In today’s society, budgeting has become even more important than ever before. As such, it is essential to have a foolproof budgeting plan in place that can help you stay on track with your spending habits. Luckily, there is a free printable monthly budget planner worksheet that can help you accomplish just that.

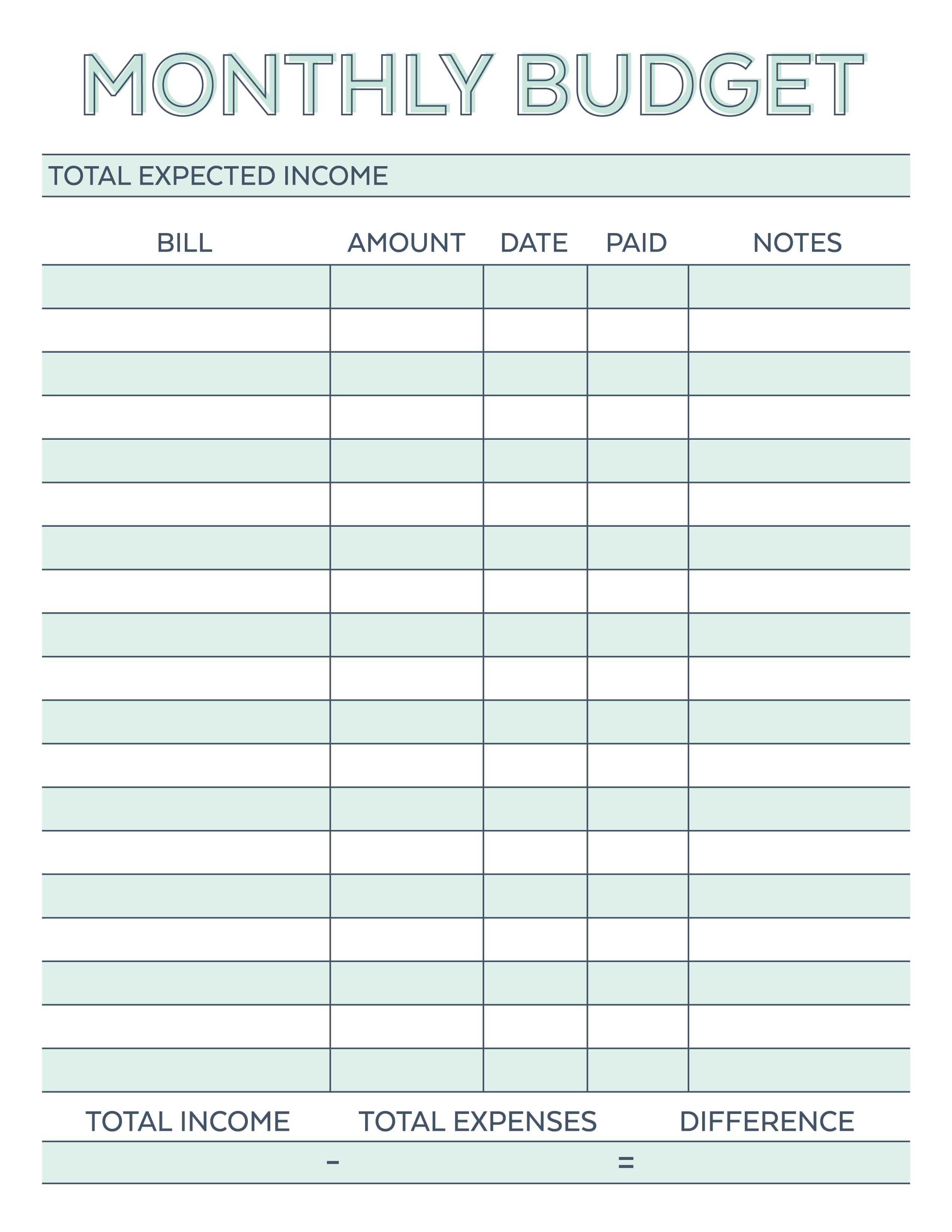

Monthly Budget Planner Worksheet

When you’re ready to start budgeting, the first thing you’ll want to do is download and print out your free monthly budget planner worksheet. You can find it online at https://savorandsavvy.com/wp-content/uploads/2017/03/Monthly-Budget-Printable-01.jpg. Make sure that you print out enough copies of the worksheet, so you have one for each month.

Next, sit down and take the time to fill out the worksheet in its entirety. The planner is divided into several sections, including income, expenses, and savings. By filling out each section of the worksheet accurately, you will have a clearer understanding of your monthly finances and be able to make better financial decisions.

Next, sit down and take the time to fill out the worksheet in its entirety. The planner is divided into several sections, including income, expenses, and savings. By filling out each section of the worksheet accurately, you will have a clearer understanding of your monthly finances and be able to make better financial decisions.

Income Section

The income section of the planner is where you will list all of your income sources, including salaries, wages, and any other income streams that you have. Make sure to include everything, so you have an accurate representation of your disposable income for the month.

If you have a variable income, it can be helpful to use your average monthly income as a baseline. This will provide you with a more stable figure to work with when planning your budget. Additionally, you’ll want to make sure that you subtract any taxes or other recurring deductions from your income total to get an accurate representation of your take-home pay for the month.

If you have a variable income, it can be helpful to use your average monthly income as a baseline. This will provide you with a more stable figure to work with when planning your budget. Additionally, you’ll want to make sure that you subtract any taxes or other recurring deductions from your income total to get an accurate representation of your take-home pay for the month.

Expenses Section

Once you’ve filled out the income section of the worksheet, it’s time to move on to the expenses section. This part of the planner is where you will list all of your monthly bills, including rent, utilities, groceries, and any other expenses that you have. Make sure to list everything, so you have an accurate understanding of your expenses for the month.

One strategy that can be helpful is to break your expenses down into categories, such as housing, transportation, and food. This can make it easier to see where your money is going and identify areas where you may be overspending.

One strategy that can be helpful is to break your expenses down into categories, such as housing, transportation, and food. This can make it easier to see where your money is going and identify areas where you may be overspending.

Savings Section

The final section of the planner is the savings section. This area is where you will list any money that you plan on putting into savings for the month. In addition to savings accounts, you may also want to consider investing in stocks, bonds, or other long-term investments that can help you grow your wealth over time.

It’s important to make sure that you have a healthy balance of short-term and long-term savings goals. This will help to ensure that you’re adequately prepared for unexpected expenses while also building your wealth over time.

It’s important to make sure that you have a healthy balance of short-term and long-term savings goals. This will help to ensure that you’re adequately prepared for unexpected expenses while also building your wealth over time.

Final Thoughts

By utilizing the free monthly budget planner worksheet, you can take control of your finances and start making smart financial decisions. Remember to fill out the planner in its entirety each month and review it regularly to identify areas where you can improve your spending habits. With diligence and discipline, you can achieve financial freedom and accomplish your long-term financial goals.