If you’re a working professional or an employer, you’re probably aware of the W-4 form, which needs to be filled out by every employee when they start a new job. The W-4 form helps your employer determine the correct amount of federal income tax to withhold from your paychecks.

What is a W-4 Form?

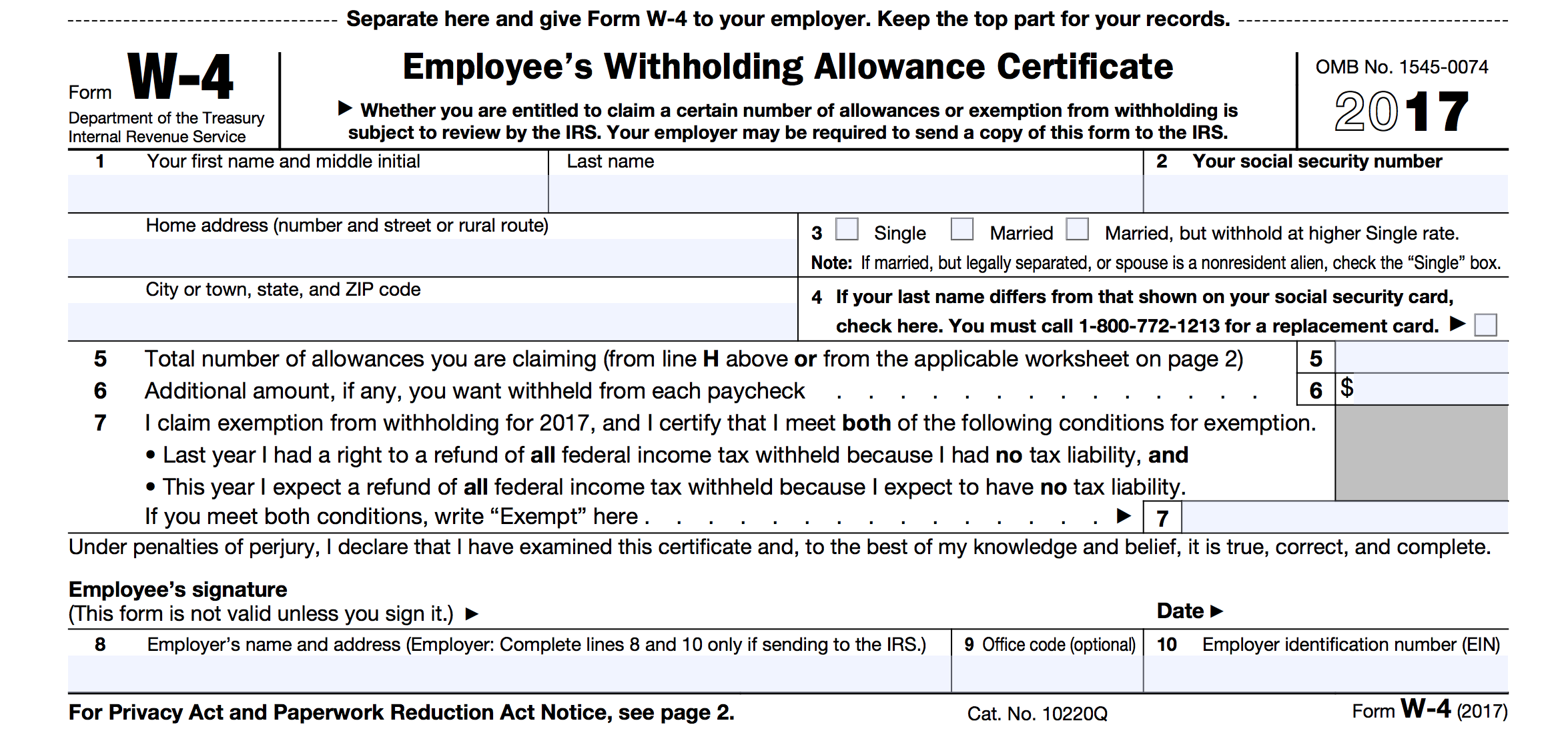

A W-4 form is a document that an employee needs to fill out when they start a new job. The purpose of this form is to provide your employer with information about your tax situation. This information will help them determine how much tax to withhold from your paycheck each pay period.

The W-4 form has several sections that you need to fill out. You need to provide your personal information, such as your name, address, and Social Security number. You also need to provide information about your marital status, the number of dependents you have, and whether you’re claiming any allowances. Each allowance reduces the amount of tax that is withheld from your paycheck.

Why is it important to fill out a W-4 Form?

Filling out a W-4 form is important because it helps your employer determine how much federal income tax to withhold from your paycheck. If you don’t fill out a W-4 form, your employer will withhold taxes as if you were single and claiming no allowances. This could result in too much or too little tax being withheld from your paycheck.

If too little tax is withheld from your paycheck, you could owe money to the IRS when you file your tax return. If too much tax is withheld, you’ll get a refund, but you’re essentially giving the government an interest-free loan. By filling out a W-4 form, you can ensure that the correct amount of tax is withheld from your paycheck.

How to Fill out a W-4 Form?

Filling out a W-4 form is relatively easy. Here’s how to do it:

- Start with your personal information: Provide your full name, address, and Social Security number.

- Marital status: Choose your marital status from the list of options.

- Allowances: The more allowances you claim, the less tax will be withheld from your paycheck. If you’re not sure how many allowances to claim, use the IRS withholding estimator.

- Additional withholding: If you want additional tax withheld from your paycheck, you can indicate that on the form.

- Signature: Finally, sign and date the form and give it to your employer.

When to Update Your W-4 Form?

You should update your W-4 form whenever your personal or financial situation changes. For example, if you get married or have a child, you may need to adjust the number of allowances you’re claiming. If you get a second job, you’ll need to fill out a new W-4 form for that job as well.

It’s also a good idea to review your W-4 form annually to make sure it still reflects your current tax situation. If you had a large tax bill or a large refund on your most recent tax return, you may want to adjust the number of allowances you’re claiming.

Conclusion

Filling out a W-4 form is an important step in starting a new job. It ensures that the correct amount of federal income tax is withheld from your paycheck. By following the simple steps outlined above, you can fill out your W-4 form with ease and avoid any future issues with your taxes.

Free Printable W-4 Forms

If you’re looking for a printable W-4 form, you’ve come to the right place! Here at W4FormPrintable.com, we offer free printable W-4 forms for you to download and print. Our W-4 forms are up-to-date with the latest tax regulations, so you can be sure that you’re filling them out correctly.

If you’re looking for a printable W-4 form, you’ve come to the right place! Here at W4FormPrintable.com, we offer free printable W-4 forms for you to download and print. Our W-4 forms are up-to-date with the latest tax regulations, so you can be sure that you’re filling them out correctly.

To download our free printable W-4 forms, simply click on the link below. Choose the form that applies to your personal situation and print it out. Then, fill out the form and give it to your employer.

With our free printable W-4 forms, you can take the hassle out of filling out this important document. Download yours today!