Are you an independent contractor who needs to report your non-employee compensation on your taxes? Then you’ll want to know about Form 1099-NEC. This form is specifically designed for reporting non-employee compensation, which was previously reported on Form 1099-MISC.

What is Form 1099-NEC?

What is Form 1099-NEC?

Form 1099-NEC is used to report non-employee compensation for services rendered. This form is required if you paid an independent contractor $600 or more for their services during the year. Non-employee compensation includes payments for services such as consulting, freelance work, or any other work performed as an independent contractor.

When to use Form 1099-NEC

When to use Form 1099-NEC

You will use Form 1099-NEC to report payments made to independent contractors for services rendered. If you paid an independent contractor $600 or more during the year, you are required to report these payments on Form 1099-NEC. You must provide a copy of this form to both the independent contractor and the IRS.

Why was Form 1099-NEC created?

Why was Form 1099-NEC created?

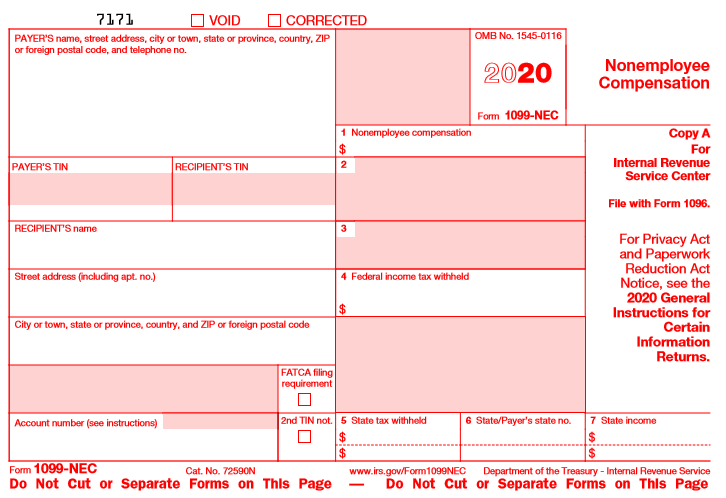

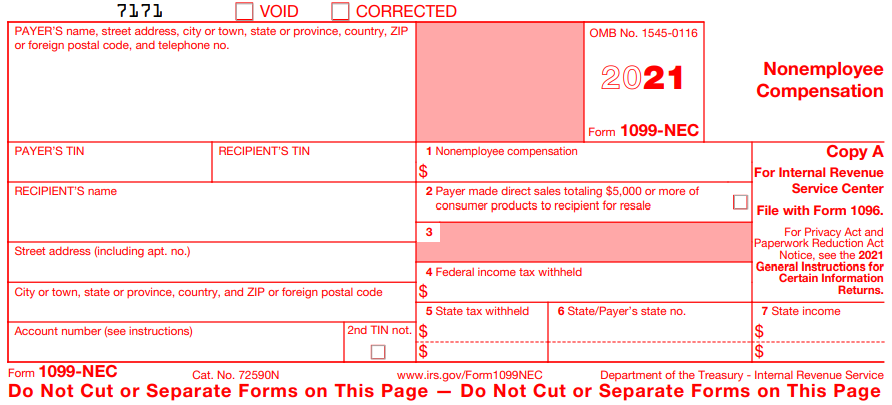

Starting with the 2020 tax year, non-employee compensation must be reported on Form 1099-NEC. Prior to 2020, non-employee compensation was reported on Form 1099-MISC. The creation of Form 1099-NEC was a response to the confusion caused by using Form 1099-MISC for both non-employee compensation and other types of payments.

What do I need to report on Form 1099-NEC?

What do I need to report on Form 1099-NEC?

