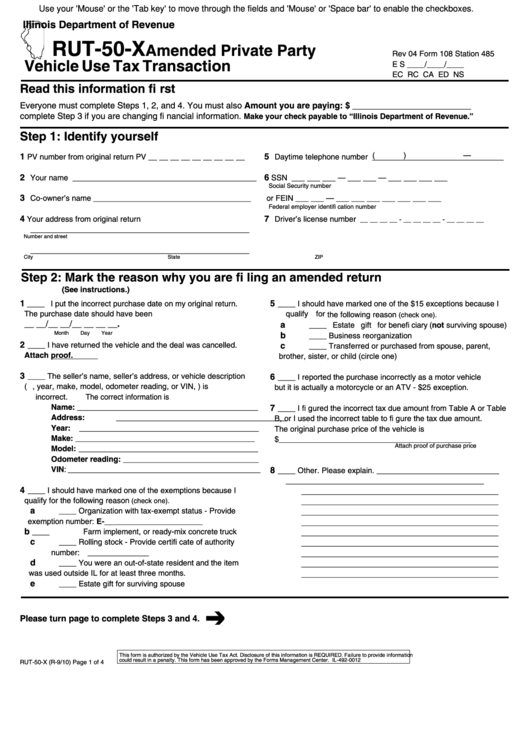

Oh, honey! Have y’all seen the latest fillable form for Rut-50-X? Lord have mercy, it’s a mess! But don’t worry, I gotcha covered. Let’s take a look at this form, step by step.

First, let’s get a look at the form

Whoo, child! This form is a doozy, but don’t fret. We’re going to tackle it together.

Whoo, child! This form is a doozy, but don’t fret. We’re going to tackle it together.

What is Rut-50-X?

For those of y’all who don’t know, Rut-50-X is the Amended Private Party Vehicle Use Tax form. Basically, if you’ve recently bought or sold a used car, this is the form you need to fill out to report taxes to the state. But this form isn’t just for private parties. If you are a dealership that sold or leased a vehicle to an individual or private party, you also need to file this form.

What do you need to fill out this form?

Well, honey, let me tell you. There are quite a few things you need before you start filling out this form. Here’s a list:

- The original Rut-50 Private Party Vehicle Use Tax form

- A copy of the bill of sale

- The original title, if available

- A copy of the current registration and title, if applicable

- A check or money order payable to the Illinois Department of Revenue, if you owe any taxes

Now, if you’re just amending your original Rut-50 form, you’ll also need to have a reason for the amendment. Was the original form filled out incorrectly? Did you change your mind about how the taxes should be reported? Make sure you have a reason for why you’re filing an amended form.

What do you do with the form once it’s filled out?

Once you’ve filled out the Rut-50-X form, honey, it’s time to mail it off to the Illinois Department of Revenue. But listen, boo, make sure you make a copy of everything you’re sending. This is important just in case something gets lost in the mail or if there is a question about your submission. Keep copies of the original Rut-50 form, the bill of sale, the title, and the amended Rut-50-X form for your records.

What if you need help filling out this form?

Don’t worry, child. The Illinois Department of Revenue has got you covered. You can call their toll-free number or visit their website to get help. You can also check out the instructions that come with the form for additional guidance on how to fill it out.

Well, honey, we made it!

That was a lot to take in, but we made it through together. Filling out the Rut-50-X form may seem daunting at first, but with a little help, you can get through it with ease. Make sure you have all the necessary paperwork, take your time filling out the form, and double-check everything before you mail it off. Now, go ahead and fill out that form! I know you can do it, boo.