It’s that time of year again. People are scrambling to get their taxes in order and file them on time. We know it can be a daunting task, but fear not, dear reader. We’ve got you covered with these blank tax forms printable to make the process a little bit easier.

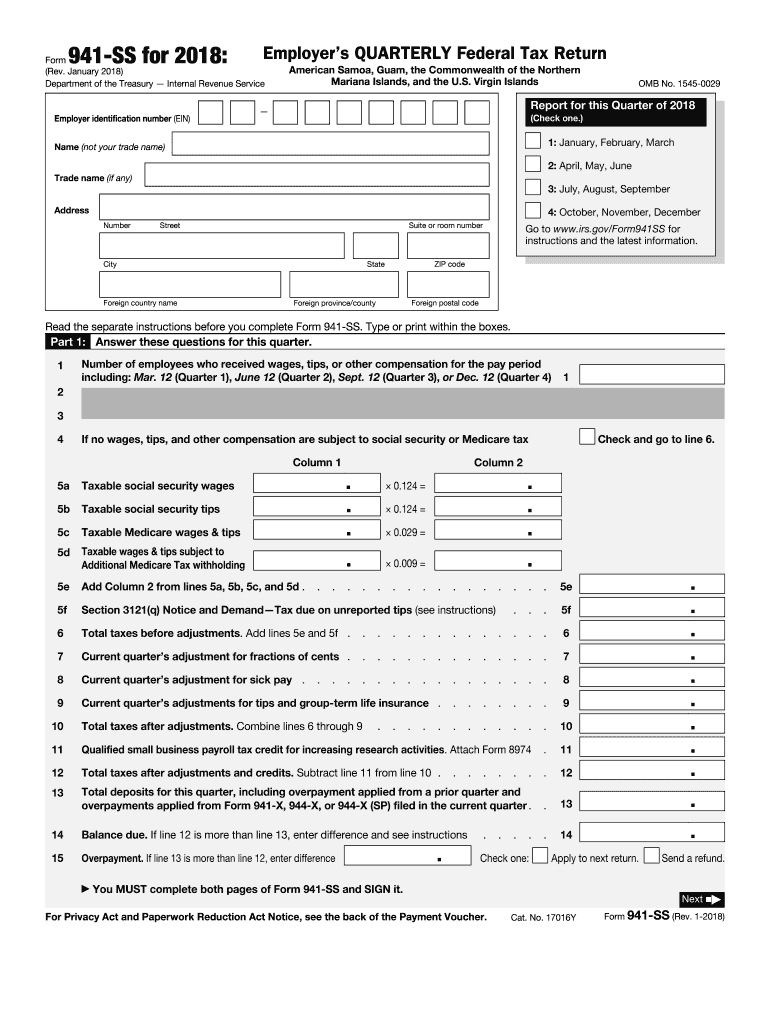

Form 941

The first form we have for you is Form 941, which is used to report payroll taxes. It’s important to fill this form out correctly, as any mistakes can result in penalties and fines. Make sure to take your time and double check all the information you provide.

The first form we have for you is Form 941, which is used to report payroll taxes. It’s important to fill this form out correctly, as any mistakes can result in penalties and fines. Make sure to take your time and double check all the information you provide.

Form W-4

The next form we have is Form W-4, which is used to determine the amount of federal income tax withheld from your paycheck. This form may seem a little confusing at first, but take your time and follow the instructions carefully. It’s important to make sure you’re withholding the appropriate amount to avoid any surprises come tax season.

The next form we have is Form W-4, which is used to determine the amount of federal income tax withheld from your paycheck. This form may seem a little confusing at first, but take your time and follow the instructions carefully. It’s important to make sure you’re withholding the appropriate amount to avoid any surprises come tax season.

Schedule C

If you’re a small business owner, you’ll need to familiarize yourself with IRS Schedule C. This form is used to report your business income and expenses, and calculate your net profit or loss. It’s important to keep accurate records throughout the year to make filling out this form easier come tax season.

If you’re a small business owner, you’ll need to familiarize yourself with IRS Schedule C. This form is used to report your business income and expenses, and calculate your net profit or loss. It’s important to keep accurate records throughout the year to make filling out this form easier come tax season.

Form 1099-MISC

Individuals and businesses who pay independent contractors $600 or more during the year will need to file Form 1099-MISC. This form is used to report the income paid to the contractor, and must be filed with the IRS and provided to the contractor by January 31st. Make sure to keep accurate records of all payments made to contractors throughout the year.

Individuals and businesses who pay independent contractors $600 or more during the year will need to file Form 1099-MISC. This form is used to report the income paid to the contractor, and must be filed with the IRS and provided to the contractor by January 31st. Make sure to keep accurate records of all payments made to contractors throughout the year.

Form 8863

For students or parents of students, Form 8863 is used to claim education credits on your tax return. This can include the American Opportunity Credit or the Lifetime Learning Credit. Make sure to have all relevant information regarding your educational expenses on hand when filling out this form.

For students or parents of students, Form 8863 is used to claim education credits on your tax return. This can include the American Opportunity Credit or the Lifetime Learning Credit. Make sure to have all relevant information regarding your educational expenses on hand when filling out this form.

Form 1040

And finally, we have Form 1040, which is the main tax form used by individuals to report their income and calculate their tax liability. This form can seem daunting, but take your time and follow the instructions carefully. Make sure to have all relevant documentation on hand, such as W-2s and 1099s.

And finally, we have Form 1040, which is the main tax form used by individuals to report their income and calculate their tax liability. This form can seem daunting, but take your time and follow the instructions carefully. Make sure to have all relevant documentation on hand, such as W-2s and 1099s.

With these blank tax forms printable, you should be better prepared for tax season. Remember to take your time and double check all information provided. And always consult with a tax professional if you have any questions or concerns.