Today we’re talking about the important topic of tax forms - specifically, the W-9 form. Whether you’re a freelancer, contractor, or work in any type of self-employment, you’ll likely need to fill out a W-9 form at some point. But what exactly is a W-9 form, and how do you fill it out?

First, let’s start with what a W-9 form is. A W-9 form is a tax form used by businesses to request your taxpayer identification number. This identification number is typically your Social Security number or Employer Identification Number.

If you’re classified as an independent contractor or self-employed, you’ll need to fill out a W-9 form if you earn over $600 from a company or client in a given tax year. At the end of the year, the company or client will use the information on your W-9 form to issue a 1099 form, which shows how much money they paid you during the year.

1099 Forms 2021 Printable | Calendar Template Printable

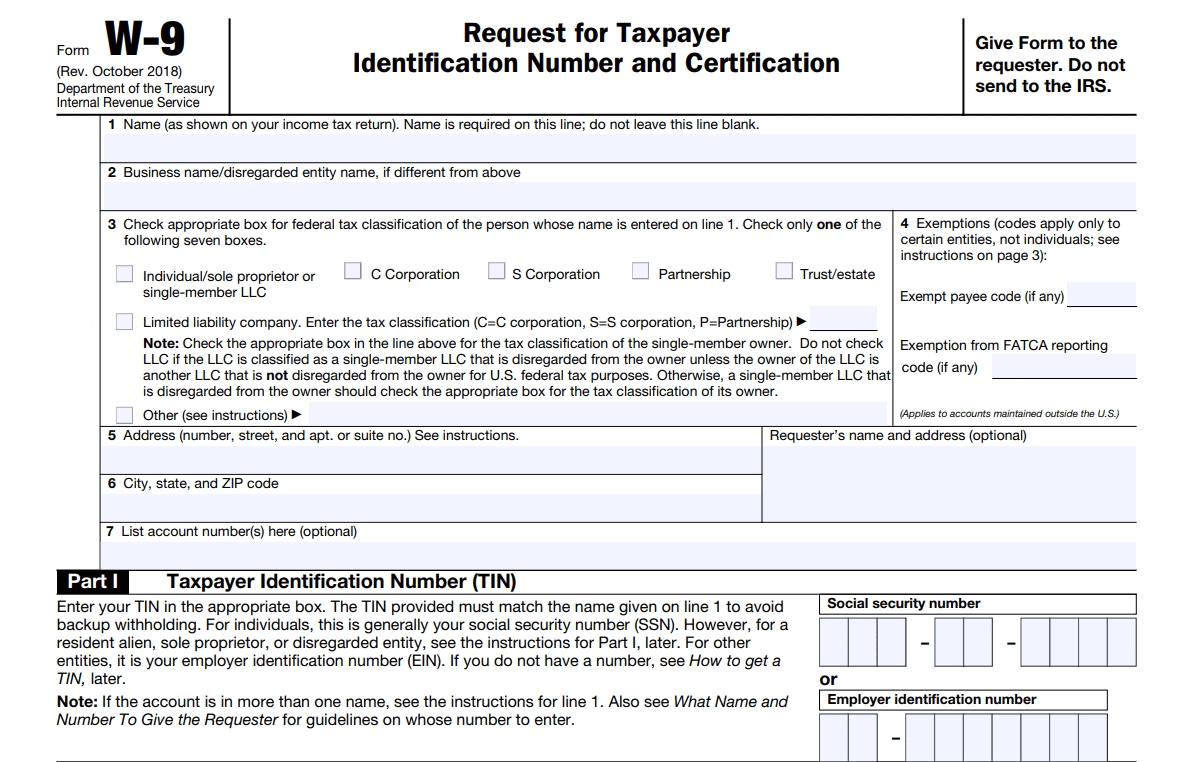

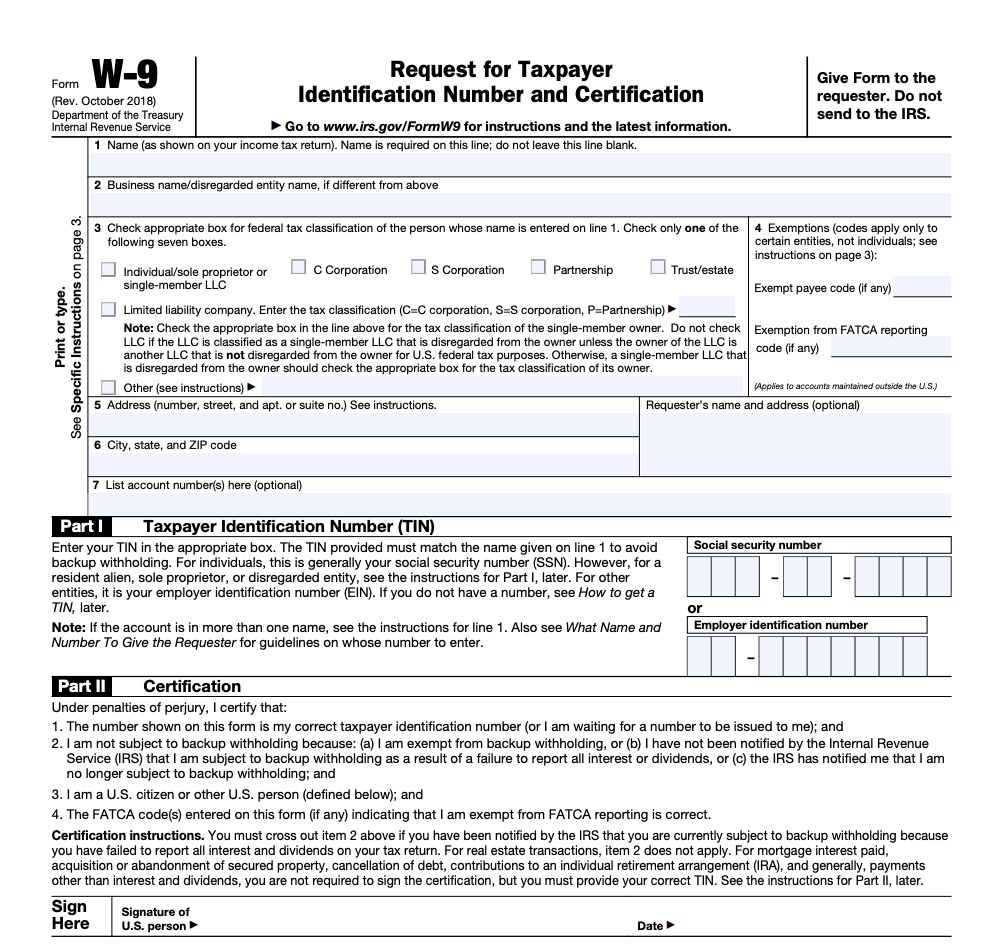

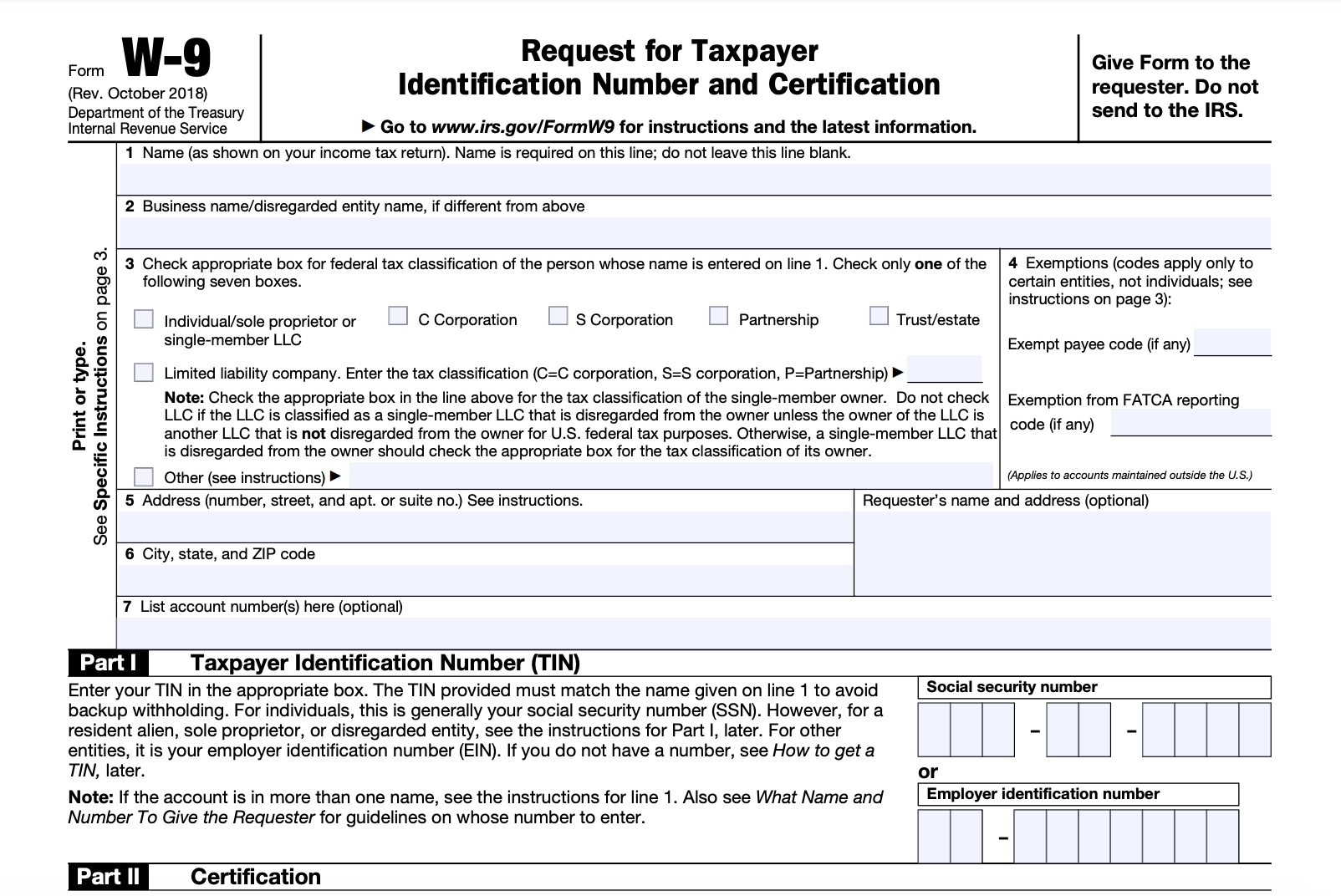

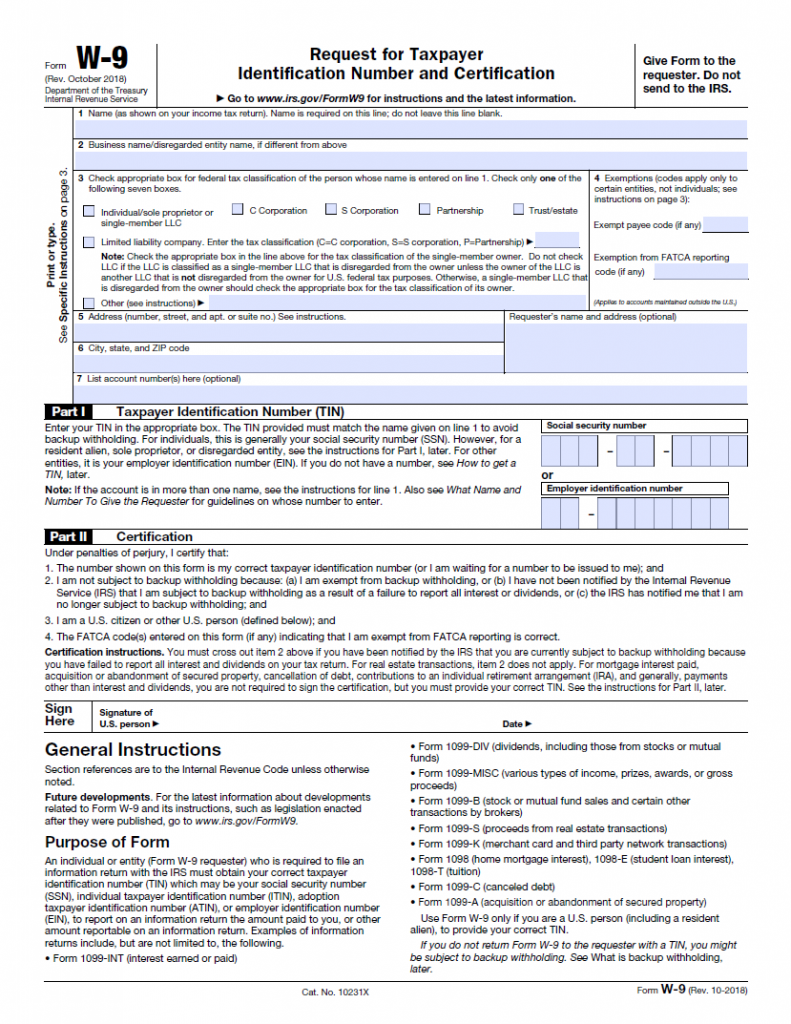

So, now that you know what a W-9 form is and why it’s important, how do you fill it out? The W-9 form is a simple one-page document that asks for basic information about yourself and your business.

So, now that you know what a W-9 form is and why it’s important, how do you fill it out? The W-9 form is a simple one-page document that asks for basic information about yourself and your business.

The first section of the form asks for your name and business name. If you operate under a business name, enter that name. If you don’t, enter your own name.

The second section asks for your tax classification. This is where you’ll indicate whether you are an individual, sole proprietor, partnership, or corporation. If you’re unsure which tax classification to choose, consult with a tax professional.