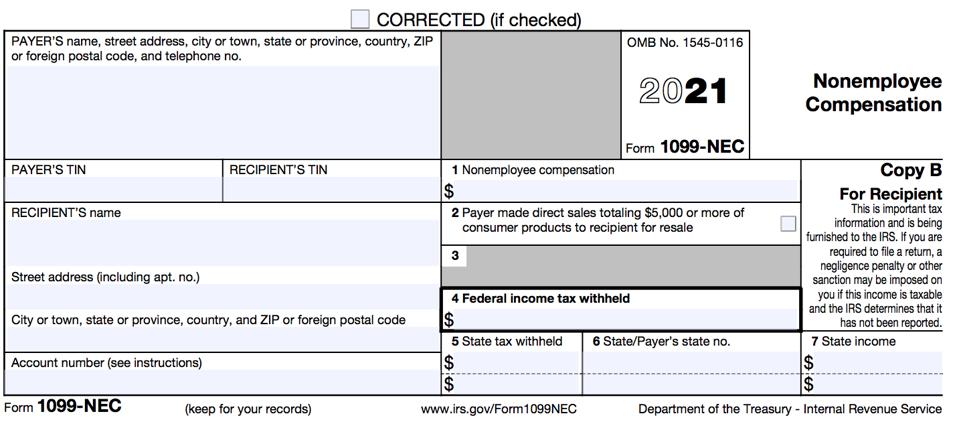

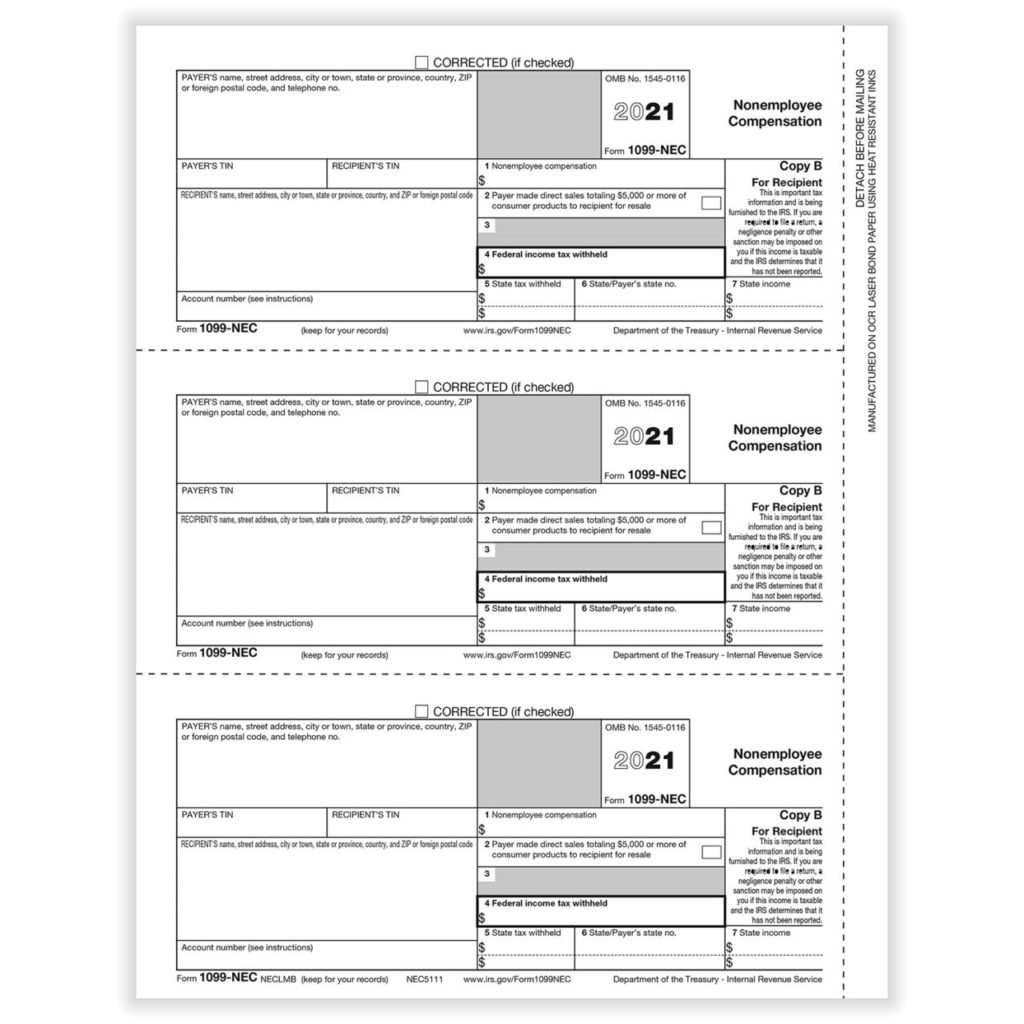

You will report the amount of non-employee compensation paid to an independent contractor during the year on Form 1099-NEC. This form is also used to report any federal income tax withholding that was taken out of those payments. Additionally, you will need to include the independent contractor’s name, address, and social security number or employer identification number on the form.

How do I fill out Form 1099-NEC?

How do I fill out Form 1099-NEC?

