If you’re a senior citizen in the USA, you’ll be delighted to know that filing taxes just got easier than ever before. Thanks to the new 2019 Form 1040-SR U.S. Tax Return for Seniors, tax filing can be a breeze. In this post, we’ll tell you everything you need to know about this fantastic new form.

What is the 2019 Form 1040-SR?

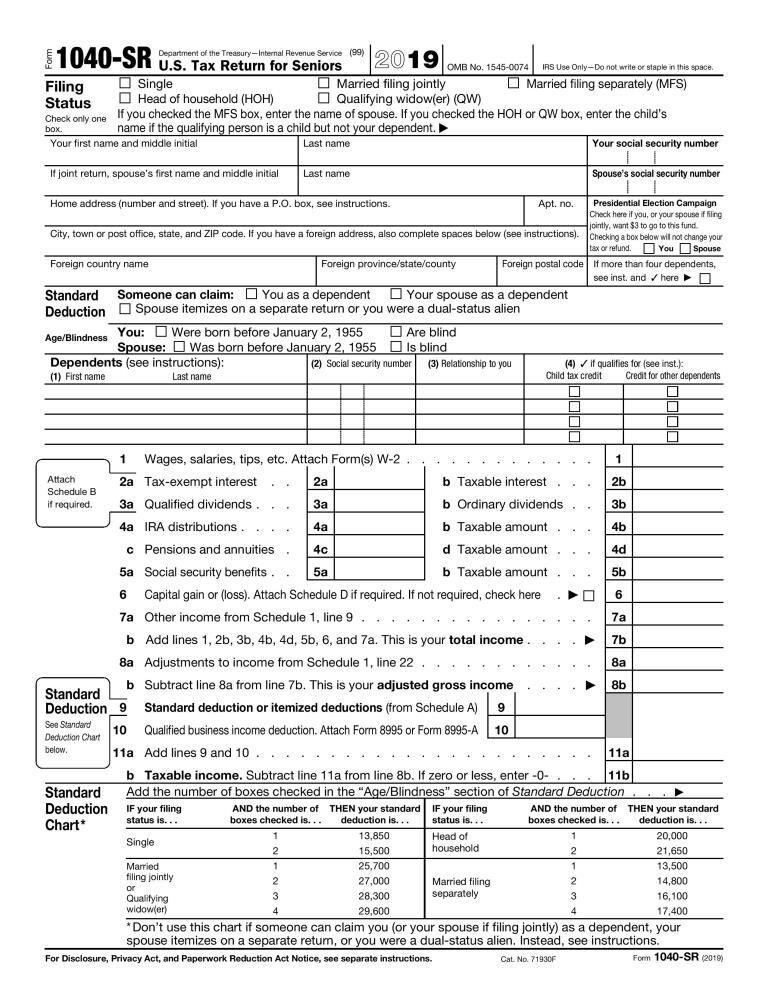

The 2019 Form 1040-SR is a special tax return form that’s designed specifically for senior citizens who are 65 years of age and older. This form aims to ease the tax filing process for senior citizens who may have retirement income, Social Security benefits, and other sources of income. By using this form, seniors can save time and effort while effectively reporting their income.

How is the 1040-SR different from other tax forms?

The 1040-SR differs from other tax forms because it’s larger and has larger fonts. This makes it easier to read and fill out. It has been designed so that seniors can easily understand and complete the form without any outside help. The form also has a standard deduction chart, which makes it easier for seniors to know how much to deduct. This can be especially helpful for seniors who are new to tax filing.

What are the benefits of using the 1040-SR?

The 1040-SR has several benefits, all of which are aimed at making the tax filing process easier for seniors. Here are some of the benefits:

- The larger fonts and shapes make it easier to complete the form

- The standard deduction chart makes it simpler to know how much to deduct

- Simplified reporting of Social Security, IRA distributions, and pensions

- Reporting retirement income is easier with the 1040-SR

- Bigger boxes for entering and calculating figures

- More user-friendly and less complicated than other forms

Who is eligible to use the 1040-SR?

The 1040-SR is available to seniors who are 65 years of age and older. If you’re married but filing separately and you or your spouse is 65 or older, you can use the 1040-SR as well. Single seniors who earn $100,000 or less annually can also use the 1040-SR.

How do I fill out the 1040-SR?

The instructions to fill out the 1040-SR are simple and easy to follow. Here’s how to do it:

- Enter your name and Social Security number at the top of the form

- Fill out the income section by reporting your income and deductions

- Fill out the payments section by reporting any payments you’ve made towards taxes

- Calculate if you owe taxes or if you are due a refund

- If you’re due a refund, you can choose to receive it via direct deposit or a check

- Sign and date the form

When is the 1040-SR due?

The deadline for filing taxes is April 15 of each year. However, if you need more time to file your taxes, you can request an extension of time to file.

What happens if I don’t file my taxes on time?

If you don’t file your taxes on time, you may face penalties and interest charges. The penalty for filing a late tax return is 5% of the unpaid taxes per month. The maximum penalty is 25%

In conclusion

The new 2019 Form 1040-SR U.S. Tax Return for Seniors is a great way for seniors to simplify their tax filing process. It’s easy to use, easy to understand, and comes with all the necessary tools to report your income effectively. So if you’re a senior citizen in the USA, be sure to take advantage of this fantastic form and make tax filing a breeze!