When it comes to tax season, one of the most important documents that you need to have is your W-2 form. This form is issued to you by your employer and it contains important information about your income, taxes withheld, and other financial details that you need to report to the IRS.

Understanding Your W-2 Form

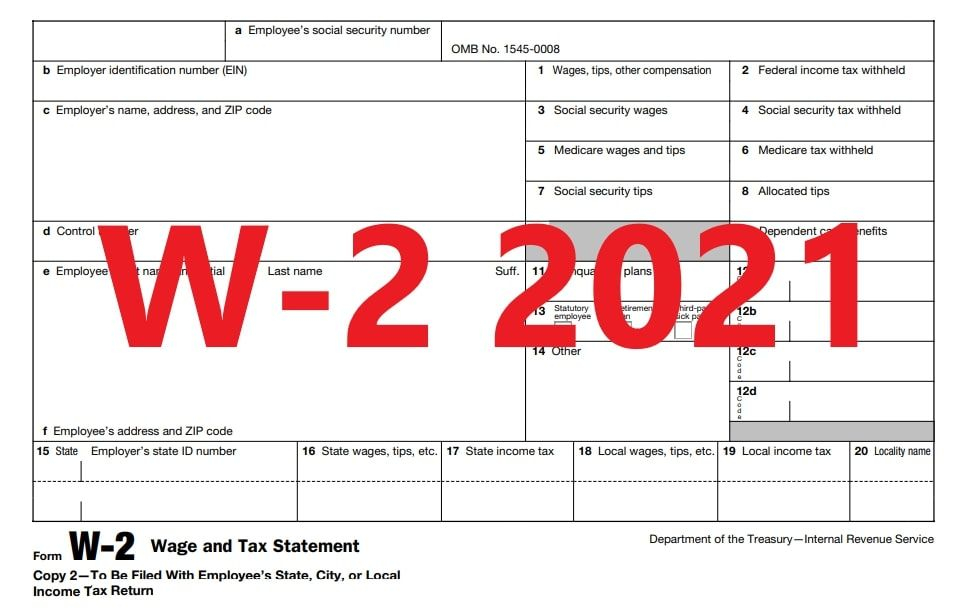

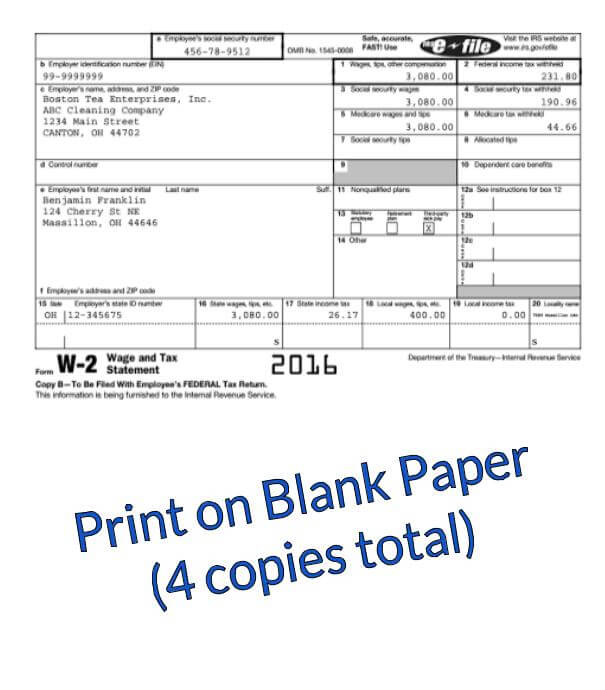

:max_bytes(150000):strip_icc()/w2-9ca13523f4d74e958b821aab63af2e60.png) One of the first things that you need to do when you get your W-2 form is to understand what each box means. Here’s a breakdown of what you will see on your form:

One of the first things that you need to do when you get your W-2 form is to understand what each box means. Here’s a breakdown of what you will see on your form:

- Box 1: This is your total taxable wages for the year. It includes your salary, bonuses, and any other income that is subject to income tax.

- Box 2: This is the federal income tax that was withheld from your paycheck throughout the year. This amount is based on the information that you provided on your W-4 form when you started working for your employer.

- Box 3: This is your total Social Security wages for the year. It includes your salary and any other income that is subject to Social Security tax. This amount is capped at a certain limit each year.