Filling out Form 1099-NEC can be a bit complicated, especially if you’ve never done it before. You will need to gather all of the information required to complete the form, including the independent contractor’s name, address, and social security number or employer identification number. Once you have all of the necessary information, you will use it to complete the form, including reporting the amount of non-employee compensation paid and any federal income tax withholding that was taken out of those payments.

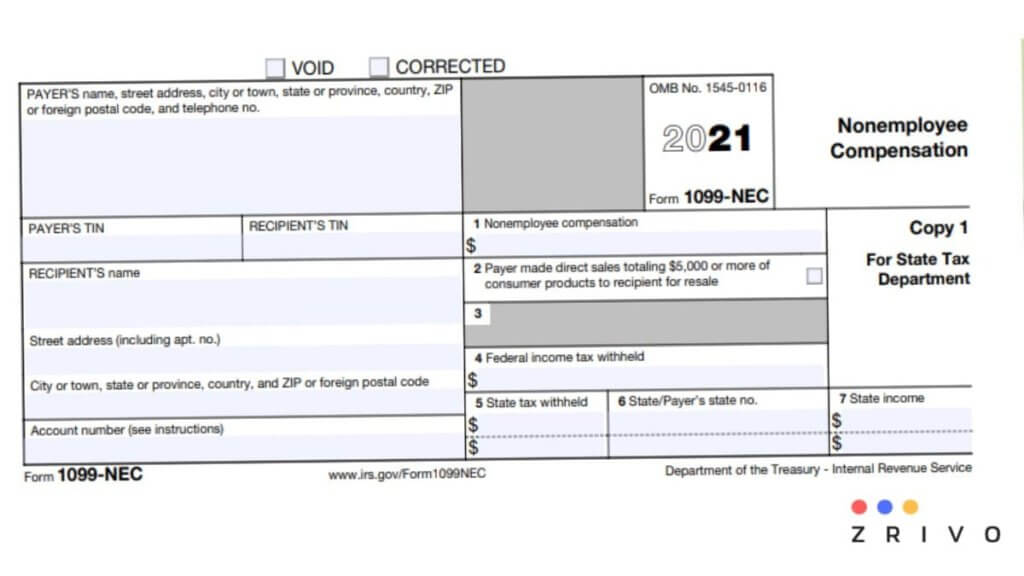

What copy of Form 1099-NEC should I use?

What copy of Form 1099-NEC should I use?

There are three copies of Form 1099-NEC that you will need to complete: Copy A, Copy B, and Copy C. You will provide a copy of Copy A to the IRS, a copy of Copy B to the independent contractor, and keep a copy of Copy C for your records. Make sure to use the correct copy of the form for each recipient.

How do I file Form 1099-NEC?

How do I file Form 1099-NEC?

You will need to file Form 1099-NEC with the IRS, along with a transmittal Form 1096. This must be done by January 31st of the year following the tax year in which the payments were made. You can file these forms electronically or by mail. It is recommended that you file electronically if you have more than 250 forms to file.

Can I fill out Form 1099-NEC online?

Can I fill out Form 1099-NEC online?

Yes, you can fill out Form 1099-NEC online. There are many online services that allow you to fill out and file this form electronically. Some of these services charge a fee, while others are free. Be sure to choose a reputable service if you decide to file your forms online.

What is the difference between Form 1099-NEC and Form 1099-MISC?

What is the difference between Form 1099-NEC and Form 1099-MISC?

Form 1099-MISC is used to report a variety of payments made to individuals or businesses, including rents, royalties, and other types of income. Prior to 2020, non-employee compensation was also reported on Form 1099-MISC. However, starting with the 2020 tax year, non-employee compensation must be reported on Form 1099-NEC.

What happens if I don’t file Form 1099-NEC?

What happens if I don’t file Form 1099-NEC?

If you fail to file Form 1099-NEC when required, you could be subject to penalties. The amount of the penalty depends on how late you file the form and how many forms you failed to file. It’s important to file these forms on time to avoid these penalties.

In conclusion, if you are an independent contractor who received $600 or more in non-employee compensation during the year, you will need to report this income on Form 1099-NEC. This form is used to report the amount of non-employee compensation paid, any federal income tax withholding taken out of those payments, and the independent contractor’s name, address, and social security number or employer identification number. You must file this form with the IRS by January 31st of the year following the tax year in question. If you need help filling out or filing Form 1099-NEC, be sure to consult with a tax professional.