Yo what’s good, my people?

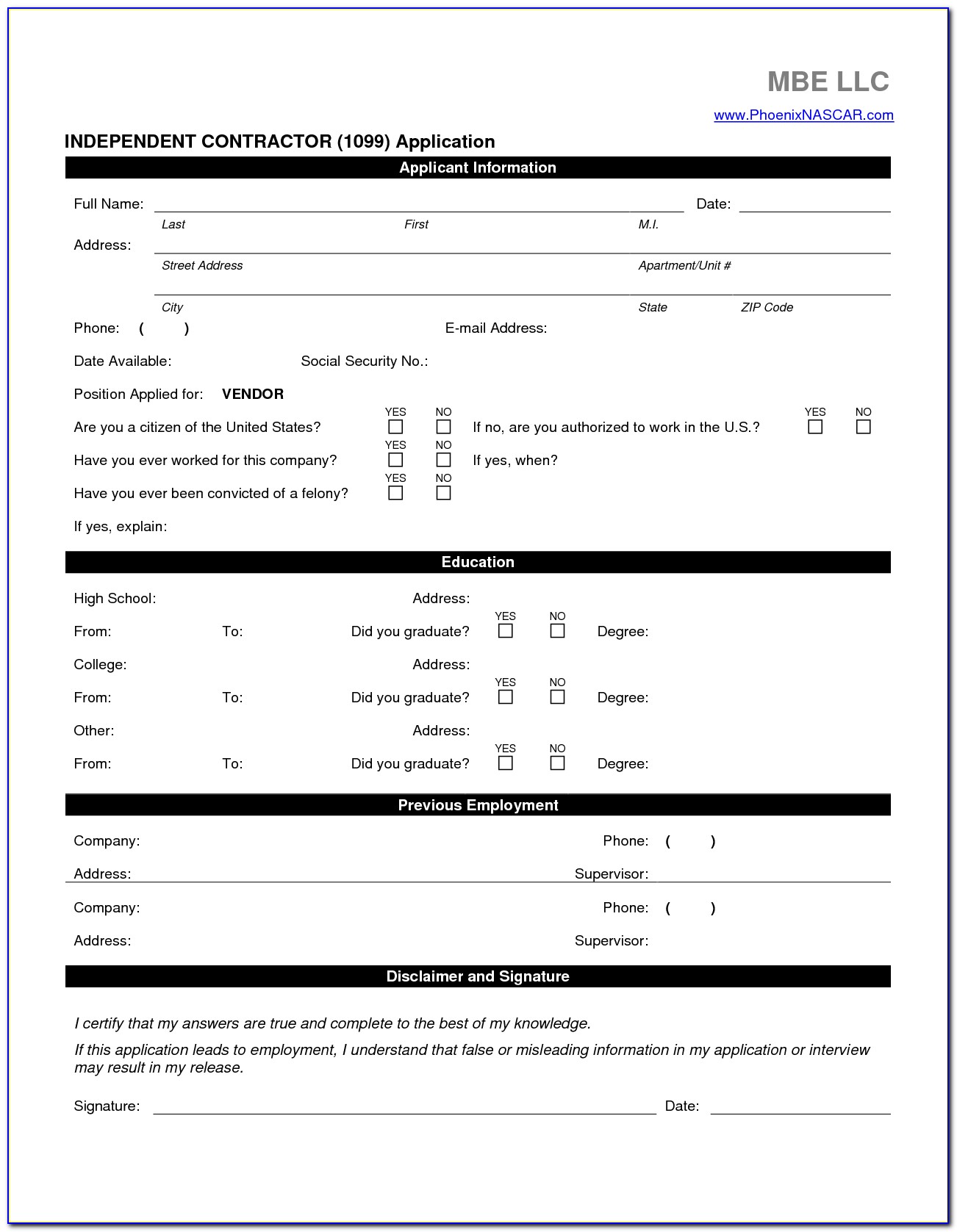

It’s tax season and you know what that means, time to talk about the dreaded 1099 form. If you’re an independent contractor like myself, then you know all too well the headache that comes with filling out this form. Lucky for you, I’ve gathered some helpful info and resources to make this process a little less painful.

First Things First: What is a 1099 Form?

