It’s that time of year again - time to start thinking about taxes. With the deadline approaching, it’s important to make sure you have all the necessary forms and information to file accurately and on time. One important form to have on hand is the 1040-ES payment voucher. Here are some versions of the form that you may find helpful.

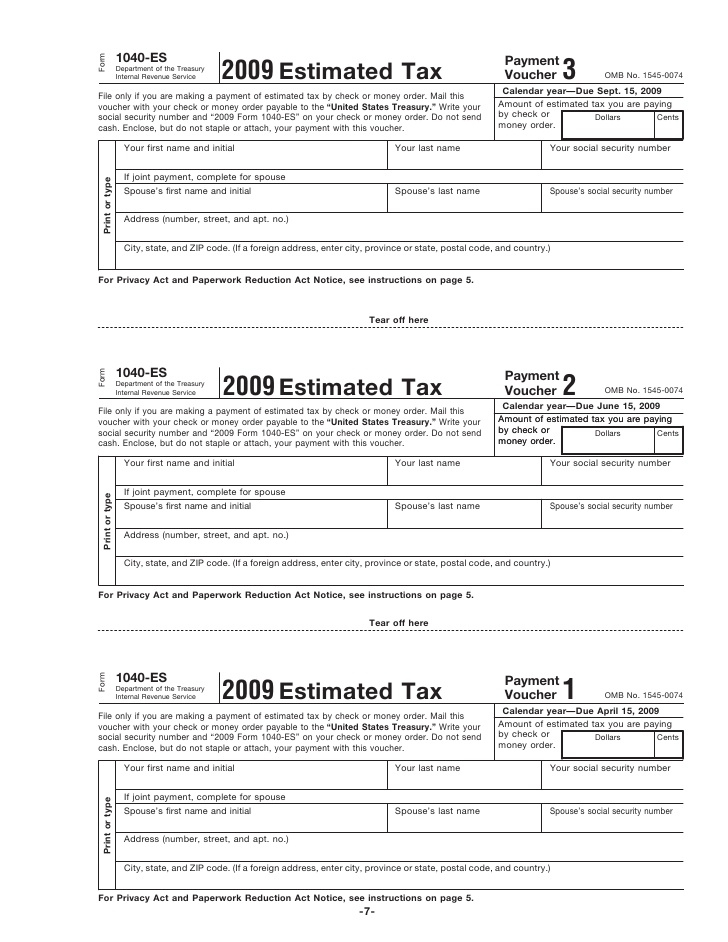

Form 1040-ES Payment Voucher 1

If you’re making estimated tax payments for the year, this payment voucher can be used to submit your payment electronically. It’s important to use the correct payment voucher for your payment period, so be sure to check the due dates carefully.

If you’re making estimated tax payments for the year, this payment voucher can be used to submit your payment electronically. It’s important to use the correct payment voucher for your payment period, so be sure to check the due dates carefully.

Form 1040-ES Payment Voucher 2

This payment voucher is for the second payment period of the year. It’s important to make payments on time to avoid penalties and interest charges.

This payment voucher is for the second payment period of the year. It’s important to make payments on time to avoid penalties and interest charges.

Form 1040-ES Payment Voucher 3

Use this payment voucher for the third payment period of the year. It’s important to keep track of your payments and dates to avoid any mistakes.

Use this payment voucher for the third payment period of the year. It’s important to keep track of your payments and dates to avoid any mistakes.

Form 1040-ES Payment Voucher 4

The fourth payment period of the year is covered by this payment voucher. Make sure to keep all of your payment information organized and easily accessible.

The fourth payment period of the year is covered by this payment voucher. Make sure to keep all of your payment information organized and easily accessible.

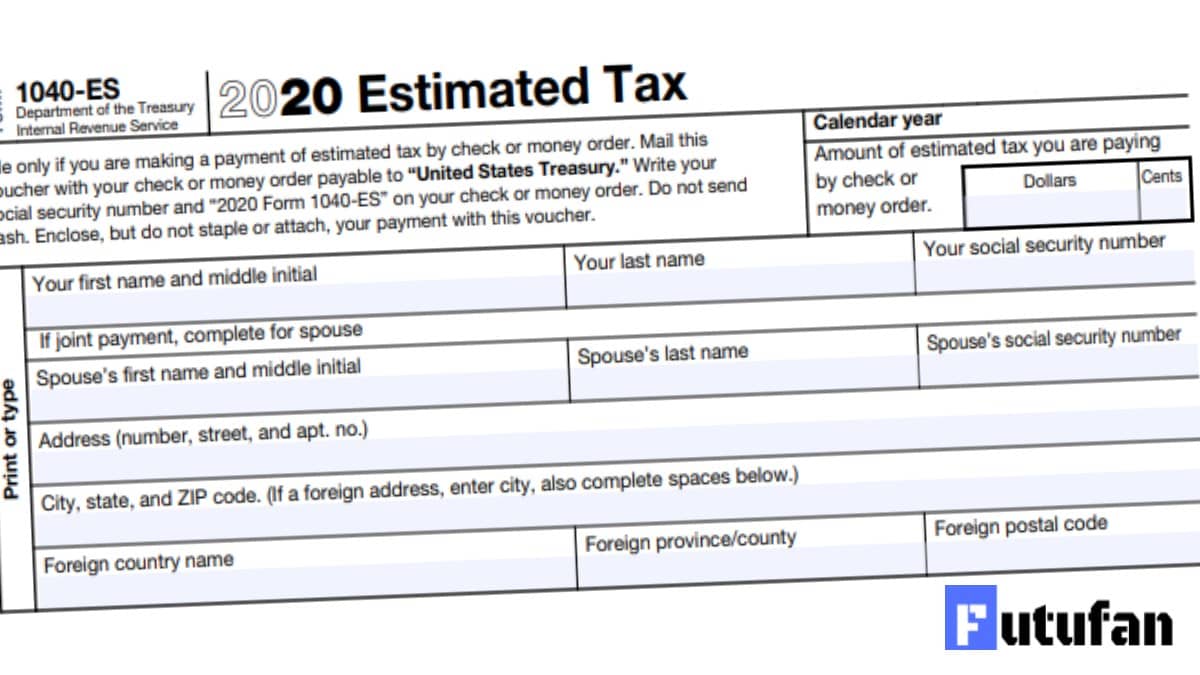

Form P 1040-ES Estimated Tax for Individuals

This form is used to calculate and pay estimated taxes for the year. It’s important to stay on top of your estimated tax payments to avoid any surprises at tax time.