- Box 4: This is the Social Security tax that was withheld from your paycheck throughout the year. The rate is 6.2% of your total Social Security wages.

- Box 5: This is your total Medicare wages for the year. It includes your salary and any other income that is subject to Medicare tax.

- Box 6: This is the Medicare tax that was withheld from your paycheck throughout the year. The rate is 1.45% of your total Medicare wages.

- Box 7: This box is for tips that you received throughout the year. If you did not receive any tips, this box will be blank.

- Box 8: This is the allocated tips that your employer reported to you. It is only included if you worked in a job where tips are customary, such as a restaurant server.

- Box 9: This is the amount of miscellaneous income that you received throughout the year. This could include things like bonuses or prizes that you won.

- Box 10: This is the amount of federal income tax that was withheld from your bonus payments throughout the year.

- Box 11: This is the amount of state income tax that was withheld from your paycheck throughout the year.

- Box 12: This box is used to report various types of compensation that you received throughout the year. The codes that are used in this box are listed on the back of your W-2 form.

- Box 13: This box is used to report whether or not you participated in a retirement plan through your employer during the year.

- Box 14: This box is used to report any additional information that your employer wants to provide. The information that is included in this box can vary from employer to employer.

- Box 15: This is your state and local taxable wages for the year.

- Box 16: This is the amount of state income tax that was withheld from your paycheck throughout the year.

- Box 17: This is the state and local income tax that you paid during the year.

- Box 18: This is the amount of local wages that were subject to local income tax.

- Box 19: This box is used to report the amount of income that is subject to a state unemployment tax.

- Box 20: This box is used to report the amount of state unemployment tax that was withheld from your paycheck throughout the year.

- Box 21: This box is used to report the amount of income that is subject to a local unemployment tax.

- Box 22: This box is used to report the amount of local unemployment tax that was withheld from your paycheck throughout the year.

Printing Your W-2 Form

If you need to print your W-2 form, there are several options available to you. One option is to use an online tax preparation website like TurboTax or H&R Block. These websites will allow you to input your information and generate a W-2 form that you can print out.

If you need to print your W-2 form, there are several options available to you. One option is to use an online tax preparation website like TurboTax or H&R Block. These websites will allow you to input your information and generate a W-2 form that you can print out.

Another option is to use a free W-2 form generator like StubCreator. This website allows you to input your information and create a W-2 form that you can print out for free.

If you prefer to do things the old-fashioned way, you can always contact your employer and ask them to provide you with a printed copy of your W-2 form. They are required by law to provide you with a copy by January 31st of each year.