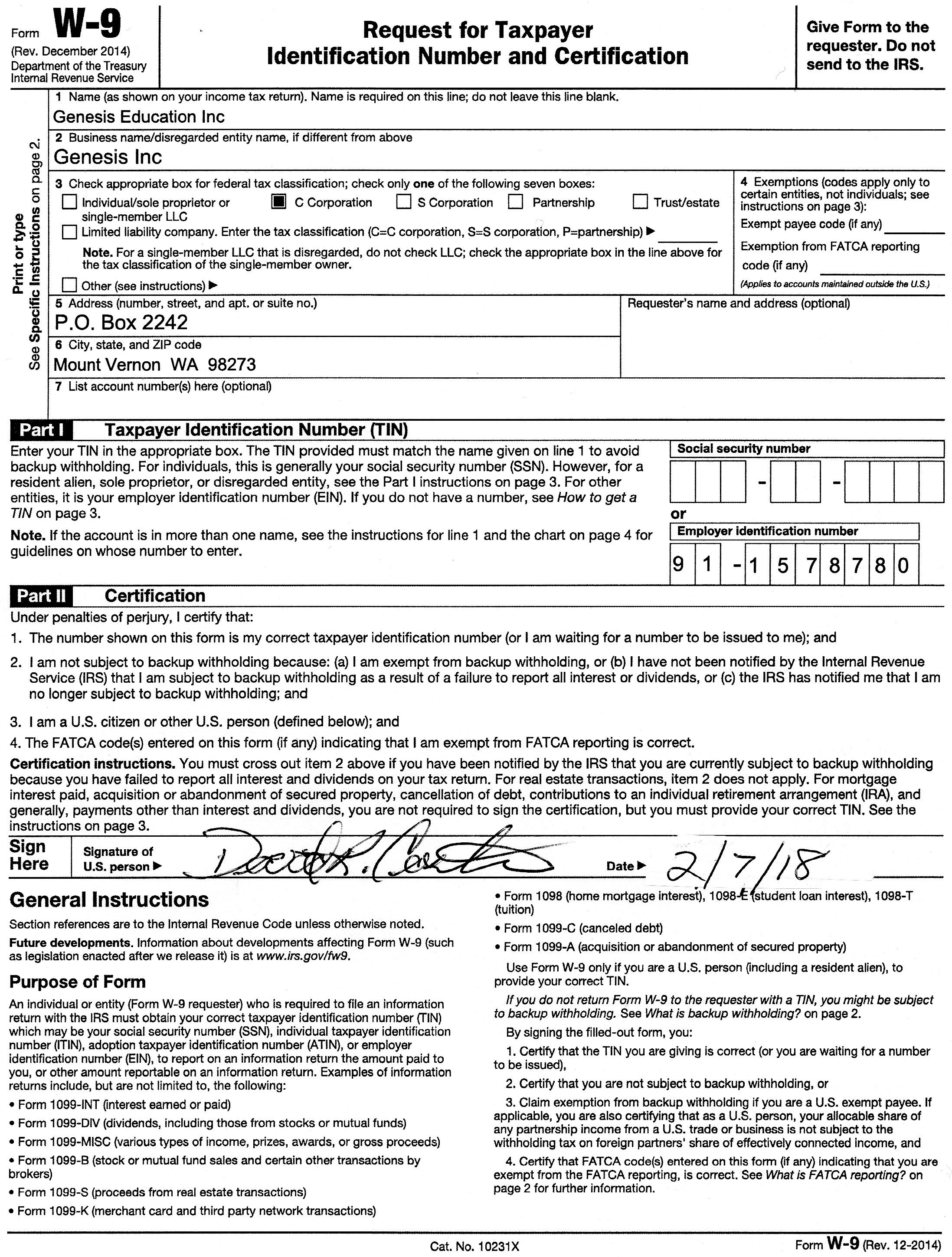

2020 W9 Printable Form | Example Calendar Printable

The next section asks for your taxpayer identification number (TIN). If you’re a sole proprietor or individual, this will likely be your Social Security number. If you have a registered business, you’ll need to enter your Employer Identification Number (EIN).

The next section asks for your taxpayer identification number (TIN). If you’re a sole proprietor or individual, this will likely be your Social Security number. If you have a registered business, you’ll need to enter your Employer Identification Number (EIN).

The fourth section asks for your address. Be sure to enter your mailing address, not your physical address if they are different.

Blank Tax Forms W9 | Example Calendar Printable

The final section asks for your signature, date, and the date you signed the form. Be sure to sign and date the form before submitting it to the company or client.

The final section asks for your signature, date, and the date you signed the form. Be sure to sign and date the form before submitting it to the company or client.

Overall, filling out a W-9 form is a straightforward process. However, it’s important to ensure that you’re filling it out correctly - incorrect information can lead to delays in payments or tax issues down the line. Keep in mind that you’ll likely need to fill out a new W-9 form each year for each company or client you work with.

Why Use a W-9 Form

But why do companies use W-9 forms in the first place? It’s all about documentation and reporting. Companies are required to issue 1099 forms to any independent contractors or self-employed individuals they paid over $600 to during the year. The information on the 1099 form comes directly from the W-9 form that the individual filled out, so it’s important to ensure that the W-9 form is accurate and up to date.

But why do companies use W-9 forms in the first place? It’s all about documentation and reporting. Companies are required to issue 1099 forms to any independent contractors or self-employed individuals they paid over $600 to during the year. The information on the 1099 form comes directly from the W-9 form that the individual filled out, so it’s important to ensure that the W-9 form is accurate and up to date.

