Post Title: Travel Expenses Made Easy with PS Form 1164-E! If you’re someone who travels for business or work, you know how tedious and confusing it can be to keep track of all your travel expenses. This is where the PS Form 1164-E comes in to make your life easier! Here are some things you need to know about this form.

PS Form 1164-E - What is it?

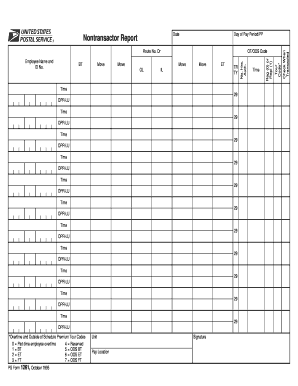

The PS Form 1164-E, also known as the eTravel Expense Report, is a document that helps you track and report all your travel expenses. The form is primarily used by members of the United States Postal Service (USPS), but can be used by anyone who incurs travel expenses for business purposes.

The PS Form 1164-E, also known as the eTravel Expense Report, is a document that helps you track and report all your travel expenses. The form is primarily used by members of the United States Postal Service (USPS), but can be used by anyone who incurs travel expenses for business purposes.

Why Use PS Form 1164-E?

The PS Form 1164-E is a convenient way of tracking your travel expenses. It helps you organize and record expenses such as lodging, meals, and transportation, which are often tax-deductible. The form also allows you to attach receipts and other supporting documents to substantiate your expenses, making it easier to file accurate and complete expense reports.

The PS Form 1164-E is a convenient way of tracking your travel expenses. It helps you organize and record expenses such as lodging, meals, and transportation, which are often tax-deductible. The form also allows you to attach receipts and other supporting documents to substantiate your expenses, making it easier to file accurate and complete expense reports.

How to Use PS Form 1164-E?

Using the PS Form 1164-E is quite simple. First, you need to enter your personal information such as your name, employee id, and address. Next, you need to fill in details about your travel, such as the date of travel, destination, and purpose of the trip. You will also need to list all the expenses you incurred during your trip, including details such as the name of the vendor, the amount spent, and the date of the purchase. Make sure you attach all relevant receipts and documents to support your expenses. Once you’ve completed the form, you can submit it to your employer or supervisor for approval.

Using the PS Form 1164-E is quite simple. First, you need to enter your personal information such as your name, employee id, and address. Next, you need to fill in details about your travel, such as the date of travel, destination, and purpose of the trip. You will also need to list all the expenses you incurred during your trip, including details such as the name of the vendor, the amount spent, and the date of the purchase. Make sure you attach all relevant receipts and documents to support your expenses. Once you’ve completed the form, you can submit it to your employer or supervisor for approval.

Benefits of Using PS Form 1164-E?

The PS Form 1164-E offers a range of benefits to both employees and employers. For employees, it provides a more streamlined and accurate way of tracking travel expenses, which can help them get reimbursed faster. It also helps to avoid any misunderstandings or disputes between the employee and employer regarding expenses incurred during travel. For employers, it provides a record of all the travel expenses incurred by their employees, which makes it easier to budget and allocate funds for business travel.

The PS Form 1164-E offers a range of benefits to both employees and employers. For employees, it provides a more streamlined and accurate way of tracking travel expenses, which can help them get reimbursed faster. It also helps to avoid any misunderstandings or disputes between the employee and employer regarding expenses incurred during travel. For employers, it provides a record of all the travel expenses incurred by their employees, which makes it easier to budget and allocate funds for business travel.

Where to Get PS Form 1164-E?

Conclusion

The PS Form 1164-E is a handy tool for anyone who incurs travel expenses for business purposes. It helps to streamline the process of tracking and reporting expenses, making it easier for employees to get reimbursed and for employers to budget and allocate funds for business travel. By filling out this form accurately and completely, you can ensure that you get reimbursed for all your eligible expenses and avoid any disputes or misunderstandings with your employer. So, the next time you travel for business, make sure you use the PS Form 1164-E to make your life easier!

The PS Form 1164-E is a handy tool for anyone who incurs travel expenses for business purposes. It helps to streamline the process of tracking and reporting expenses, making it easier for employees to get reimbursed and for employers to budget and allocate funds for business travel. By filling out this form accurately and completely, you can ensure that you get reimbursed for all your eligible expenses and avoid any disputes or misunderstandings with your employer. So, the next time you travel for business, make sure you use the PS Form 1164-E to make your life easier!

Additional Resources

Still have questions about PS Form 1164-E? Here are some additional resources that you may find helpful:

- USPS - Travel Expenses

- GSA - eTravel Forms and Resources

- IRS - Travel, Gift, and Car Expenses (Publication 463)

Remember, using the PS Form 1164-E can help you keep track of all your travel expenses, so you can get reimbursed faster and avoid any disputes or misunderstandings with your employer. Happy travels!