IRS Approved W-2 Forms

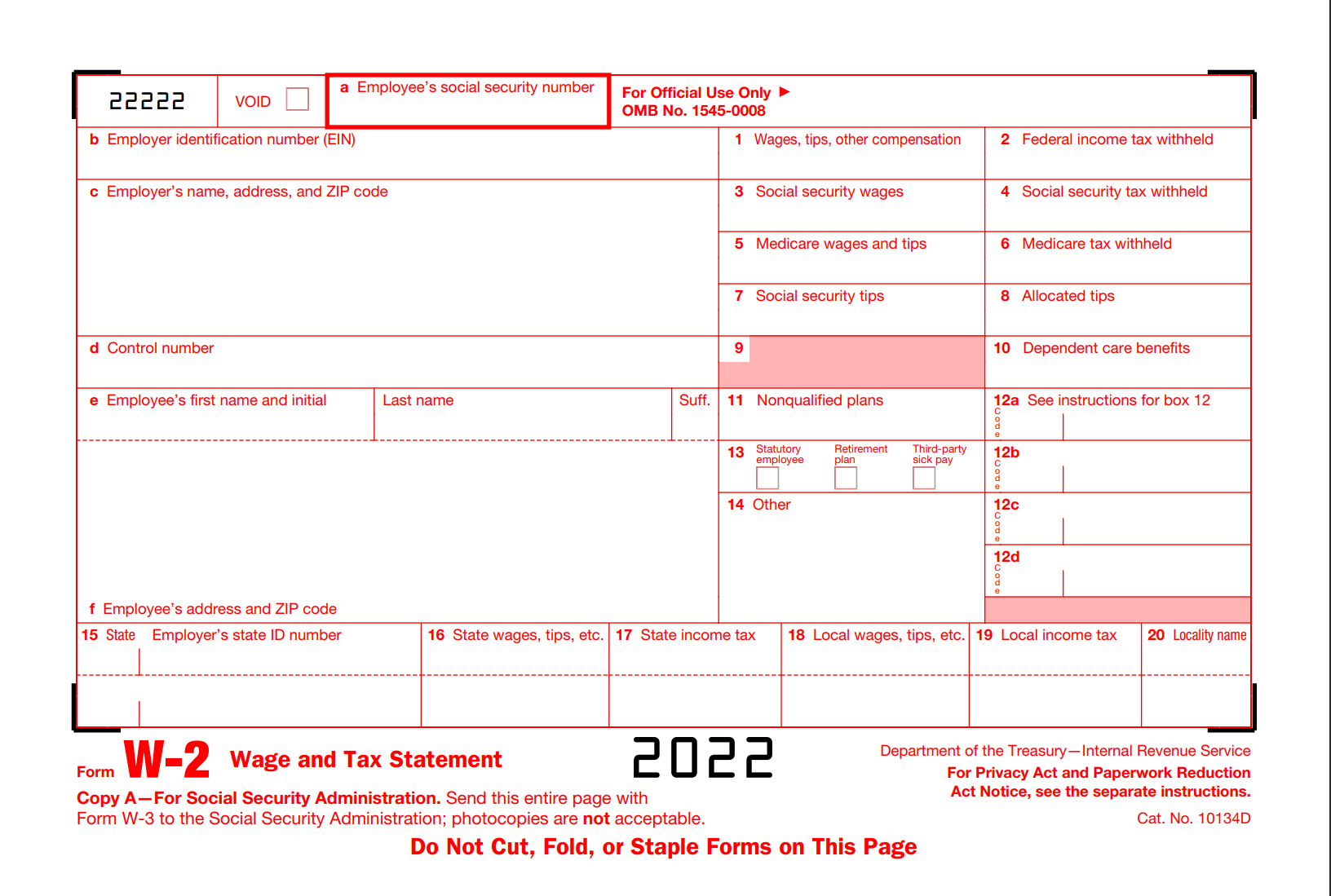

It’s important to use the correct W-2 form when you file your taxes. The IRS approves specific forms each year, so you need to make sure that you are using the correct one.

It’s important to use the correct W-2 form when you file your taxes. The IRS approves specific forms each year, so you need to make sure that you are using the correct one.

