Keeping track of bills can be a daunting task, but it’s an essential part of being a responsible adult. Making sure all of your bills are paid on time can help you avoid late fees, maintain good credit, and keep your finances organized. Fortunately, there are many tools available to help you stay on top of your bills, such as bill pay checklists and calendars.

BILL PAY CHECKLISTS

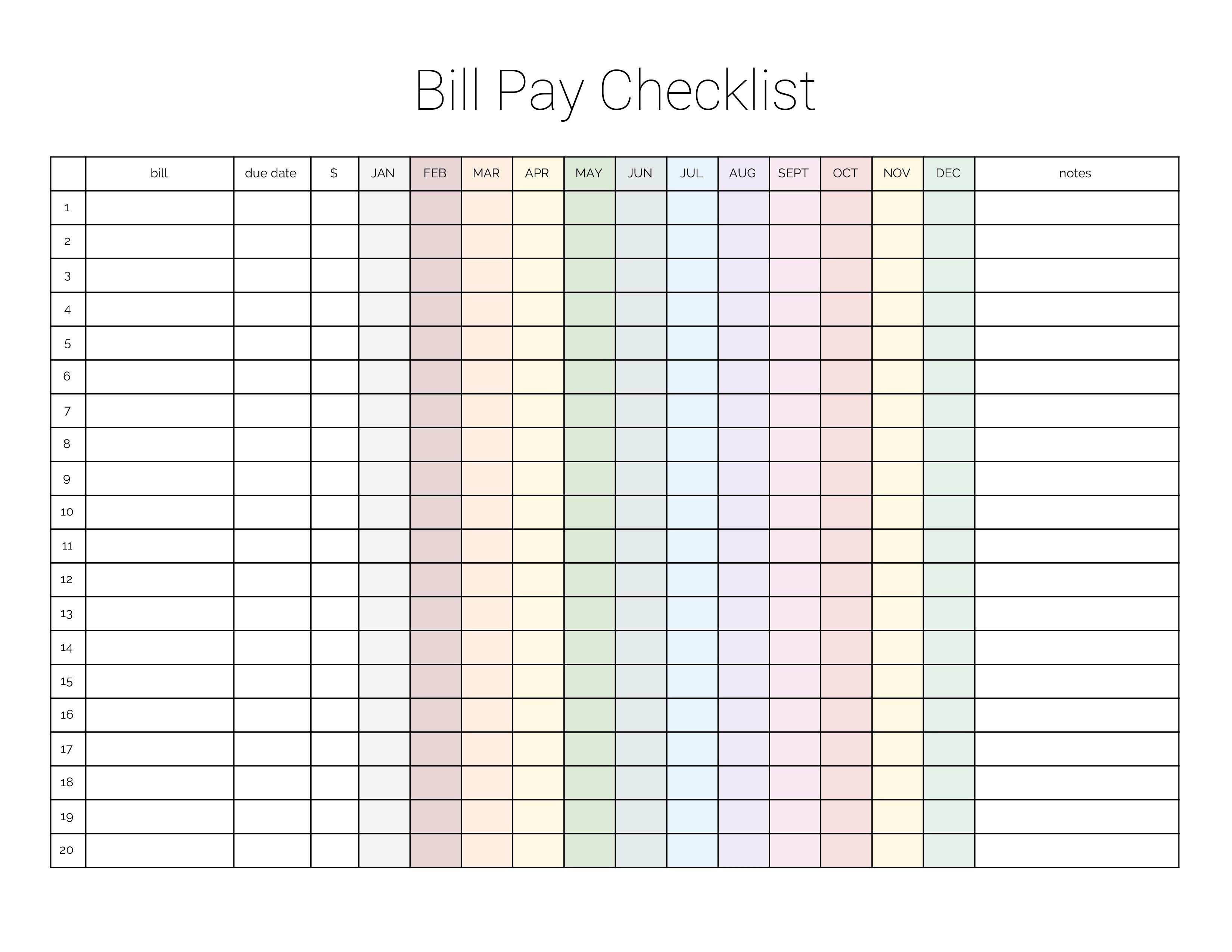

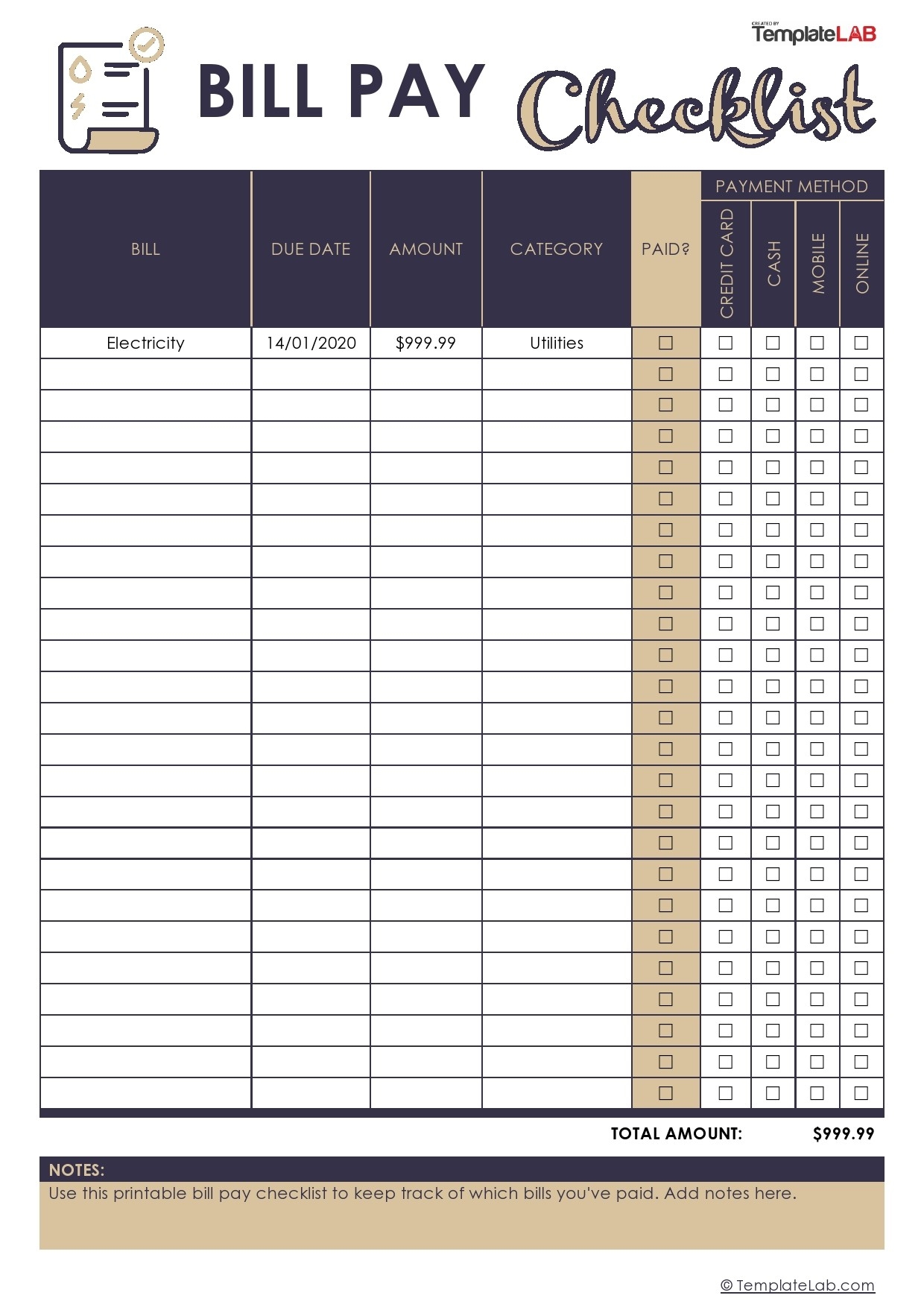

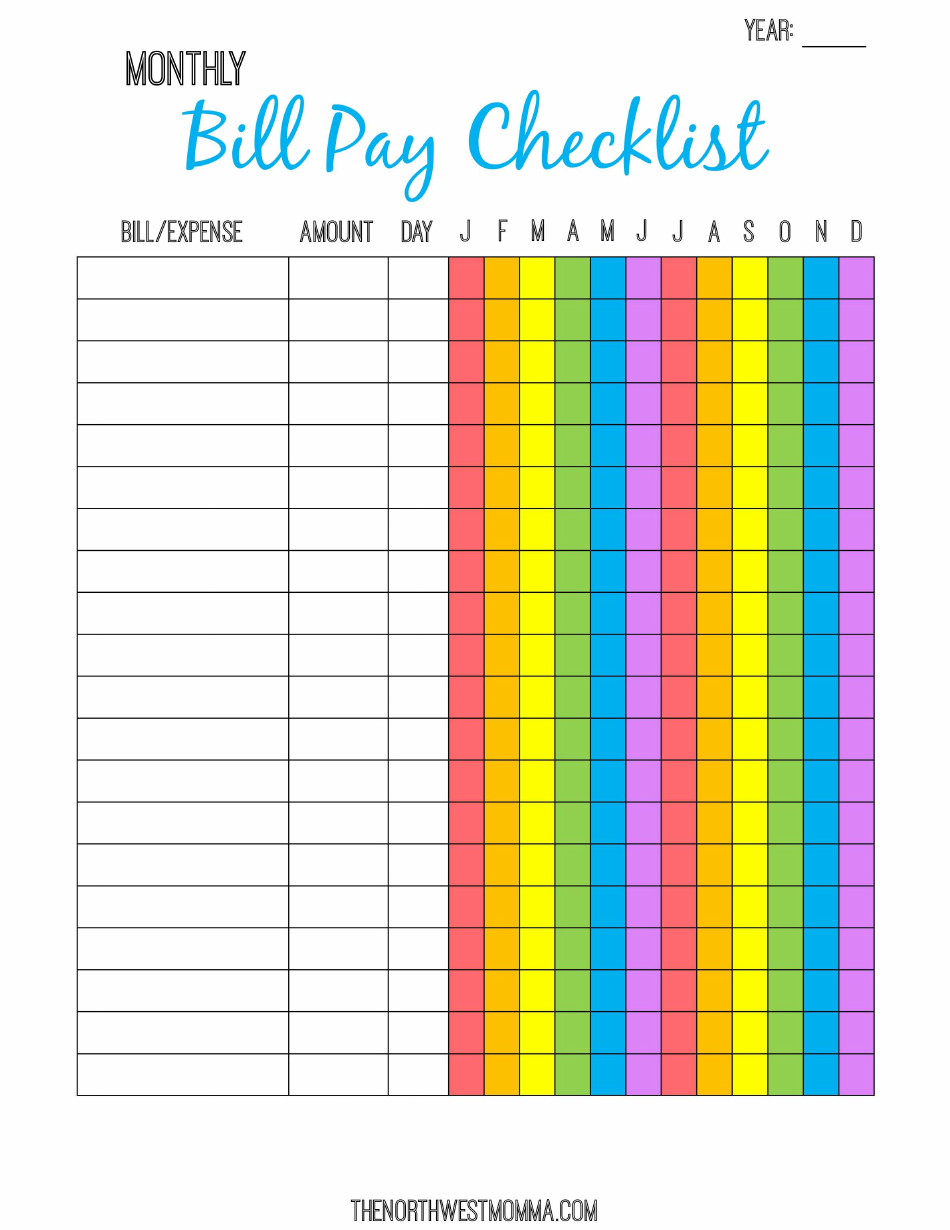

One popular tool for staying on top of bills is the bill pay checklist. A bill pay checklist is a simple sheet that you fill out with a list of all the bills you have to pay each month. You can print it out and keep it on your fridge or in a binder for easy reference.

Bill pay checklists are available in many different formats, from printable PDFs to Excel spreadsheets. They can be customized to include all of the bills you have to pay, including rent or mortgage, utilities, credit cards, and other regular expenses. Some bill pay checklists even include a spot to write down the due date of each bill, so you can keep track of when each payment is due.

