Hey y’all, I just came across this amazing Paycheck Bill Tracker that I think could really help us all stay on top of our finances. It’s a printable, which means you can easily keep it with you and update it as needed. I love that it’s customizable to fit your unique needs and budget.

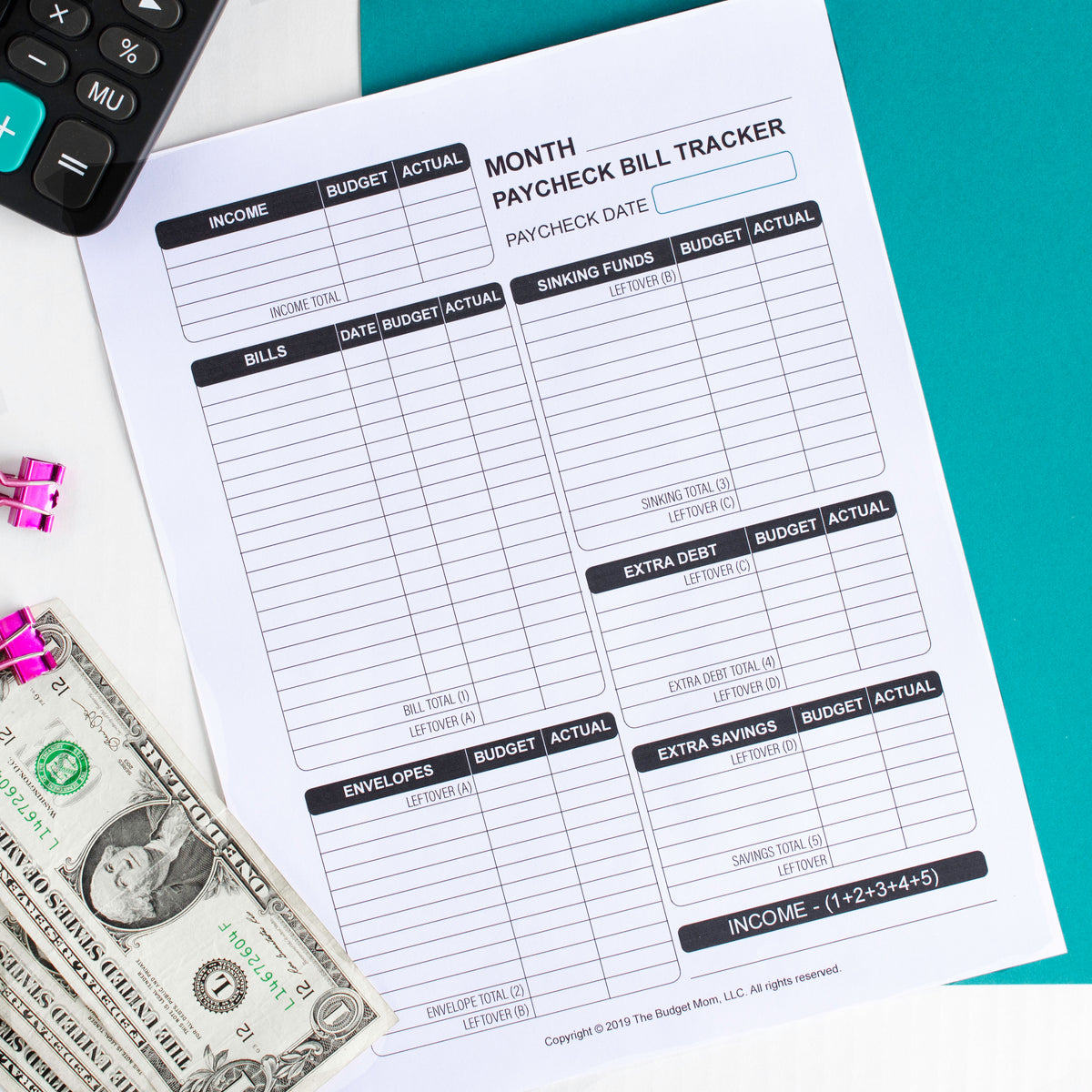

Check out this image of the Paycheck Bill Tracker:

As you can see, it’s a simple and easy-to-use layout. You can input your bills and expenses for each pay period and track them throughout the month. This helps you stay on top of your spending and avoid any surprise bills or expenses.

As you can see, it’s a simple and easy-to-use layout. You can input your bills and expenses for each pay period and track them throughout the month. This helps you stay on top of your spending and avoid any surprise bills or expenses.

Here are a few reasons why I think this Paycheck Bill Tracker is worth checking out:

- You can easily see what bills are due and when they’re due

- You can track your spending and keep yourself accountable

- You can see your progress and make adjustments as needed

- You can use it as a budgeting tool to help you save money and stay on track

How to use the Paycheck Bill Tracker:

To use the Paycheck Bill Tracker, simply print it out and fill in your bills and expenses for each pay period. You can customize the categories to fit your unique needs and budget. You can also make notes in the “Notes” section to remind yourself of important details or upcoming expenses.

As you pay your bills and expenses throughout the month, mark them off on the tracker. This will help you see your progress and avoid any missed payments or surprise bills. At the end of the month, you can take a look at your spending and make adjustments as needed for the next pay period.

Final thoughts:

I hope you find this Paycheck Bill Tracker as useful as I have. It’s a simple and effective tool for staying on top of your finances and avoiding any financial surprises. Let’s all work together to stay on top of our budgets and achieve our financial goals.