Have you ever needed to request a copy of your tax return from the IRS? The Form 4506-T is the document you need to fill out in order to request a transcript of your tax return.

What is a Form 4506-T?

The Form 4506-T, also known as the Request for Transcript of Tax Return, is a document that allows an individual or business to request a transcript or copy of a previously filed tax return. This form is typically used to verify income for a mortgage or loan application, or when applying for financial aid for college.

The 4506-T form can be filled out and signed online, making it a convenient option for individuals who need their tax information quickly. The form can be submitted online or by mail, and there is no fee to request a transcript of your tax return.

The 4506-T form can be filled out and signed online, making it a convenient option for individuals who need their tax information quickly. The form can be submitted online or by mail, and there is no fee to request a transcript of your tax return.

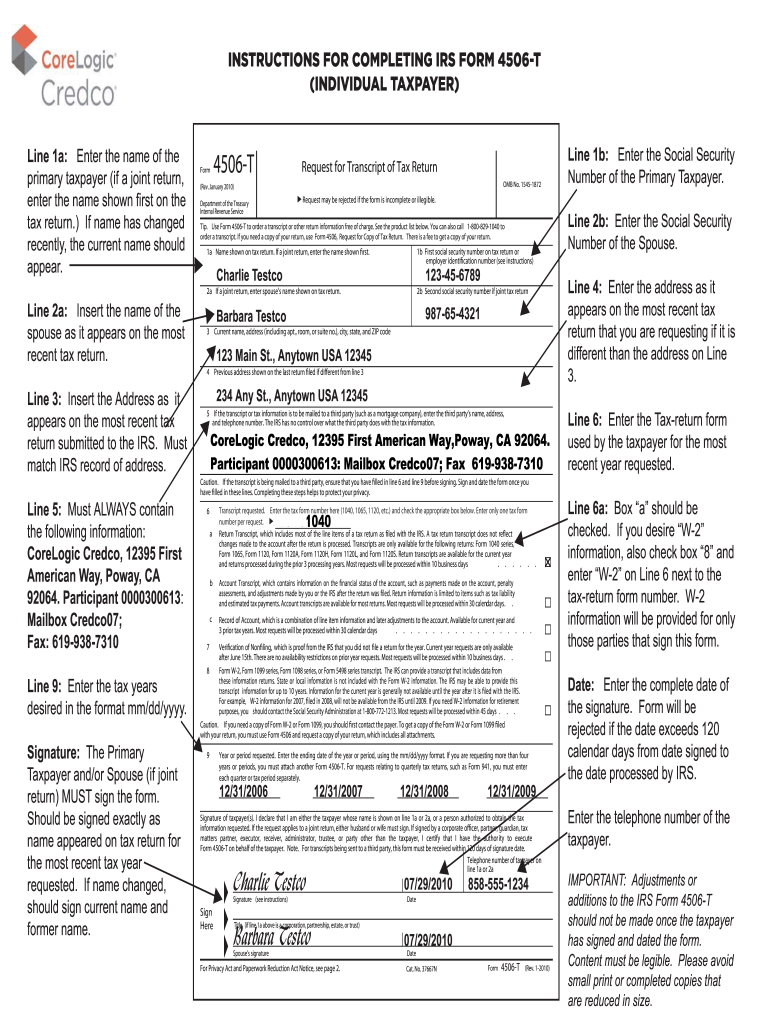

How to Fill Out a Form 4506-T

Filling out a Form 4506-T is relatively straightforward. The form includes several sections, including:

- Personal information, such as your name, address, and social security number

- The type and year of the tax return you are requesting

- Contact information for the individual or entity that will receive the transcript

- The reason you need the transcript

It is important to fill out the form completely and accurately in order to expedite the processing of your request. If any information is missing or incorrect, your request may be delayed or denied.

It is important to fill out the form completely and accurately in order to expedite the processing of your request. If any information is missing or incorrect, your request may be delayed or denied.

How Long Does it Take to Receive a Form 4506-T?

The amount of time it takes to receive a Form 4506-T can vary depending on how it is submitted and how busy the IRS is at the time. If you submit the form online, you can typically expect to receive your transcript within 5 to 10 business days. If you submit the form by mail, it may take up to 30 days to receive your transcript.

If you need your transcript quickly, you may be able to expedite your request for an additional fee. However, not all requests are eligible for expedited processing, so be sure to check with the IRS before submitting your request.

If you need your transcript quickly, you may be able to expedite your request for an additional fee. However, not all requests are eligible for expedited processing, so be sure to check with the IRS before submitting your request.

