It’s that time of the year again - tax season. For many of us, filing our taxes can be a daunting task, but fortunately, signNow has made it easy with their printable 1040ez form. Simply download the form from their website, fill it out, and sign it electronically.

What is the 1040ez form?

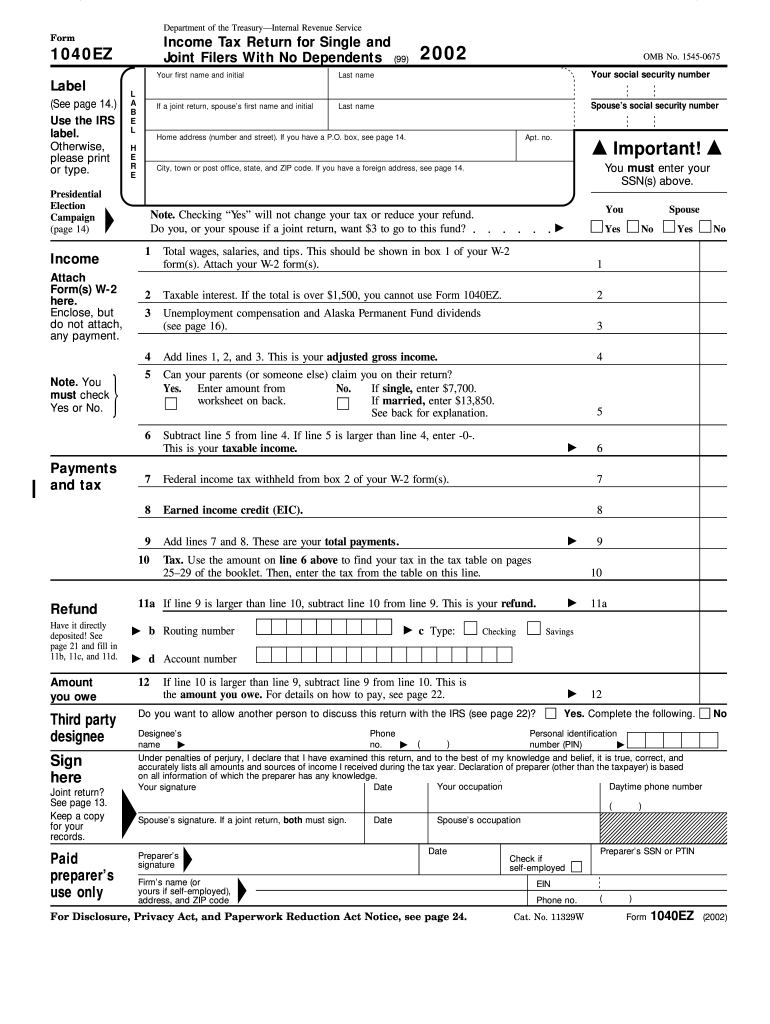

The 1040ez form is a simplified tax form used by individuals who have a relatively simple financial situation. It is designed to make the process of filing taxes easier and less time-consuming.

The 1040ez form is a simplified tax form used by individuals who have a relatively simple financial situation. It is designed to make the process of filing taxes easier and less time-consuming.

Who can use the 1040ez form?

The 1040ez form is available for use by single or married taxpayers who do not have any dependents, who do not itemize deductions, and who have a total income of less than $100,000.

How to fill out the 1040ez form

The 1040ez form consists of only one page and is divided into several sections. The sections include:

- Personal information

- Income information

- Tax information

- Signatures

Personal information

In the personal information section, you will need to provide your name, address, and social security number. You will also need to indicate whether you are single or married, and if you are married, you will need to provide your spouse’s name and social security number.

Income information

The income information section requires you to provide details about your income, including wages, salaries, tips, and any other income you may have received throughout the tax year. You will also need to indicate whether you received any taxable interest or unemployment compensation.

Tax information

The tax information section requires you to calculate your taxable income, tax liability, and any credits you may be eligible for. This section also includes a worksheet to help you calculate your total Earned Income Credit.

Signatures

The final section of the 1040ez form requires you and your spouse, if applicable, to sign and date the form electronically.

Overall, the 1040ez form is a great option for individuals with a simple tax situation. With signNow’s printable form, filing your taxes has never been easier.