W9 Tax Form 2021 Irs | PapersPanda.com

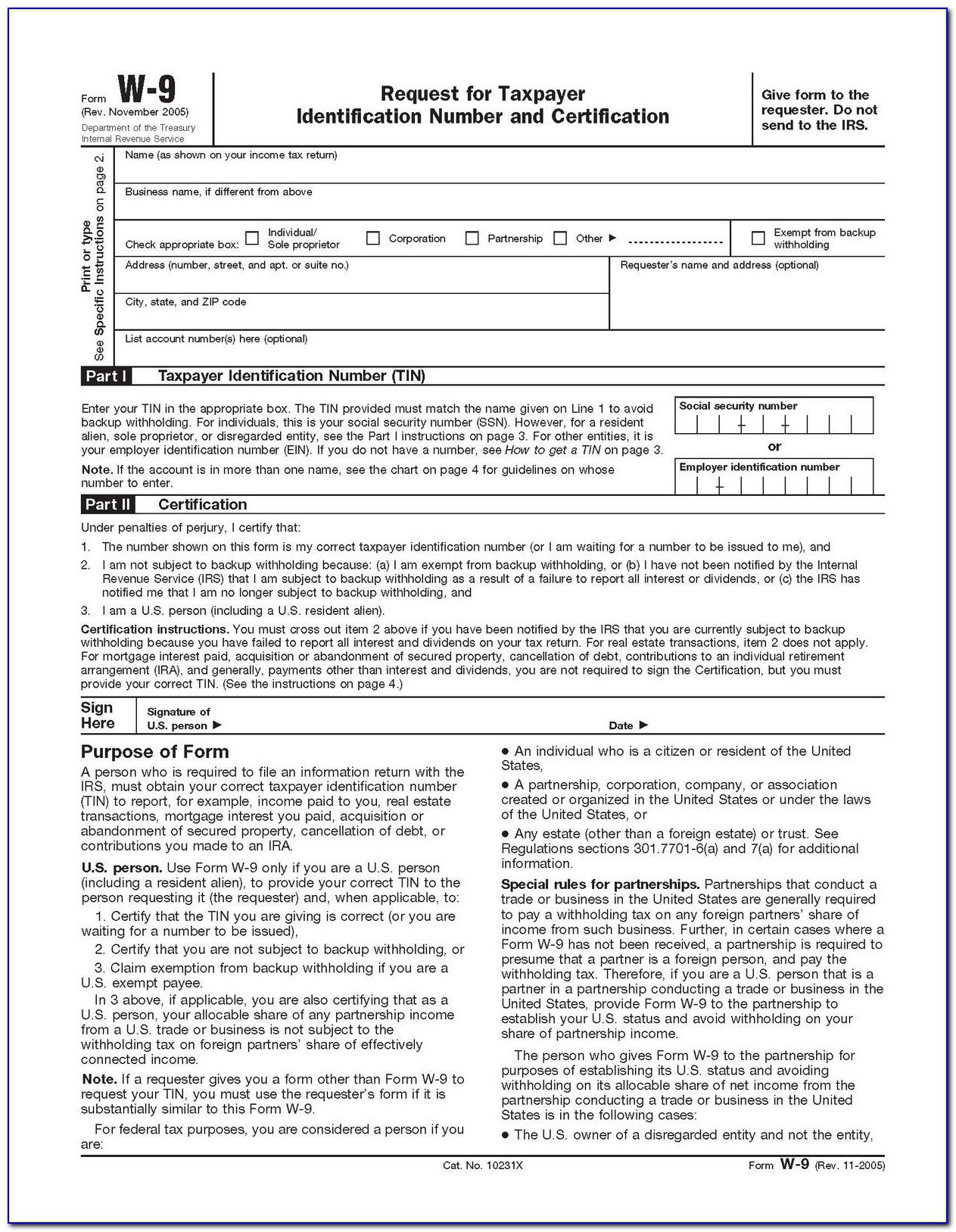

If you’re looking for a W-9 form to fill out, there are plenty of resources available online. Many tax preparation websites offer free printable versions of the form. However, be sure that you’re downloading the most up-to-date version of the form. The IRS updates the W-9 form periodically, so using an outdated form can lead to issues down the line.

If you’re looking for a W-9 form to fill out, there are plenty of resources available online. Many tax preparation websites offer free printable versions of the form. However, be sure that you’re downloading the most up-to-date version of the form. The IRS updates the W-9 form periodically, so using an outdated form can lead to issues down the line.

Blank Printable W9 Form | Calendar Template Printable

Finally, it’s important to keep copies of any W-9 forms you’ve filled out. If any issues or disputes arise regarding your tax information, having documentation of your W-9 forms can help resolve the issue quickly.

Finally, it’s important to keep copies of any W-9 forms you’ve filled out. If any issues or disputes arise regarding your tax information, having documentation of your W-9 forms can help resolve the issue quickly.

Printable W9 Form | W9Form With Regard To Printable W9 - Form - Free

Overall, the W-9 form is a simple but important part of any independent contractor or self-employed individual’s tax documentation. By understanding what the form is used for and how to fill it out correctly, you can ensure that you’re meeting your tax obligations and staying in good standing with the companies and clients you work with.

Overall, the W-9 form is a simple but important part of any independent contractor or self-employed individual’s tax documentation. By understanding what the form is used for and how to fill it out correctly, you can ensure that you’re meeting your tax obligations and staying in good standing with the companies and clients you work with.

Irs Printable 2022 W9 Form | PapersPanda.com

If you have any questions or concerns about the W-9 form, don’t hesitate to reach out to a tax professional or consult the IRS website for more information. Happy filing!

If you have any questions or concerns about the W-9 form, don’t hesitate to reach out to a tax professional or consult the IRS website for more information. Happy filing!