Important Things to Know About the Form 4506-T

Before you fill out a Form 4506-T, there are a few important things that you should know:

- You must sign and date the form in order for it to be valid

- You can request transcripts for up to four tax years on a single Form 4506-T

- If you need transcripts for more than four tax years, you will need to fill out additional forms

- If you are requesting a copy of your tax return, rather than a transcript, you will need to fill out a different form

Other Forms You May Need

If you need a copy of a previously filed tax return, you will need to fill out Form 4506, Request for Copy of Tax Return. This form requires a fee, which varies depending on the year of the tax return you are requesting.

If you need to make changes to a previously filed tax return, you will need to fill out Form 1040-X, Amended U.S. Individual Income Tax Return. This form allows you to correct errors on your tax return or claim a refund if you were entitled to one but did not claim it on your original return.

If you need to make changes to a previously filed tax return, you will need to fill out Form 1040-X, Amended U.S. Individual Income Tax Return. This form allows you to correct errors on your tax return or claim a refund if you were entitled to one but did not claim it on your original return.

The Bottom Line

Requesting a transcript of your tax return can be a useful tool in many situations, such as when you need to apply for a loan or verify your income for financial aid. By filling out a Form 4506-T, you can easily request a transcript of your tax return online or by mail. Just be sure to fill out the form completely and accurately in order to expedite the processing of your request.

Remember, if you need a copy of your tax return rather than a transcript, you will need to fill out a different form and pay a fee. And if you need to make changes to your tax return, you will need to fill out Form 1040-X. With these tools at your disposal, you can easily manage your tax information and make any necessary changes or requests.

Remember, if you need a copy of your tax return rather than a transcript, you will need to fill out a different form and pay a fee. And if you need to make changes to your tax return, you will need to fill out Form 1040-X. With these tools at your disposal, you can easily manage your tax information and make any necessary changes or requests.

