Are you struggling to find the right tax forms for your business? Look no further than these Blank W-9 Forms Printable. It’s important to make sure that you have the right tax forms to be sure you’re compliant with the law. And with this printable, all the necessary fields will be easy to fill in accurately.

What is a W-9 Form?

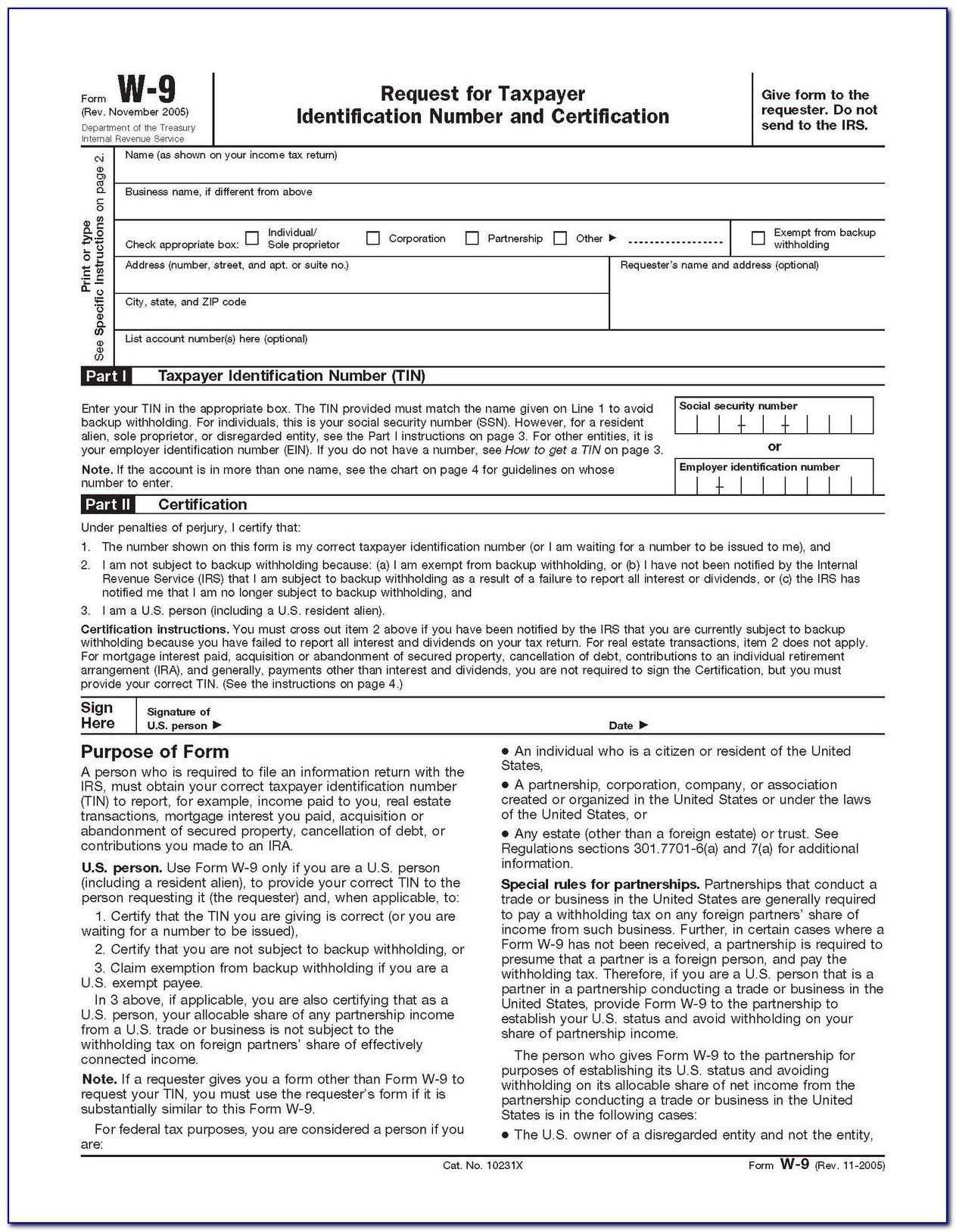

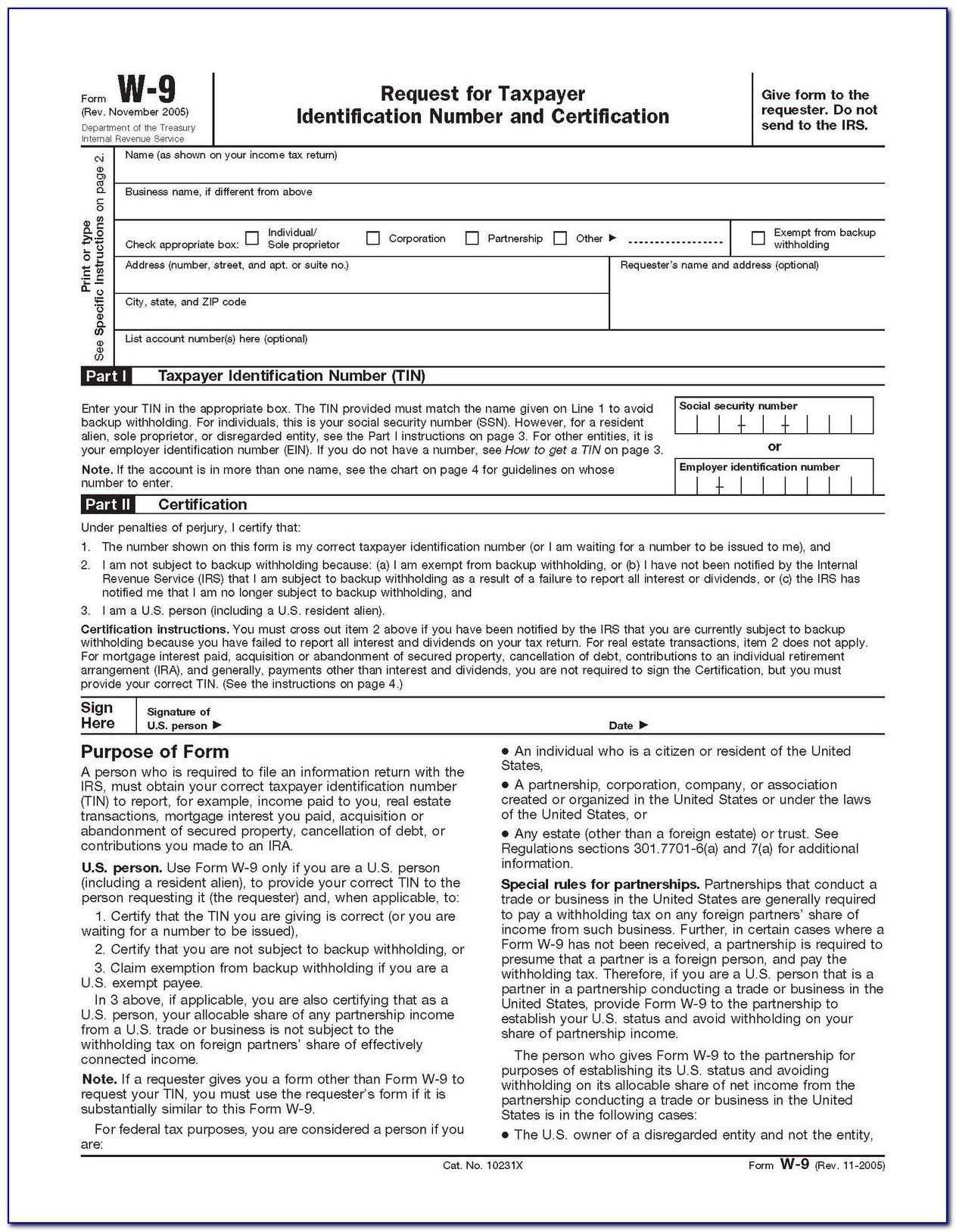

A W-9 form is an Internal Revenue Service (IRS) form that’s used to request the Taxpayer Identification Number (TIN) or Social Security Number (SSN) of an individual, sole proprietorship, limited liability company(LLC), partnership, or other entities. It may be required if you are a vendor, contractor, or freelancer that works with other businesses.

The form’s primary purpose is to provide the IRS with the necessary information to prepare a Form 1099 in case the company pays you more than $600. Typically, companies request a W-9 form before they pay you for your products or services. This requirement is to comply with federal tax law and ensure that the correct tax returns are filed.

The form’s primary purpose is to provide the IRS with the necessary information to prepare a Form 1099 in case the company pays you more than $600. Typically, companies request a W-9 form before they pay you for your products or services. This requirement is to comply with federal tax law and ensure that the correct tax returns are filed.

How to Fill out a W-9 Form

Before filling out a W-9 form, you should have your Taxpayer Identification Number (TIN) or Social Security Number (SSN) handy. You should also know your business status (i.e., sole proprietorship, LLC, partnership, or corporation), and whether you’re subject to backup withholding (i.e., 24% tax withholdings from your payment if you fail to provide the right information on your form).

Each field on the form should be completed with the appropriate information. The form asks for several details, including your full name, address, type of entity, and TIN or SSN number. You may also need to supply your exemption codes or “participation codes” depending on your situation. Make sure to read the instructions on the form to ensure that the document is accurately filled out.