This form is used to calculate and pay estimated taxes for the year. It’s important to stay on top of your estimated tax payments to avoid any surprises at tax time.

2023 Form 1040-ES Payment Voucher

This payment voucher is for the year 2023. It’s never too early to start planning for your tax payments and making sure you have all the necessary forms.

This payment voucher is for the year 2023. It’s never too early to start planning for your tax payments and making sure you have all the necessary forms.

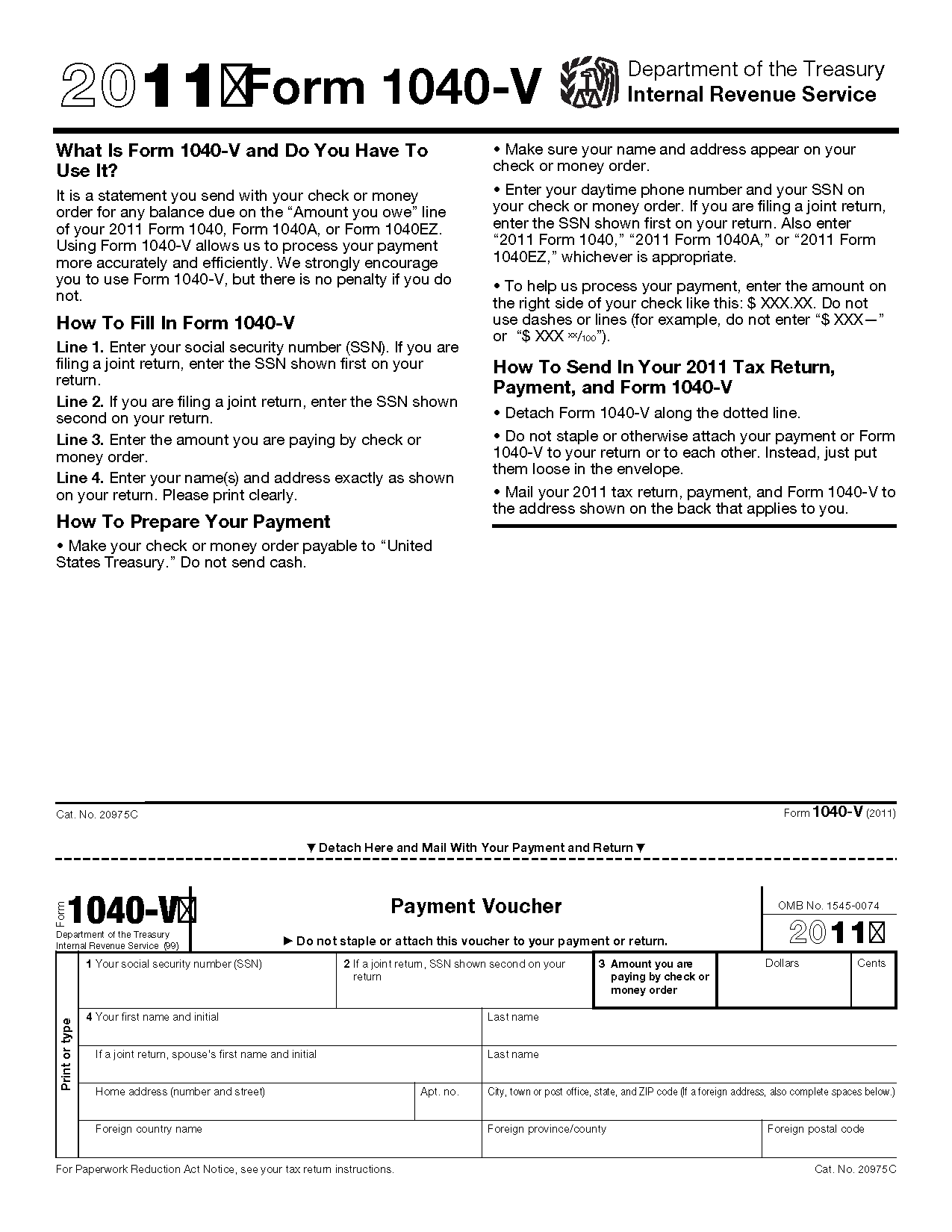

Form 1040-V Payment Voucher

If you need to make a payment on your tax return, this payment voucher can be used to submit your payment electronically. Be sure to use the correct form and payment method for your situation.

If you need to make a payment on your tax return, this payment voucher can be used to submit your payment electronically. Be sure to use the correct form and payment method for your situation.

Schedule C Instructions for 2022

If you are a sole proprietor or self-employed individual, you may need to file a Schedule C with your tax return. These instructions can help you understand the requirements and complete the form accurately.

If you are a sole proprietor or self-employed individual, you may need to file a Schedule C with your tax return. These instructions can help you understand the requirements and complete the form accurately.

Remember, paying your taxes on time and accurately is important to avoid penalties and interest charges. Make sure to use the correct forms and keep accurate records of your payments and dates. Consult a tax professional if you have any questions or concerns about your tax situation.