Bill pay checklists are available in many different formats, from printable PDFs to Excel spreadsheets. They can be customized to include all of the bills you have to pay, including rent or mortgage, utilities, credit cards, and other regular expenses. Some bill pay checklists even include a spot to write down the due date of each bill, so you can keep track of when each payment is due.

BILL CALENDARS

BILL CALENDARS

If you prefer a visual approach to keeping track of bills, a bill calendar may be a good option for you. A bill calendar is a simple calendar that you fill out with all of your bill due dates each month. You can hang it on your fridge or keep it on your desk for easy reference.

Bill calendars come in many different formats as well, from printable PDFs to online calendars. Some bill calendars even allow you to set reminders for when each bill is due, so you never forget to pay an important bill.

Bill calendars come in many different formats as well, from printable PDFs to online calendars. Some bill calendars even allow you to set reminders for when each bill is due, so you never forget to pay an important bill.

OTHER BILL PAY TOOLS

In addition to bill pay checklists and calendars, there are many other tools available to help you stay on top of your bills. Here are a few examples:

Automatic Payments

Many utility companies and credit card companies offer the option to set up automatic payments. This means that the bill will be paid automatically each month on the due date, so you don’t have to worry about forgetting to make a payment.

Banking Apps

Many banks offer mobile apps that allow you to keep track of your bills and make payments on the go. With a banking app, you can check your account balances, transfer money, and pay bills from your smartphone or tablet.

Budgeting Apps

There are many apps available that can help you create and stick to a budget. These apps can help you track your expenses, set financial goals, and plan for the future. Some budgeting apps even allow you to link your bills and accounts, so you can keep track of everything in one place.

CONCLUSION

Keeping track of bills can be overwhelming, but it’s an important part of managing your finances. With the help of bill pay checklists, calendars, and other tools, you can make sure that all of your bills are paid on time and avoid late fees and other penalties. So if you’re struggling to keep track of your bills, give these tools a try and see how they can help you stay on top of your finances.