Have you ever heard of the term 1099-MISC? It’s a form used to report income that’s not earned in the form of salary, wages or tips. Basically, it’s used for independent contractors or freelancers. In this post, we’ll be looking at some common misconceptions about 1099 forms and how to find free printable 1099-MISC forms.

Myth #1: Only Business Owners Need to Fill Out 1099-MISC Forms

This is one of the most common misconceptions about 1099 forms. In reality, anyone who pays more than $600 to an independent contractor or freelancer for their services during the calendar year needs to fill out a 1099-MISC form. This includes individuals, non-profits, and even government agencies.

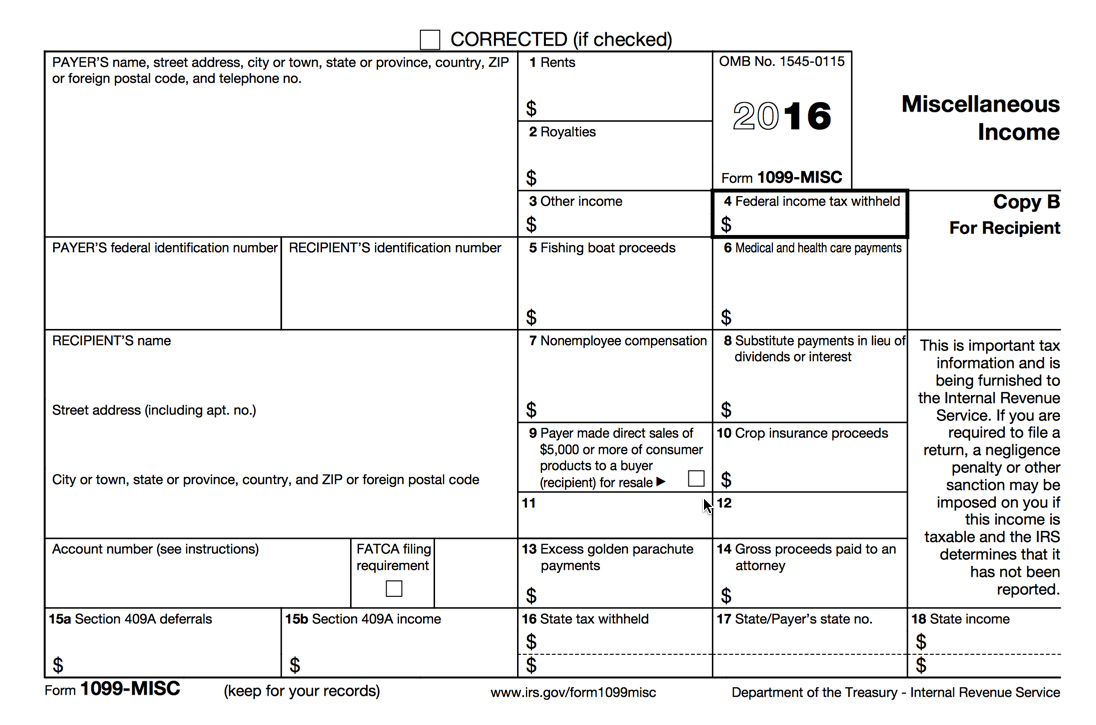

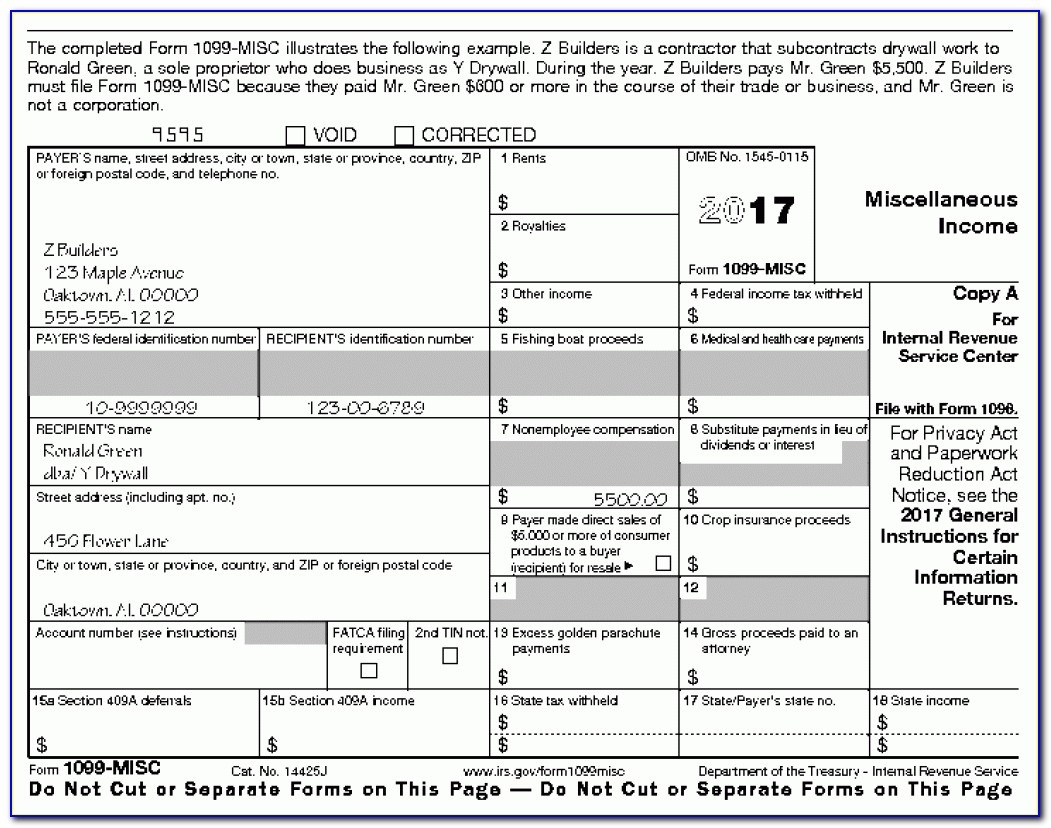

In order to fill out a 1099-MISC form, you’ll need the independent contractor’s full name, address, and tax ID number (or social security number). You’ll also need to report the total amount paid to the contractor during the calendar year in question.

In order to fill out a 1099-MISC form, you’ll need the independent contractor’s full name, address, and tax ID number (or social security number). You’ll also need to report the total amount paid to the contractor during the calendar year in question.

Myth #2: 1099 Forms Are Only for U.S. Citizens

Another common misconception is that only U.S. citizens need to fill out 1099 forms. The truth is that anyone who earned income while working in the U.S. needs to fill out a 1099-MISC form if they meet the criteria mentioned above.

Non-U.S. citizens may need to provide additional paperwork or documentation in order to fill out a 1099-MISC form, so it’s important to consult with a tax professional if you have any questions.

Non-U.S. citizens may need to provide additional paperwork or documentation in order to fill out a 1099-MISC form, so it’s important to consult with a tax professional if you have any questions.

Myth #3: I Only Need to Fill Out One 1099 Form per Independent Contractor

While it may seem like you only need to fill out one 1099-MISC form per independent contractor, the truth is a bit more complicated. If you paid the contractor for multiple jobs or projects throughout the year, you’ll need to fill out a separate 1099 form for each payment of $600 or more.

For example, if you paid a freelance graphic designer $800 for a website design project and another $600 for a logo design project, you’ll need to fill out a separate 1099-MISC form for each payment.

For example, if you paid a freelance graphic designer $800 for a website design project and another $600 for a logo design project, you’ll need to fill out a separate 1099-MISC form for each payment.

Myth #4: I Can Fill Out 1099 Forms by Hand

While it’s technically possible to fill out 1099 forms by hand, it’s not recommended. Handwritten forms can be difficult for the IRS to read and may result in errors or delays in processing. Additionally, the IRS requires that 1099 forms be typed or printed, so it’s not technically allowed to fill them out by hand.