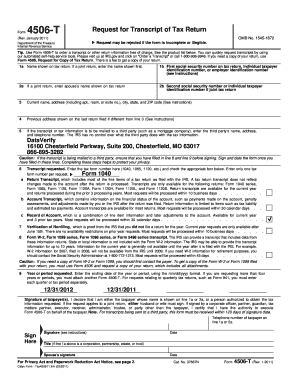

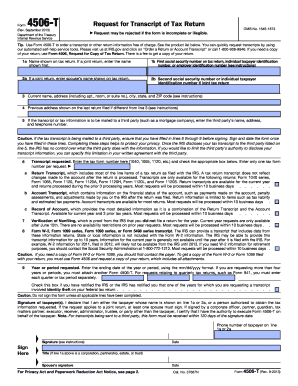

Printable Forms

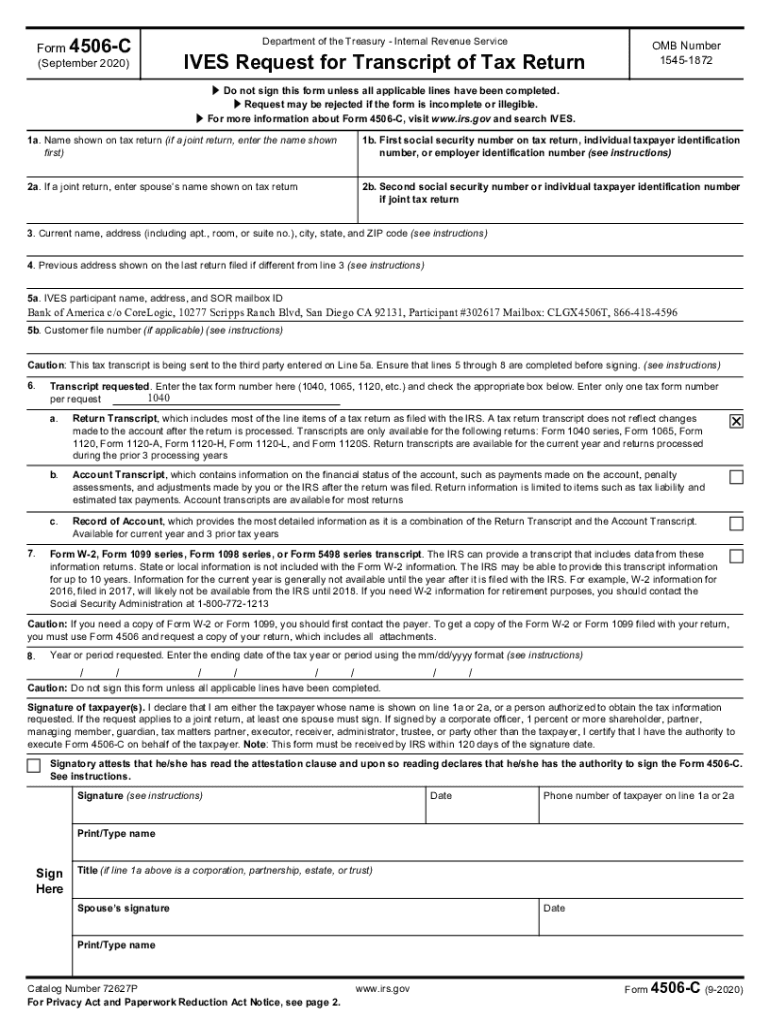

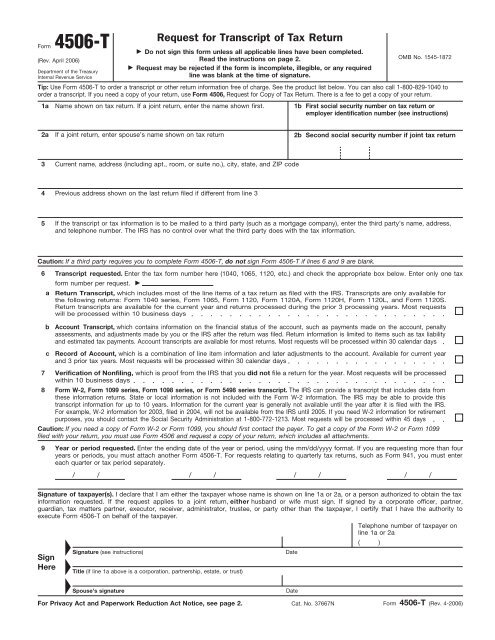

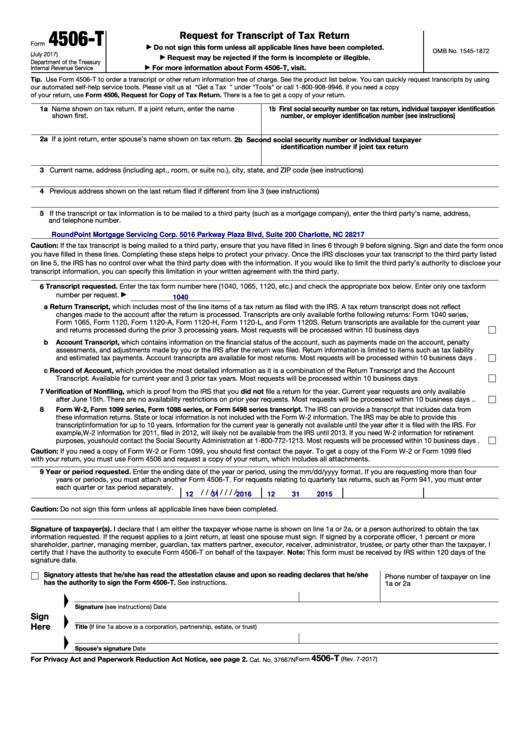

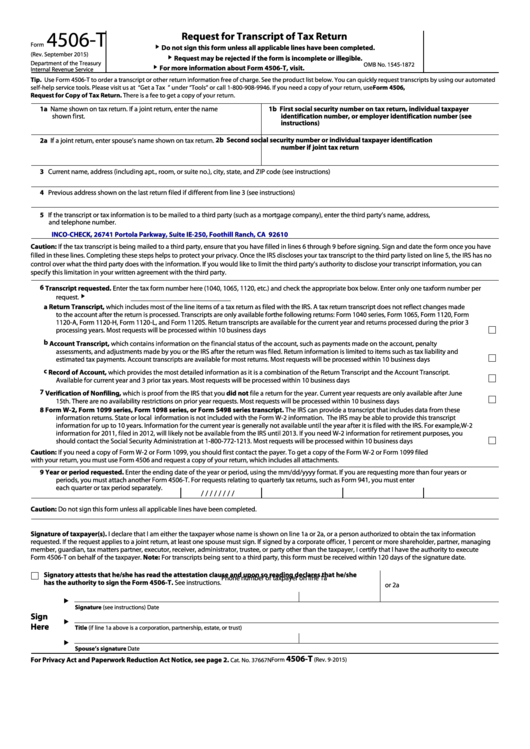

If you prefer to fill out a paper form, there are printable versions available online. Here are a few examples:

If you prefer to fill out a paper form, there are printable versions available online. Here are a few examples:

These printable forms can be filled out manually and submitted by mail. Just be sure to follow the instructions carefully and include all required information.

These printable forms can be filled out manually and submitted by mail. Just be sure to follow the instructions carefully and include all required information.

Wrapping Up

Whether you are applying for a loan, financial aid, or just need a copy of your tax return, knowing how to fill out a Form 4506-T can be a useful skill. By following the instructions carefully and providing accurate information, you can quickly and easily request a transcript of your tax return. And if you need a copy of your tax return or need to make changes to a previously filed return, there are other forms available to meet your needs.