There’s no denying the fact that tax season can be a stressful and confusing time for many of us. But, luckily, there are resources available to help make the process a little bit easier - one of which is the W-9 form. In this post, we’ll discuss everything you need to know about the W-9 form for 2021 and provide a printable PDF for your convenience.

What is the W-9 form?

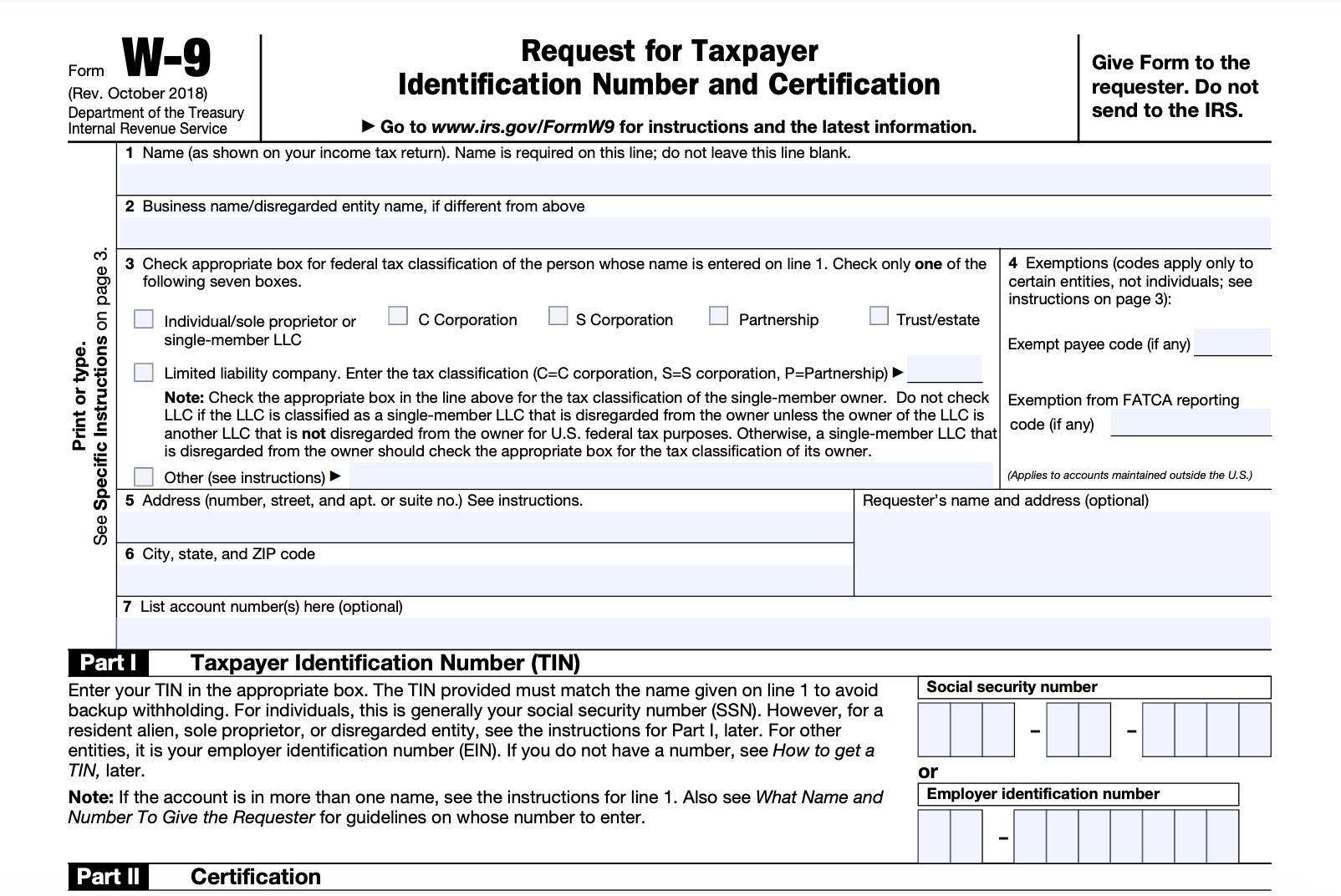

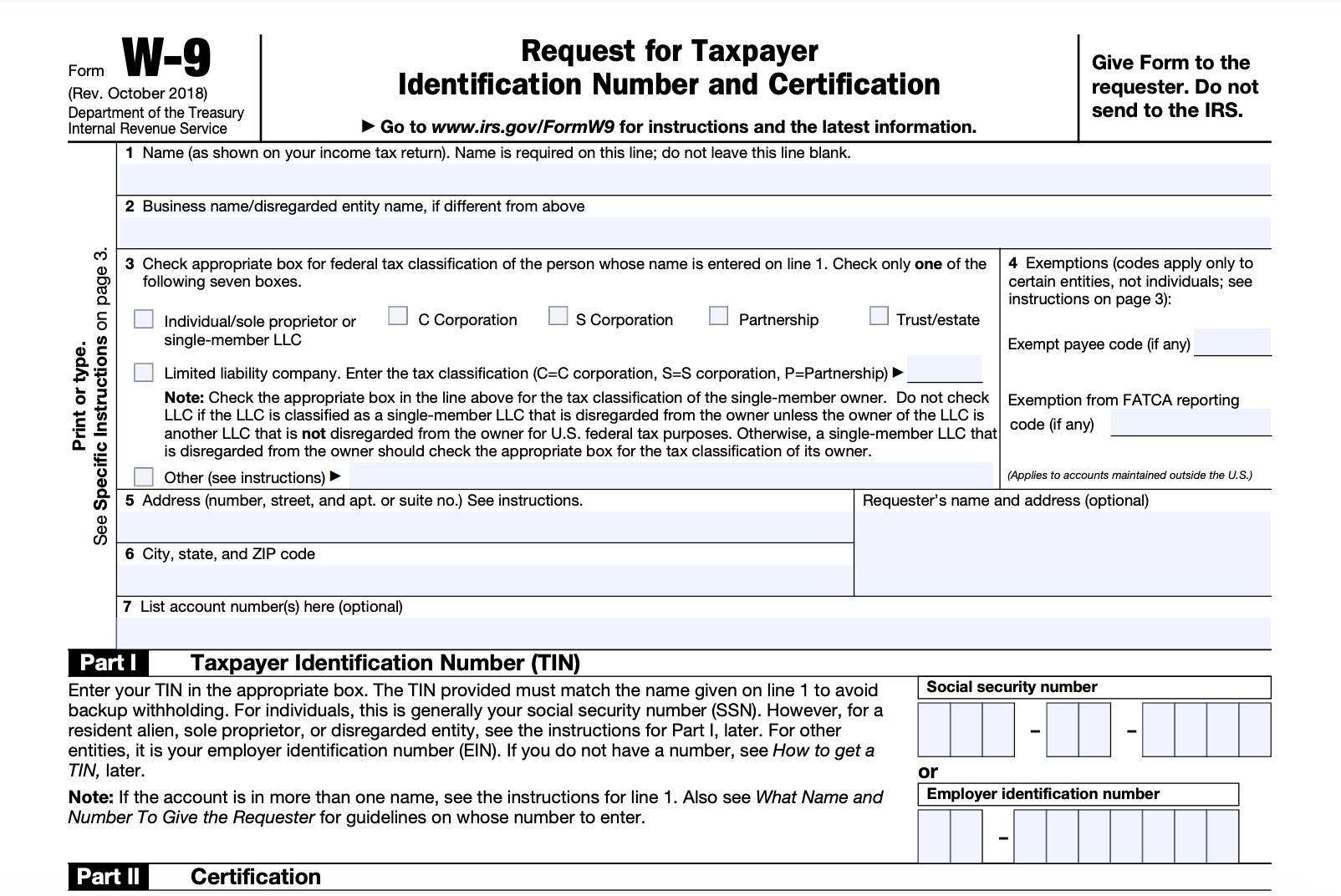

The W-9 form is an official Internal Revenue Service (IRS) form that individuals and businesses use to provide their taxpayer identification number (TIN) to other entities. TINs can be Social Security numbers (SSNs), employer identification numbers (EINs), or individual taxpayer identification numbers (ITINs).

The purpose of the W-9 form is to provide accurate information for tax reporting purposes to the entity that will be paying you. For example, if you’re a freelancer and a client hires you for a project, they’ll need your TIN to file a Form 1099 with the IRS if they pay you more than $600 during the year.

The purpose of the W-9 form is to provide accurate information for tax reporting purposes to the entity that will be paying you. For example, if you’re a freelancer and a client hires you for a project, they’ll need your TIN to file a Form 1099 with the IRS if they pay you more than $600 during the year.

When is the W-9 form necessary?

The W-9 form is typically necessary any time you’re being paid by an entity that needs your TIN for tax purposes. This includes scenarios like:

- Working as a contractor or freelancer and being paid more than $600 during the year

- Receiving interest or dividend income from a financial institution

- Receiving rental income from a property

- Receiving unemployment benefits or other forms of government compensation

How to fill out the W-9 form

Now that you know why the W-9 form is necessary, let’s discuss how to fill it out. The form itself is relatively simple, with just a few sections to complete.

Section 1: Name and address

The first section of the W-9 form asks for your name and address. This should be your legal name and the address where you receive your mail. If you’re completing the form on behalf of a business, you would provide the business name and address here.