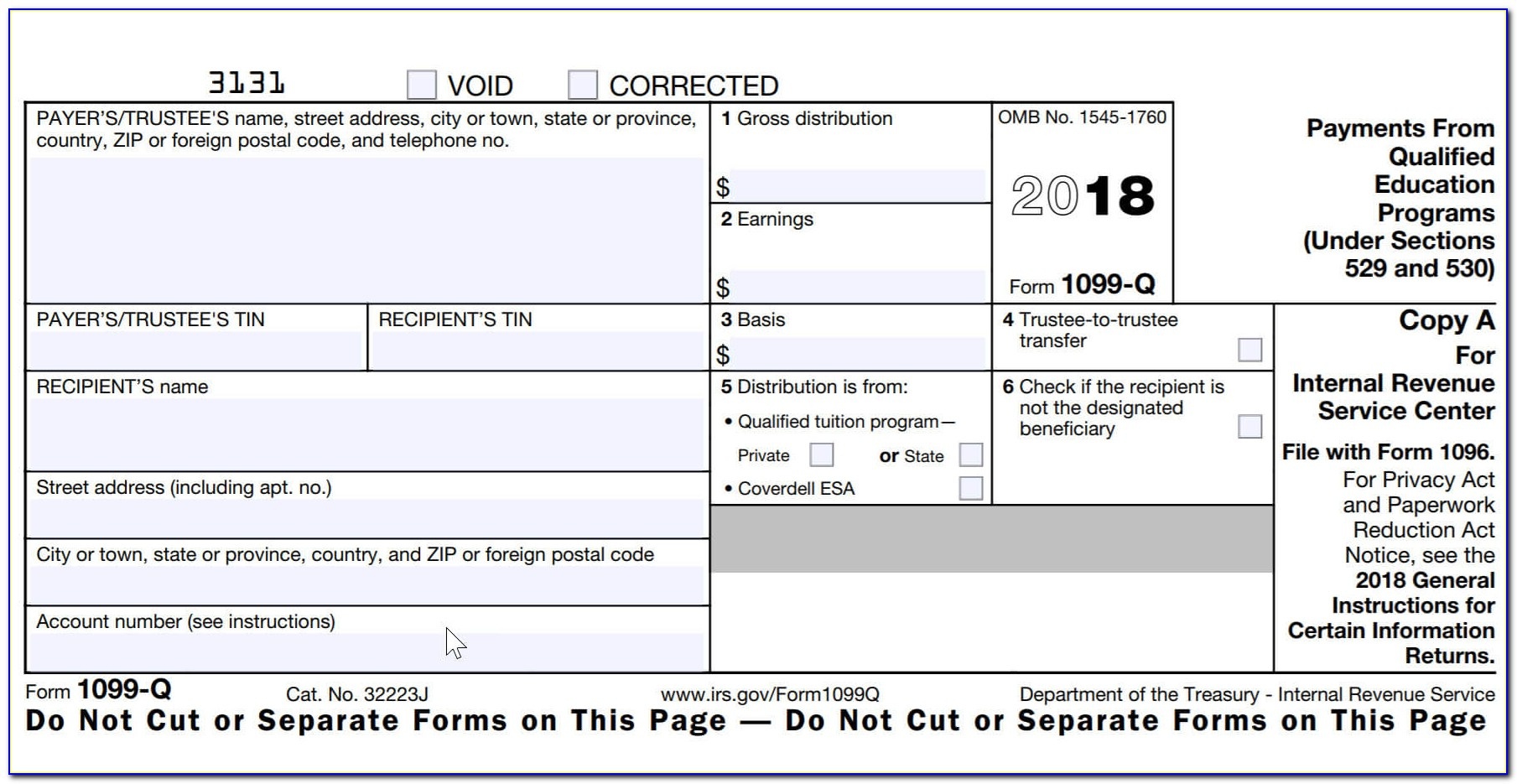

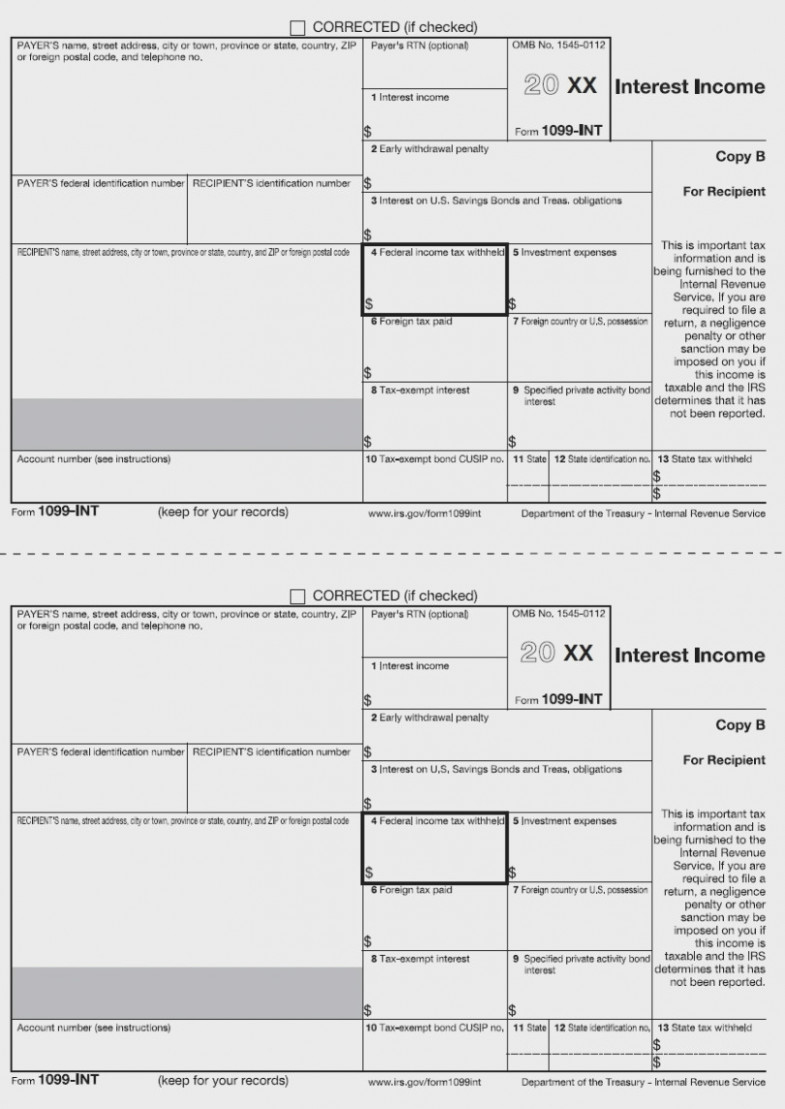

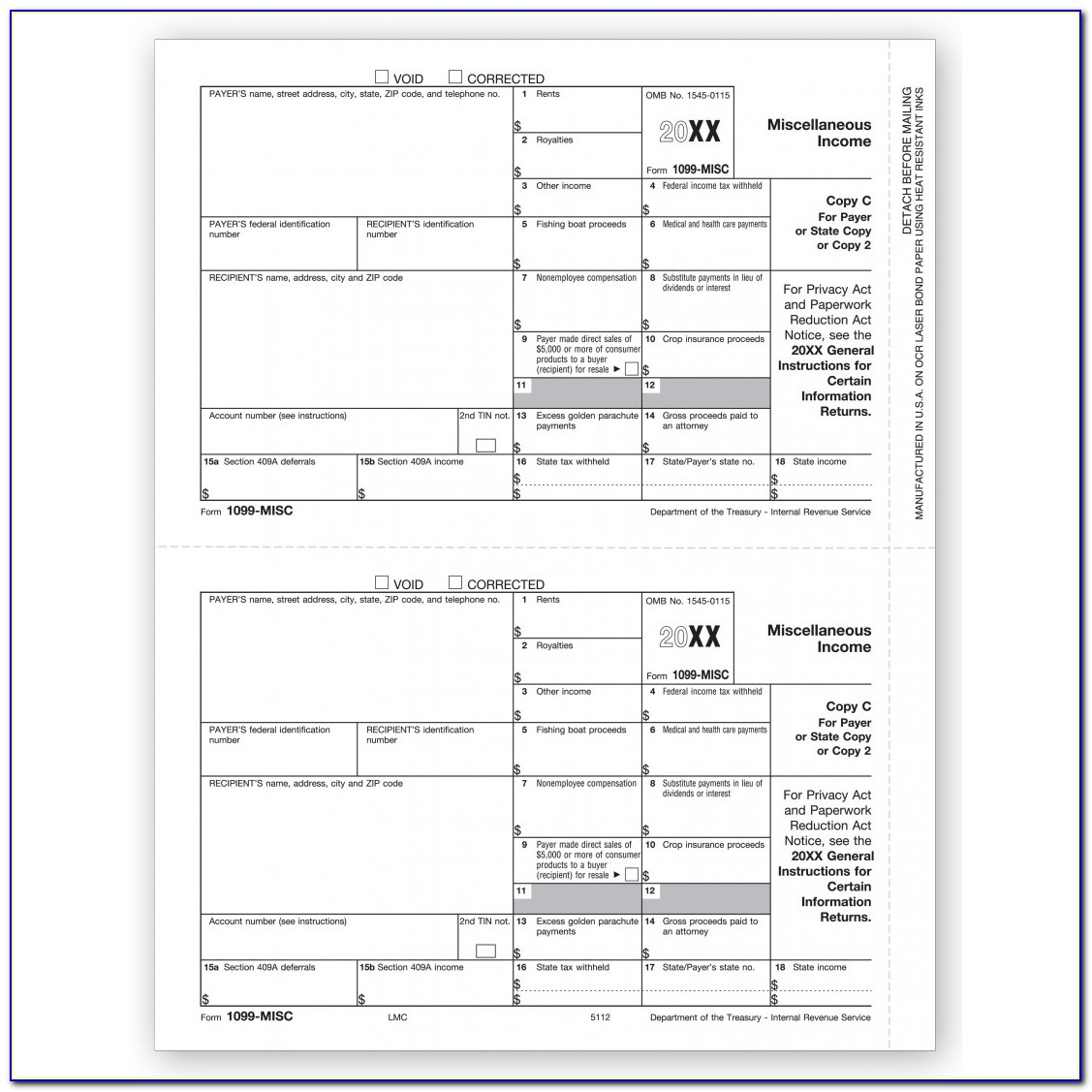

Thankfully, there are plenty of free printable 1099-MISC forms available online that you can fill out using your computer. Many of these forms are fillable PDFs, which allow you to type in the required information and then print out the form.

Thankfully, there are plenty of free printable 1099-MISC forms available online that you can fill out using your computer. Many of these forms are fillable PDFs, which allow you to type in the required information and then print out the form.

Myth #5: I Have to Pay for 1099 Forms

Some companies may try to charge you for 1099 forms, but the truth is that there are plenty of free printable 1099-MISC forms available online. These forms are provided by a variety of sources, including tax software companies, accounting firms, and even the IRS.

Be sure to double-check that the form you’re downloading is for the correct tax year, as 1099-MISC forms are updated annually. In general, it’s a good idea to download forms directly from reputable sources rather than third-party sites to ensure that you’re getting accurate and up-to-date information.

Be sure to double-check that the form you’re downloading is for the correct tax year, as 1099-MISC forms are updated annually. In general, it’s a good idea to download forms directly from reputable sources rather than third-party sites to ensure that you’re getting accurate and up-to-date information.

