to problems down the line. For example, if you provide an incorrect TIN, the person or entity that is paying you will not be able to issue you a 1099-MISC form. This can lead to the IRS auditing your tax return and possibly imposing penalties and interest charges.

2020 W9 Blank Tax Form

Overall, filling out a W-9 form is a straightforward process. It is important that you provide accurate information on the form and keep a copy for your own records. If you have any questions about the form, you should consult with a tax professional or contact the IRS.

Overall, filling out a W-9 form is a straightforward process. It is important that you provide accurate information on the form and keep a copy for your own records. If you have any questions about the form, you should consult with a tax professional or contact the IRS.

W 9 Forms Printable 2019

Remember, it is your responsibility to ensure that you have provided accurate information on your W-9 form. If you provide incorrect information, it can lead to problems down the line. By taking the time to fill out the form correctly, you can avoid these problems and ensure that you are in compliance with the tax laws.

Remember, it is your responsibility to ensure that you have provided accurate information on your W-9 form. If you provide incorrect information, it can lead to problems down the line. By taking the time to fill out the form correctly, you can avoid these problems and ensure that you are in compliance with the tax laws.

2020 W9 Printable Blank

So if you are an Asian person living in the United States, make sure that you stay on top of your taxes by filling out your W-9 form correctly. By doing so, you can avoid penalties and interest charges from the IRS and ensure that you are in compliance with the tax laws.

So if you are an Asian person living in the United States, make sure that you stay on top of your taxes by filling out your W-9 form correctly. By doing so, you can avoid penalties and interest charges from the IRS and ensure that you are in compliance with the tax laws.

Remember, it’s better to be safe than sorry when it comes to your taxes. So take the time to fill out your W-9 form correctly, and you’ll be on your way to a smooth and hassle-free tax season!