As we approach the end of the year, it is essential for employees to start thinking about their W2 forms. These forms are the key to filing taxes accurately and on time. With that in mind, we have compiled a list of various W2 forms from different employers and institutions to help employees get a head start on their taxes.

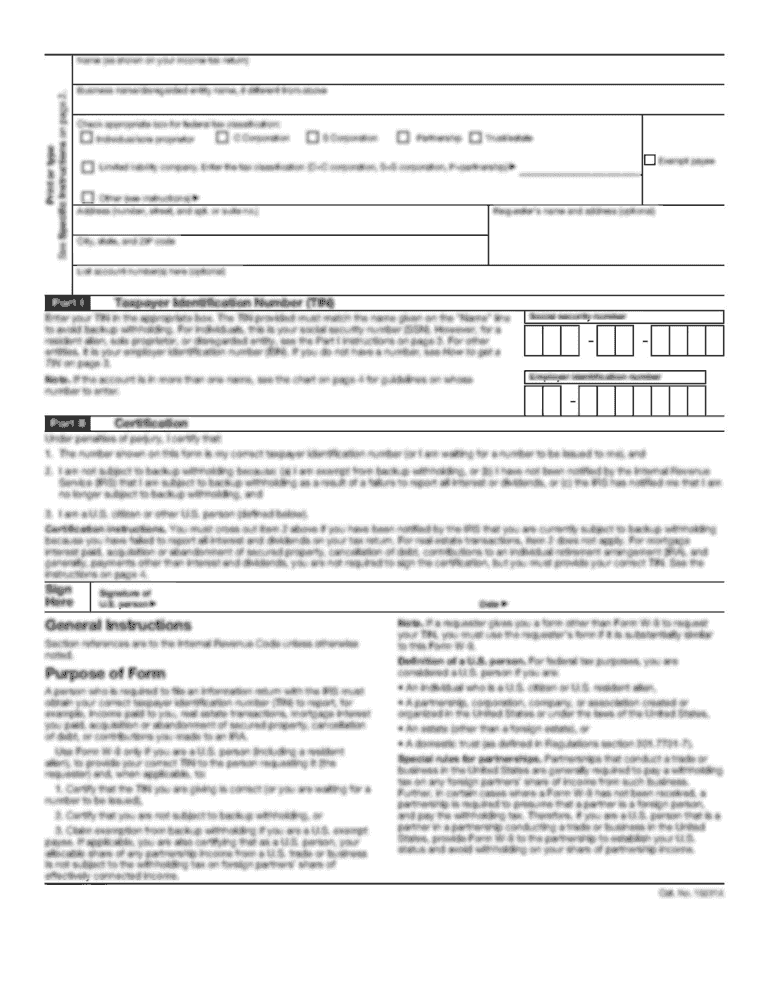

W4 Form From Employer

The W4 form is a document employers use to determine how much federal income tax they should withhold from an employee’s paycheck. It is essential that employees fill out this form accurately and update it when needed as it directly affects the amount of taxes owed.

The W4 form is a document employers use to determine how much federal income tax they should withhold from an employee’s paycheck. It is essential that employees fill out this form accurately and update it when needed as it directly affects the amount of taxes owed.

Employer W2 Form Printable

The W2 form is a tax document that an employer must provide to their employees, which reports the employee’s wages and the taxes withheld from their income during the year. Employees will need this form to accurately file their taxes with the IRS.

The W2 form is a tax document that an employer must provide to their employees, which reports the employee’s wages and the taxes withheld from their income during the year. Employees will need this form to accurately file their taxes with the IRS.

When Should My W2 Arrive

Employers are required to provide their employees with W2 forms by January 31st of each year. If the W2 form has not arrived, it is important to contact the employer to ensure there were no errors or delays in the process.

Employers are required to provide their employees with W2 forms by January 31st of each year. If the W2 form has not arrived, it is important to contact the employer to ensure there were no errors or delays in the process.

Available IRS Tax Forms 2022 to Print

The IRS provides many tax forms that taxpayers need to file their taxes, including the W2 form. These forms are available for download on their website so that taxpayers can have the necessary documents to file their taxes accurately and on time.

The IRS provides many tax forms that taxpayers need to file their taxes, including the W2 form. These forms are available for download on their website so that taxpayers can have the necessary documents to file their taxes accurately and on time.

2008 W2 Form

While this W2 form is from 2008, it is still important to include as some employees may need to file taxes for previous years. It is essential to have all necessary documents, including W2 forms, to file taxes accurately for the year it was due.

