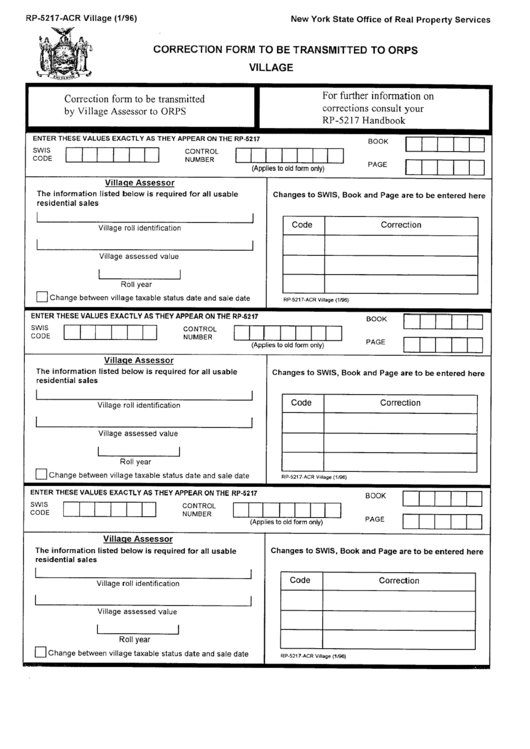

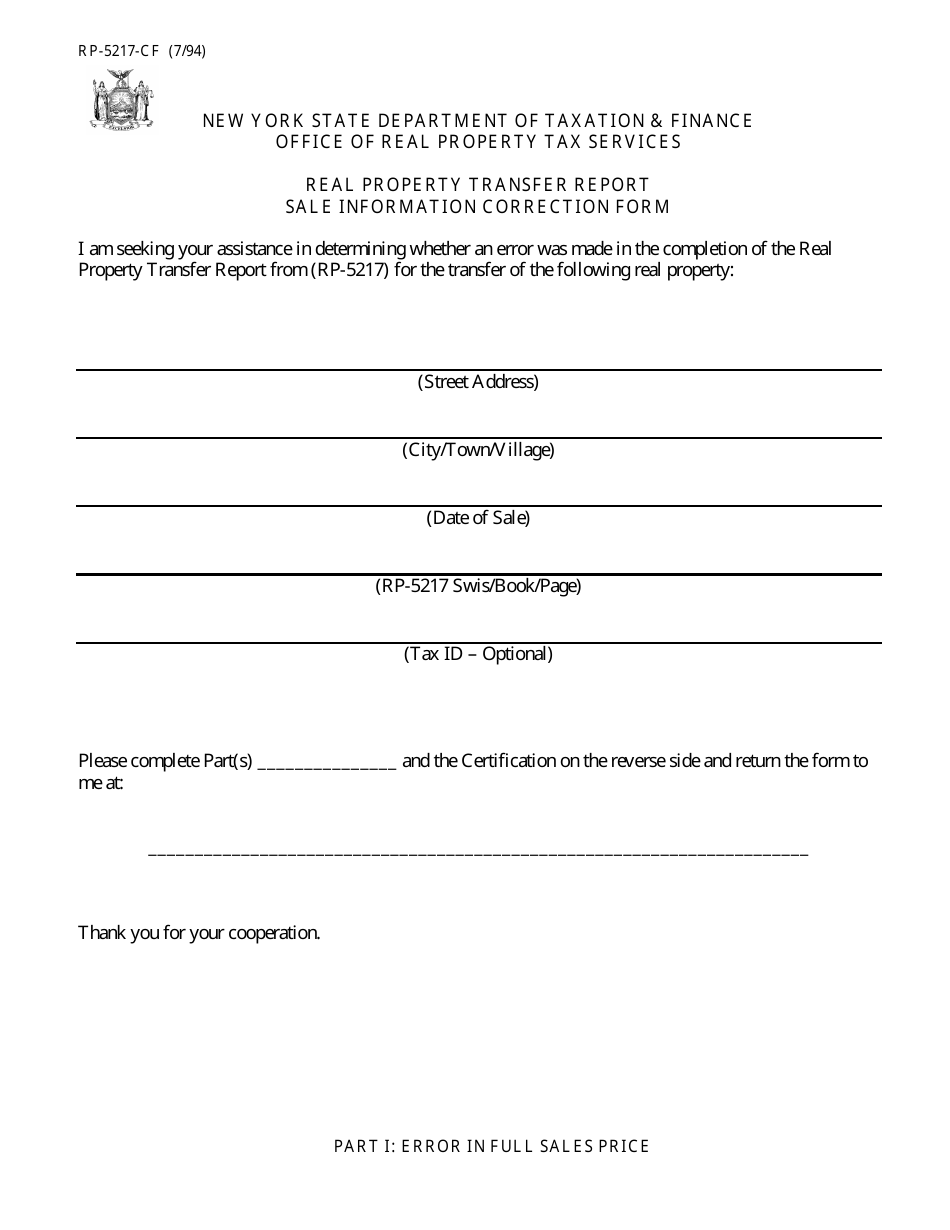

When it comes to real estate transactions in New York, there are a lot of forms and paperwork to keep track of. One of these forms is Form RP-5217-APP-1, also known as the Application/Agreement for RPS035 Transmittal to ORPTS.

What is Form RP-5217-APP-1?

Form RP-5217-APP-1 is a legal document used in real estate transactions in New York State. This form is required to be filed with the local county clerk’s office whenever a property is sold or transferred. The information provided on this form is used to help determine the proper assessment for tax purposes.