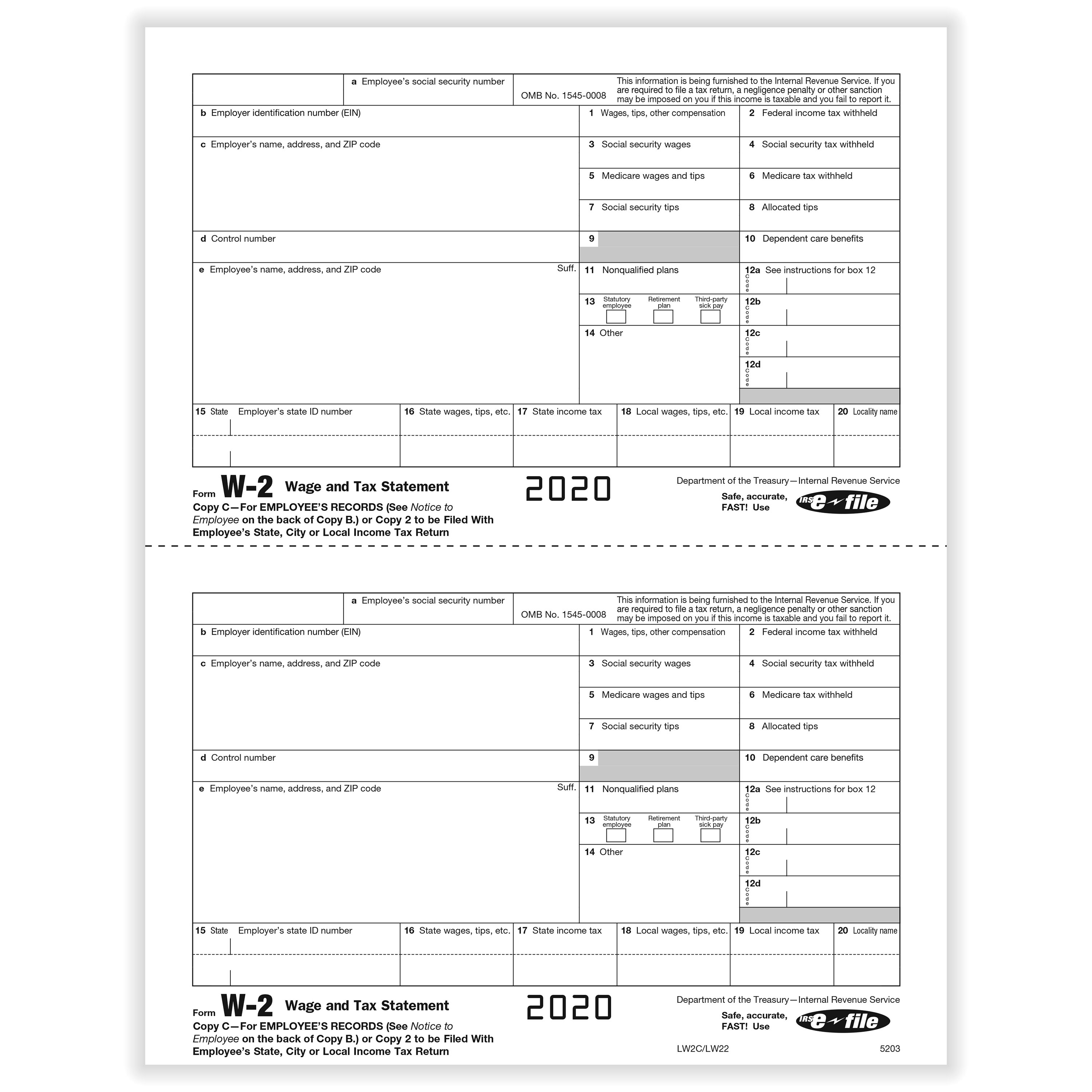

You can purchase IRS-approved W-2 forms from many office supply stores or online retailers. Some popular options include Staples, Amazon, and Formstax. These forms come in packs of 25 or 50 and are typically laser-printed.

Fillable W2 Forms

If you prefer to fill out your W-2 form online, there are several options available to you. One popular option is the fillable W2 form from the IRS website. This form allows you to input your information directly into the form and print it out when you are done.

If you prefer to fill out your W-2 form online, there are several options available to you. One popular option is the fillable W2 form from the IRS website. This form allows you to input your information directly into the form and print it out when you are done.

Another option is to use a free fillable W2 form from a website like FillableForms.net. These forms allow you to input your information online and then print out a completed form.

ABN AMRO Employee W2 Form

Are you an employee of ABN AMRO and need to access your W2 form? You can do so by visiting the ABN AMRO Employee Self-Service Portal.

Are you an employee of ABN AMRO and need to access your W2 form? You can do so by visiting the ABN AMRO Employee Self-Service Portal.

Once you log in, you will be able to view and print your W2 form right from the portal. This is a convenient option for ABN AMRO employees who need to access their W2 form quickly and easily.