Myth #6: I Don’t Have to Worry About Filing 1099 Forms If I’m a Small Business Owner

It’s true that filing 1099 forms can be more complicated for small business owners, especially if you’re also running the day-to-day operations of your business. However, it’s still important to make sure that you’re filing all necessary forms and paperwork to avoid penalties from the IRS.

If you’re feeling overwhelmed by the process of filing 1099-MISC forms, consider consulting with a tax professional or using tax preparation software to help you navigate the process. It’s always better to be safe than sorry when it comes to complying with IRS regulations.

If you’re feeling overwhelmed by the process of filing 1099-MISC forms, consider consulting with a tax professional or using tax preparation software to help you navigate the process. It’s always better to be safe than sorry when it comes to complying with IRS regulations.

Myth #7: Filing 1099 Forms is a Once-a-Year Task

While it’s true that you only need to file 1099-MISC forms once a year (typically by January 31st for the previous calendar year), it’s important to keep accurate and up-to-date records throughout the year to make the process easier. This includes keeping track of all payments made to independent contractors, as well as their contact information and tax ID numbers.

By staying organized and keeping good records, you can save yourself time and headaches when it comes time to file your 1099-MISC forms. You can also avoid late filing penalties and other consequences of filing inaccurate or incomplete forms.

By staying organized and keeping good records, you can save yourself time and headaches when it comes time to file your 1099-MISC forms. You can also avoid late filing penalties and other consequences of filing inaccurate or incomplete forms.

Myth #8: I Can Ignore 1099 Forms If I Don’t Receive Them

If you’re an independent contractor or freelancer, it’s important to keep track of your income and make sure that you’re reporting it accurately on your tax returns. This includes any income received via 1099-MISC forms.

Even if you don’t receive a 1099-MISC form from a client or employer, you’re still responsible for reporting any income you earned from that source. It’s always a good idea to keep your own records of income, expenses, and any taxes paid throughout the year to ensure that you’re accurately reporting your income on your tax returns.

Even if you don’t receive a 1099-MISC form from a client or employer, you’re still responsible for reporting any income you earned from that source. It’s always a good idea to keep your own records of income, expenses, and any taxes paid throughout the year to ensure that you’re accurately reporting your income on your tax returns.

Conclusion

There are plenty of misconceptions about 1099 forms, but by doing your research and staying organized, you can make the process of filing them go more smoothly. Whether you’re a small business owner or an independent contractor, it’s important to make sure that you’re complying with IRS regulations and accurately reporting your income.