A 1099 form is a tax form used to report income that is not subject to withholding tax. This means that if you’re an independent contractor, freelancer, or self-employed, you’ll most likely receive a 1099 form instead of a W-2 form. The form is used to report miscellaneous income and is typically issued by the person or company that paid you.

Types of 1099 Forms

There are several different types of 1099 forms, but the two most common forms for independent contractors are the 1099-MISC and the 1099-NEC. Let’s break down what each form is used for:

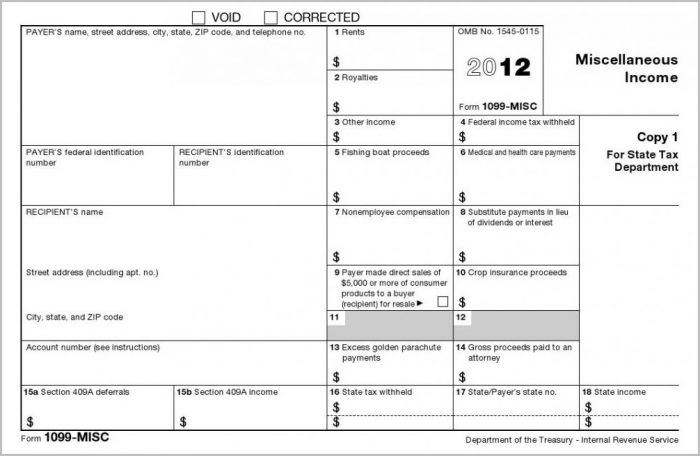

1099-MISC

The 1099-MISC form is used to report miscellaneous income such as rent, royalties, and non-employee compensation (aka money paid to an independent contractor). If you were paid $600 or more during the year by one person or company, you should receive a 1099-MISC form. This form is usually issued by January 31st.

1099-NEC

The 1099-NEC is a new form that was introduced for the 2020 tax year. It is used specifically to report non-employee compensation and replaces the non-employee compensation box on the 1099-MISC form. If you were paid $600 or more during the year by one person or company for your services, you should receive a 1099-NEC form. This form is also usually issued by January 31st.

How to Fill Out a 1099 Form

Now that you know what a 1099 form is and why you might receive one, let’s talk about how to fill it out. The form itself is pretty straightforward, but there are a few things you’ll need to know before you start:

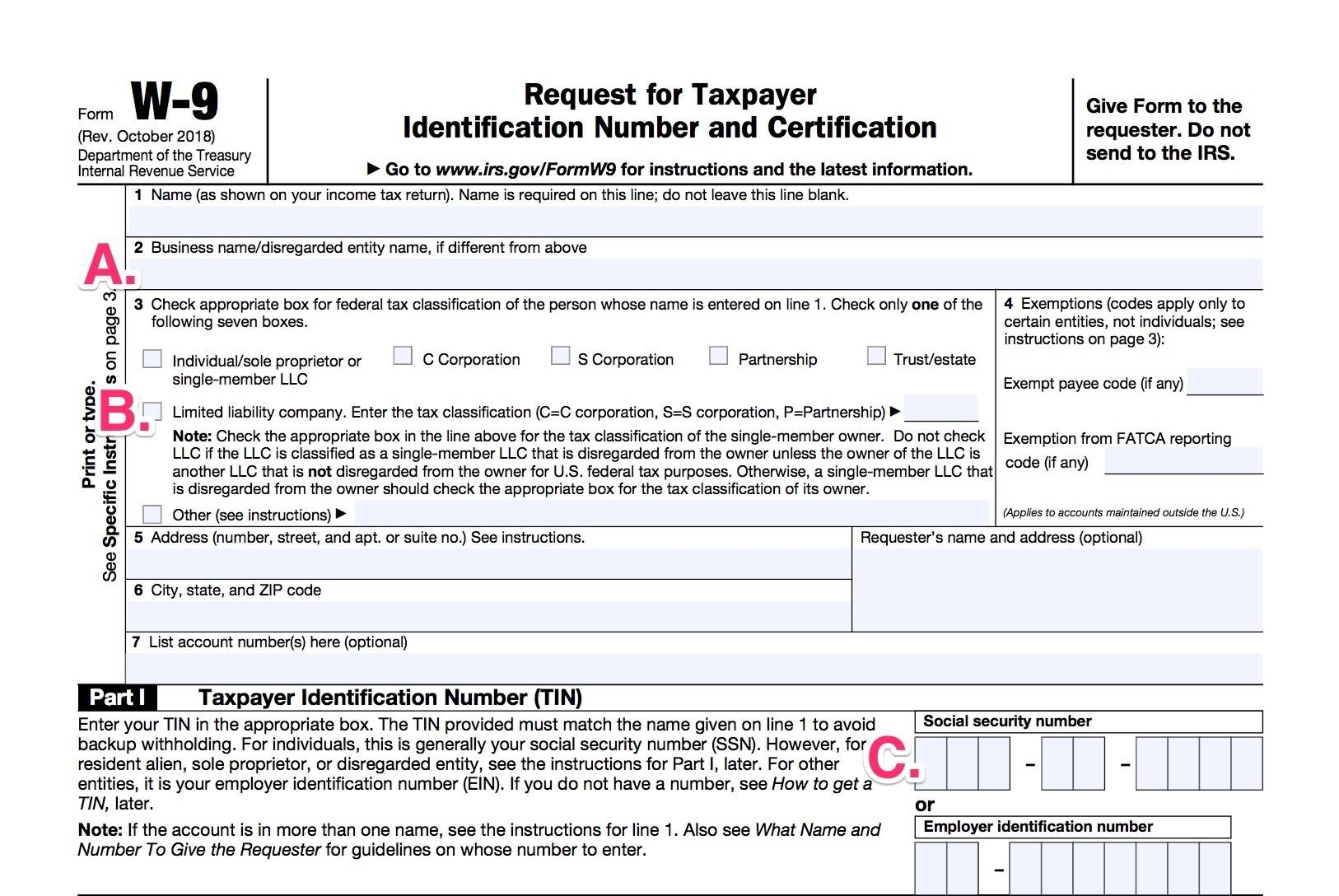

- Your name and address

- The name and address of the person or company who paid you

- Your social security number or employer identification number (EIN)

- The total amount you were paid in non-employee compensation

Once you have all that information, you can start filling out the form. Here’s a breakdown of what each box on the form means:

- Box 1: Nonemployee compensation. This is where you’ll report the total amount you were paid by the person or company who hired you.

- Box 4: Federal income tax withheld. If any federal income tax was withheld from your pay, it should be reported here. Note that this is not required unless the person or company who paid you chose to withhold taxes.

- Box 5: State tax withheld. Similar to Box 4, this box is optional and is only used if state taxes were withheld from your pay.

- Box 7: Nonemployee compensation. This is a repeat of Box 1 and is used for state reporting purposes.

- Box 15: State and state identification number. This is where you’ll report the state where you earned the income and your state tax identification number (if applicable).

Once you’ve filled out the form, you’ll need to provide a copy to the person or company who paid you (so they can include it in their tax filings) and send a copy to the IRS.

Where to Get a 1099 Form

So now that you know how to fill out a 1099 form, where can you actually get one? The good news is that you don’t need to go to any special office or website to get one - the person or company who paid you is responsible for providing you with the form. If it’s getting close to tax season and you haven’t received your 1099 form yet, make sure to contact the person or company to get a copy sent to you.

But if you’re looking for a preview of what the form looks like or just want to get a head start on filling it out, there are plenty of resources available online. Here are some of my favorites:

- IRS website - the source for all things tax-related. You can find printable 1099 forms here, as well as instructions on how to fill them out.

- Freelancers Union - a nonprofit organization dedicated to supporting independent workers. They have a great tax season resource center with tons of helpful info and tips.

- Tax1099 - a website that makes it easy to e-file your 1099 forms. They have a user-friendly interface and offer a variety of plans to fit your needs.

Final Thoughts

Filling out a 1099 form can be a pain, but it’s an important part of being an independent contractor or self-employed individual. Hopefully, these tips and resources will make the process a little easier for you. And remember, if you have any questions or concerns about your taxes, it’s always best to consult a tax professional.

Additional Resources

Additional Resources

Still have questions about 1099 forms? Check out these additional resources:

Wrapping Up

Wrapping Up

So there you have it, everything you need to know about 1099 forms for independent contractors. Don’t let tax season stress you out too much - just take it one step at a time and you’ll get through it. And don’t forget to take advantage of all the resources out there to help you along the way!

Stay blessed and hustle hard, my people.

Stay blessed and hustle hard, my people.

Until next time,

Until next time,

Peace