While this W2 form is from 2008, it is still important to include as some employees may need to file taxes for previous years. It is essential to have all necessary documents, including W2 forms, to file taxes accurately for the year it was due.

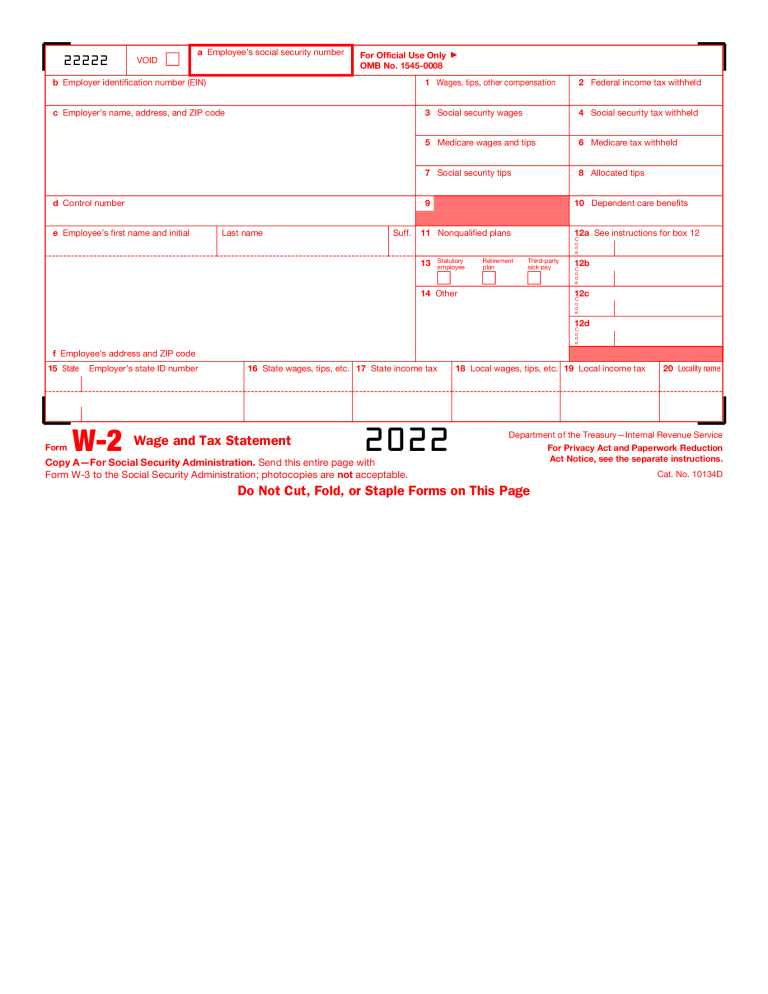

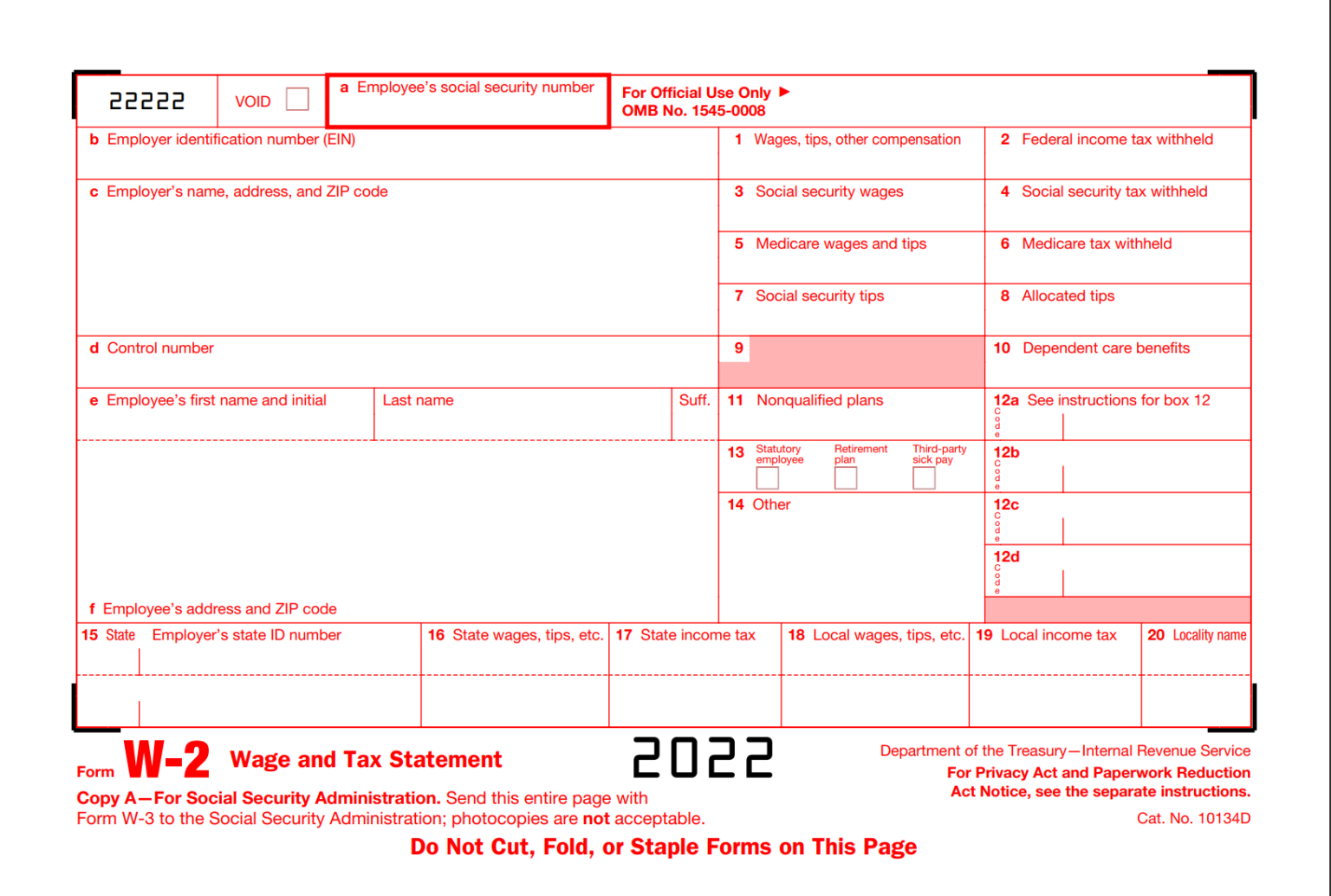

2022 W2 Free Fillable & Printable W2 Form

This W2 form is available for free, and it is fillable and printable. It is important to have accurate and up-to-date information on this form, including your employer’s identification number, your social security number, and your income and tax withholding information.

This W2 form is available for free, and it is fillable and printable. It is important to have accurate and up-to-date information on this form, including your employer’s identification number, your social security number, and your income and tax withholding information.

ABN AMRO Employee W2 Form

This W2 form is specific to employees of ABN AMRO, and it is essential to have this document to file taxes accurately. Like all W2 forms, it reports the employee’s wages and the taxes withheld from their income during the year.

This W2 form is specific to employees of ABN AMRO, and it is essential to have this document to file taxes accurately. Like all W2 forms, it reports the employee’s wages and the taxes withheld from their income during the year.

W2 Form 2022

As mentioned earlier, the W2 form is essential for accurately filing taxes. This particular form is for tax year 2022 and is available for download. When filing taxes, make sure to have this form and fill it out accurately.

As mentioned earlier, the W2 form is essential for accurately filing taxes. This particular form is for tax year 2022 and is available for download. When filing taxes, make sure to have this form and fill it out accurately.

W2 Form 2022

This W2 form is available to fill out online for free. It is important to have accurate information, including your employer’s identification number, your social security number, and your income and tax withholding information, to file taxes accurately.

This W2 form is available to fill out online for free. It is important to have accurate information, including your employer’s identification number, your social security number, and your income and tax withholding information, to file taxes accurately.

Free Printable W2 Form 2021

While this W2 form is from 2021, it is still essential to have when filing taxes for that year. It is always important to have all necessary documents, including W2 forms, when filing taxes to do so accurately and on time.

While this W2 form is from 2021, it is still essential to have when filing taxes for that year. It is always important to have all necessary documents, including W2 forms, when filing taxes to do so accurately and on time.

In conclusion, having accurate and up-to-date W2 forms is incredibly important when it comes to filing taxes. These forms provide essential information about an employee’s income and taxes withheld from their paycheck throughout the year. Without them, it can be challenging to file taxes accurately and on time. Make sure to keep all necessary documents, including W2 forms, and file taxes as efficiently as possible.