If you’re an employee in Alabama, it’s important to make sure you have the correct tax forms completed and submitted to your employer. One of the key forms you’ll need is the W-4 form, which allows you to claim exemptions and ensure that the proper amount of taxes are withheld from your paycheck. Here’s everything you need to know about the Alabama W-4 form!

What is the W-4 form?

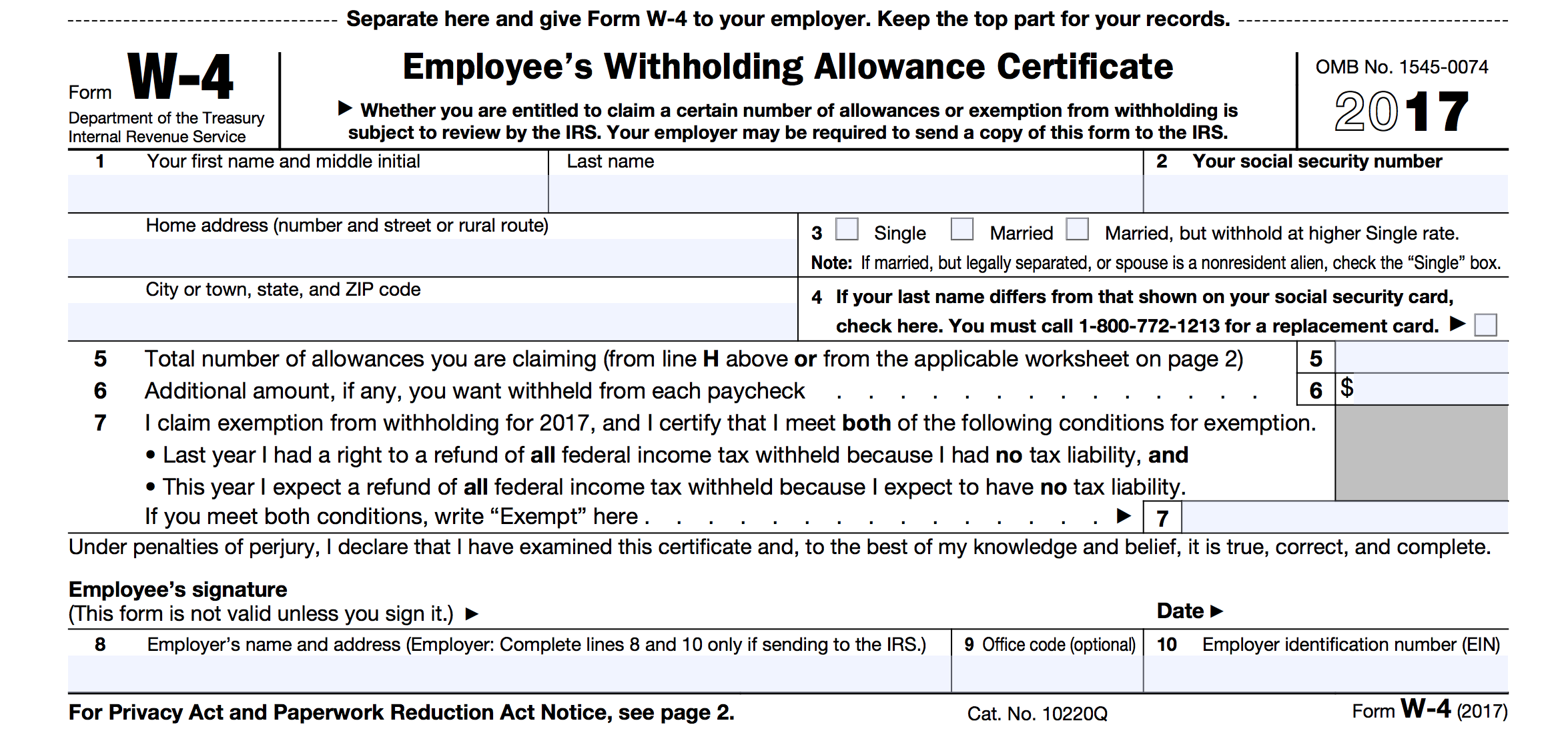

The W-4 form is a tax withholding form that all employees in the United States must complete when starting a new job. The purpose of the form is to provide your employer with information about how much federal income tax to withhold from your paycheck. The amount withheld depends on your filing status, number of dependents, and other factors.

Why would I need to update my W-4 form?

You may need to update your W-4 form if you experience any life changes that affect your tax situation. For example, if you get married or have a child, you may want to increase the number of allowances you claim on your W-4 form to reduce your tax withholding. On the other hand, if you get divorced or your child becomes independent, you may want to decrease the number of allowances to increase your tax withholding.

How do I fill out the Alabama W-4 form?

Filling out the Alabama W-4 form is relatively straightforward. You’ll need to provide your name, address, Social Security number, and other personal information. You’ll also need to indicate your filing status (such as single, married filing jointly, or head of household) and the number of allowances you want to claim. The more allowances you claim, the less tax will be withheld from your paycheck.

Filling out the Alabama W-4 form is relatively straightforward. You’ll need to provide your name, address, Social Security number, and other personal information. You’ll also need to indicate your filing status (such as single, married filing jointly, or head of household) and the number of allowances you want to claim. The more allowances you claim, the less tax will be withheld from your paycheck.

What if I’m not sure how to fill out the form?

If you’re unsure about how to fill out the Alabama W-4 form, you can use the IRS’s withholding calculator to estimate how much tax should be withheld from your paycheck. The calculator will ask you a series of questions about your income, dependents, deductions, and other factors to help you determine the best number of allowances to claim. You can then use this information to complete the W-4 form.

When should I submit my W-4 form?

You should submit your W-4 form to your employer as soon as possible, ideally before you receive your first paycheck. This will ensure that the correct amount of taxes are withheld from your first paycheck. If you experience any life changes that affect your tax situation, such as getting married or having a child, you should submit an updated W-4 form to your employer as soon as possible to ensure that your tax withholding is accurate.

What happens if I don’t fill out the W-4 form?

If you don’t fill out the W-4 form, your employer will withhold taxes from your paycheck based on the default Single filing status and zero allowances. This may result in too much or too little tax being withheld from your paycheck, which could affect your tax liability at the end of the year. It’s important to fill out the W-4 form to ensure that the proper amount of taxes are withheld from your paycheck.

Can I change my W-4 form later?

Yes, you can change your W-4 form later if your tax situation changes. If you experience any life changes that affect your tax situation, such as getting married or having a child, you should submit an updated W-4 form to your employer as soon as possible to ensure that your tax withholding is accurate.

Conclusion

The Alabama W-4 form is an important document that all employees should complete when starting a new job. It provides your employer with essential information about how much tax to withhold from your paycheck. By understanding how to fill out the form and when to submit it, you can ensure that your tax withholding is accurate and avoid any surprises at tax time.