Why You Need Blank W-9 Forms Printable

The W-9 forms are essential for transactions and activities that involve payments from one business to another. Without them, companies may face IRS penalties or the risk of being non-compliant with tax law. With this printable form, businesses can easily access the correct W-9 form to get started on the process of requesting tax information from other organizations.

The Blank W-9 Forms Printable are perfect for business owners and individuals who are looking for a hassle-free solution to filing their taxes. By printing these forms, you can save time and be sure you’re using the right form to benefit your business.

Benefits of Using Blank W-9 Forms Printable

Benefits of Using Blank W-9 Forms Printable

The Blank W-9 Forms Printable offers some excellent advantages to business owners:

- Accuracy: By using these forms, you can be sure that you’re accurately completing your tax requirements and reducing the risk of audit.

- Easy Access: These forms are available online and can be printed out anytime you need them.

- Time Saver: No need to spend hours searching for the right form to use. The Blank W-9 Forms Printable makes it easy to find the right form and file your taxes quickly.

If you’re looking to get started on filing your taxes or need to request a W-9 form from someone else, the Blank W-9 Forms Printable is the perfect resource for you. With clear and concise instructions and easy-to-use format, you can be sure that your taxes are filed accurately and quickly to keep your business running smoothly.

Conclusion

It’s crucial to ensure that you have the correct tax forms and that they are filled out correctly. With the Blank W-9 Forms Printable, you can easily access the appropriate forms and file your taxes without any hassle. Whether you’re a business owner or freelancer, these forms are a great resource that can help you to file your taxes accurately and on time.