The form is typically completed by the buyer of the property, but in some cases the seller may complete the form. It is important to ensure that all of the information on the form is accurate and complete, as any errors or omissions can result in delays or penalties.

The form is typically completed by the buyer of the property, but in some cases the seller may complete the form. It is important to ensure that all of the information on the form is accurate and complete, as any errors or omissions can result in delays or penalties.

What information is required on Form RP-5217-APP-1?

The following information is required on Form RP-5217-APP-1:

- The name, address, and phone number of the buyer and seller

- The date of the sale or transfer

- The sale price of the property

- The location and description of the property

- The type of property (residential, commercial, etc.)

- The name and address of the lender (if applicable)

- The name and address of the title company

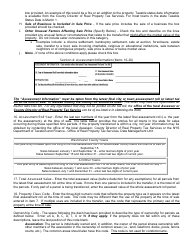

In addition to this information, there may be other requirements depending on the specific circumstances of the transaction. For example, if the sale involves a cooperative apartment or a property located in a historic district, additional paperwork may be required.

In addition to this information, there may be other requirements depending on the specific circumstances of the transaction. For example, if the sale involves a cooperative apartment or a property located in a historic district, additional paperwork may be required.

How do I file Form RP-5217-APP-1?

Form RP-5217-APP-1 must be filed with the county clerk’s office within the county where the property is located. The form can be filed in person or by mail, and there is typically a filing fee.

Before submitting the form, it is important to double-check all of the information for accuracy and completeness. Any errors or omissions can result in delays or penalties.

What happens after Form RP-5217-APP-1 is filed?

After Form RP-5217-APP-1 is filed, the information provided on the form is used to help determine the proper assessment for tax purposes. This means that the property may be reassessed based on the sale price and other information provided on the form.

In addition, the county clerk’s office will issue a receipt acknowledging that the form has been filed. This receipt should be kept in a safe place, as it may be required for future reference.

In addition, the county clerk’s office will issue a receipt acknowledging that the form has been filed. This receipt should be kept in a safe place, as it may be required for future reference.

What happens if I don’t file Form RP-5217-APP-1?

Failure to file Form RP-5217-APP-1 can result in penalties and fees. In some cases, the county may also be able to re-assess the property and impose higher taxes. In addition, failure to file the form can make it difficult to establish ownership of the property and may create other legal issues.

What other forms may be required?

What other forms may be required?

In addition to Form RP-5217-APP-1, there are several other forms that may be required in a real estate transaction in New York:

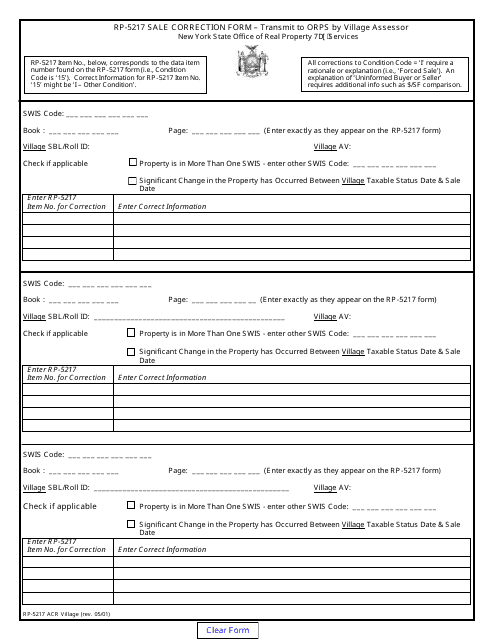

- Form RP-5217-PDF: This form is used to report real property transfer tax information to the New York State Department of Taxation and Finance.

- Form RP-5217-NW: This form is used to provide notice of a transfer of a controlling interest in an entity that owns real property in New York.

- Form TP-584: This form is used to document the consideration paid for real property and to calculate the real estate transfer tax owed.

- Form TP-584.1: This form is used to provide additional details about the transaction, such as the names of the sellers and buyers and the address of the property.

Depending on the specifics of the transaction, other forms may be required as well. It is important to consult with a qualified real estate attorney to ensure that all necessary forms are completed and filed correctly.

Depending on the specifics of the transaction, other forms may be required as well. It is important to consult with a qualified real estate attorney to ensure that all necessary forms are completed and filed correctly.

Where can I find Form RP-5217-APP-1?

Form RP-5217-APP-1 can be obtained from the county clerk’s office, or it may be available for download from the New York State Department of Taxation and Finance website.

It is important to ensure that the form being used is the most up-to-date version, as older versions may not contain all of the required information and may not be accepted by the county.

It is important to ensure that the form being used is the most up-to-date version, as older versions may not contain all of the required information and may not be accepted by the county.

Conclusion

When buying or selling property in New York State, it is important to be aware of the various forms and paperwork that may be required. Form RP-5217-APP-1 is just one of the many forms that may be necessary to complete a real estate transaction, and it is important to properly file the form to avoid penalties and other legal issues.

By working with a qualified real estate attorney and ensuring that all necessary forms are properly completed and filed, buyers and sellers can ensure a smooth and successful real estate transaction.

By working with a qualified real estate attorney and ensuring that all necessary forms are properly completed and filed, buyers and sellers can ensure a smooth and successful real estate transaction.

Disclaimer

Disclaimer

This article is intended to provide general information and should not be construed as legal advice or a legal opinion. Please consult with a qualified attorney for guidance on real estate transactions and compliance with applicable laws and regulations.

We do not claim any ownership or responsibility for the accuracy or availability of the information contained in the data provided for this article.

We do not claim any ownership or responsibility for the accuracy or availability of the information contained in the data provided for this article.