Printable W-2 Forms for 2022

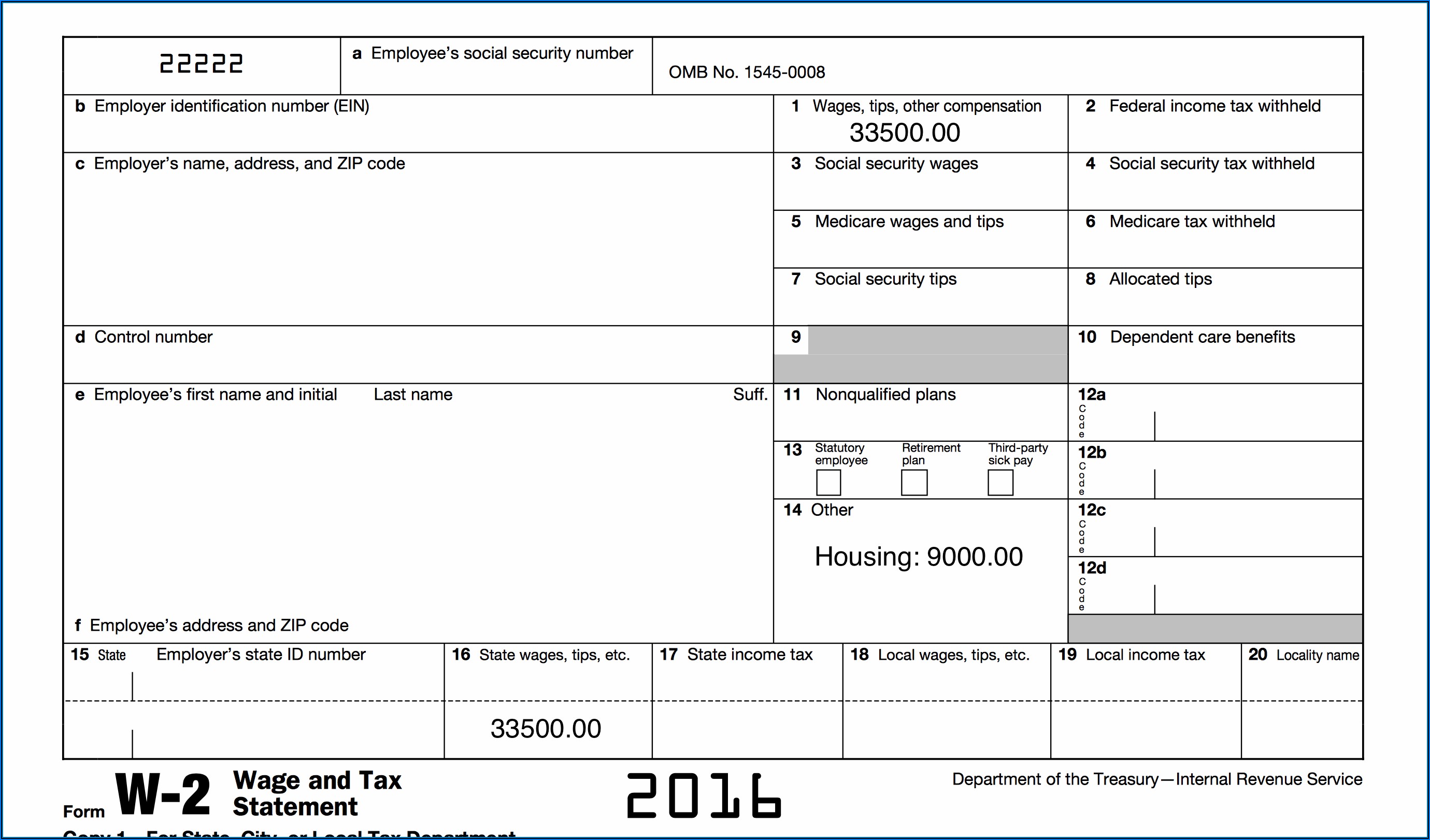

If you need to prepare your taxes for the 2022 tax year, you will likely need a printable W-2 form. These forms are typically available online starting in late January or early February each year.

If you need to prepare your taxes for the 2022 tax year, you will likely need a printable W-2 form. These forms are typically available online starting in late January or early February each year.

You can find printable W-2 forms on many tax preparation websites, as well as on the IRS website. Some popular tax preparation websites include TurboTax, H&R Block, and TaxSlayer.

Free Printable W2 Form

If you are looking for a free printable W2 form, you can find one online at efile.com. This website allows you to input your information and generate a W2 form that you can print out for free.

If you are looking for a free printable W2 form, you can find one online at efile.com. This website allows you to input your information and generate a W2 form that you can print out for free.

Another option is to use a free W2 form generator like StubCreator. This website allows you to input your information and create a W2 form that you can print out for free.

Adaptable W2 Printable Forms

Do you have a unique situation that requires an adaptable W2 form? There are several websites that offer customizable W2 forms that you can use to meet your specific needs.

Do you have a unique situation that requires an adaptable W2 form? There are several websites that offer customizable W2 forms that you can use to meet your specific needs.

One popular option is Patriot Software. This website offers W2 forms that are adaptable to any type of situation, whether you have multiple jobs, work in a non-traditional job, or have other special circumstances that require a custom form.

No matter what type of W2 form you need, there are plenty of resources available to help you get the job done. Whether you choose to fill out your form online or print it out and complete it by hand, be sure to double-check all of your information for accuracy before submitting it to the IRS.