Section 2: Taxpayer identification number

This section is where you’ll provide your taxpayer identification number (TIN). You’ll need to choose whether you’re providing a Social Security number (SSN) or an employer identification number (EIN). If you’re an individual, you’ll typically provide your SSN. If you’re completing the form on behalf of a business or other entity, you would provide the EIN.

Section 3: Exemptions

This section is where you would indicate any exemptions that apply to you. For example, if you’re exempt from backup withholding due to being subject to certain other tax provisions, you would indicate that here. Most individuals will leave this section blank.

Section 4: Signature

The final section of the W-9 form is where you’ll sign and date the form. By signing, you’re certifying, under penalties of perjury, that the information you’ve provided is accurate.

Can the W-9 form be completed electronically?

Yes! The W-9 form can be completed electronically, which can be convenient for both you and the entity requesting your information. Many businesses and organizations use electronic signature software to collect and manage W-9 forms. This allows you to avoid printing and mailing the form and can speed up the process. Just make sure that any electronic signatures you use are legally binding in your jurisdiction.

Wrapping up

That’s everything you need to know about the W-9 form for 2021. Remember, if you’re being paid by an entity that needs your TIN for tax reporting purposes, you’ll likely need to fill out a W-9 form. Make sure you complete the form accurately and legibly to avoid complications down the line.

To make things even easier for you, we’ve provided a printable PDF version of the W-9 form for 2021. Just click the link below to download the file and fill it out at your convenience. Happy tax season!

To make things even easier for you, we’ve provided a printable PDF version of the W-9 form for 2021. Just click the link below to download the file and fill it out at your convenience. Happy tax season!