Hey everyone!

I hope you are all doing well. Today, I wanted to talk about an important legal document called the Quitclaim Deed. Whether you are buying or selling a property, it is essential to understand the significance of this document as it plays an integral role in the transfer of ownership.

In simple terms, what is a Quitclaim Deed?

A Quitclaim Deed is a legally binding document that transfers ownership rights or interests in a property from one person (the grantor) to another person (the grantee) without any warranties or guarantees. This means that the grantor is not liable for any disputes or issues that may arise after the transfer of ownership. Unlike a Warranty Deed, a Quitclaim Deed does not guarantee that the title is free and clear of any liens or encumbrances.

It is important to note that a Quitclaim Deed does not transfer any financial responsibility or liabilities associated with the property. For example, if there are any outstanding mortgages, tax liens, or other debts, the grantee will not be responsible for them. Only the grantor will be held responsible for any financial obligations related to the property.

It is important to note that a Quitclaim Deed does not transfer any financial responsibility or liabilities associated with the property. For example, if there are any outstanding mortgages, tax liens, or other debts, the grantee will not be responsible for them. Only the grantor will be held responsible for any financial obligations related to the property.

When is a Quitclaim Deed used?

1. Transfer of property within a family: Quitclaim Deeds are commonly used when transferring property ownership to a family member. For example, if a parent wants to transfer ownership of a property to their child, they can use a Quitclaim Deed to do so. Since a Quitclaim Deed does not require a title search or title insurance, it is often used in these types of situations because family members usually trust each other and are not concerned with the title’s status or ownership rights.

2. Removing a spouse from a property title: In situations where one spouse wants to remove their name from the property title after a divorce, a Quitclaim Deed can be used. It is important to note that this does not remove the financial obligations associated with the property, such as mortgage payments.

3. Transferring ownership of property to a trust: A Quitclaim Deed can also be used to transfer ownership of a property to a trust. This is commonly done when people want to protect their assets or plan for their family’s future. It is important to consult with an attorney or financial advisor before transferring ownership of a property to a trust.

How to create a Quitclaim Deed?

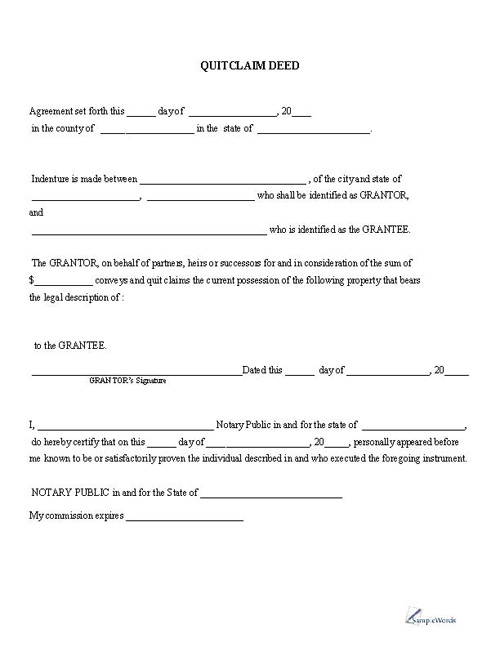

To create a Quitclaim Deed, you will need a template or a legal advisor to assist you with the process. You can find many available templates online, such as the one in the image above. Ensure that the template is valid for your state and that it covers all the necessary information. Here are some of the essential details that a Quitclaim Deed must include:

- The names and addresses of the grantor and grantee

- The legal description of the property

- The signature of the grantor and a notary public

- The date when the Quitclaim Deed is executed.

Conclusion

A Quitclaim Deed is a crucial legal document that aids in the transfer of property ownership from one person to another. While this document is relatively simple and straightforward to create, it is advisable to seek professional advice before creating one. I hope this article has provided you with valuable insights into Quitclaim Deeds and why they are essential. Let me know in the comments below if you have any questions, and I would be happy to help!