Hey there, my people! Today, I want to talk about something that affects all of us - taxes. Specifically, the W-9 form. It can be confusing and overwhelming, but don’t worry - I’m here to guide you through it.

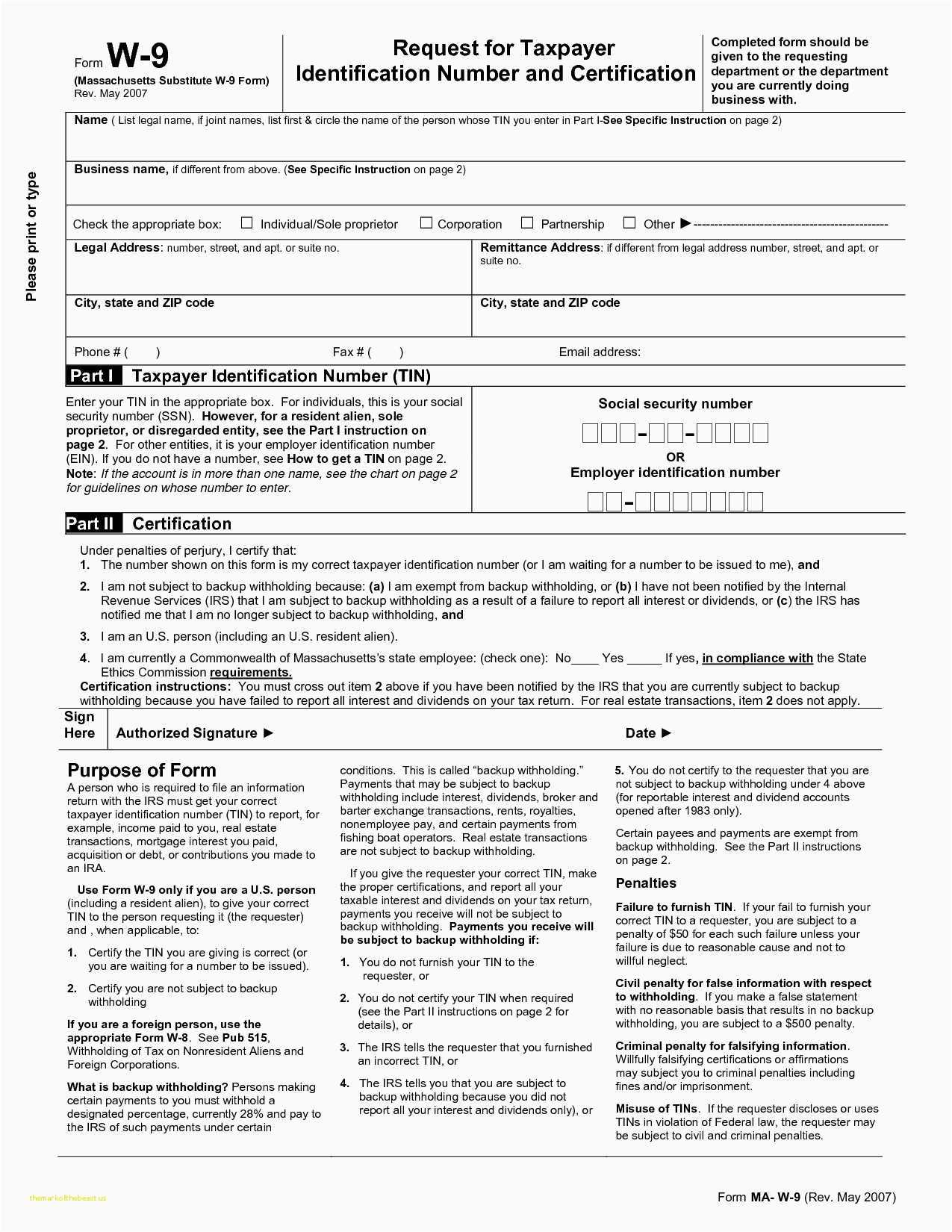

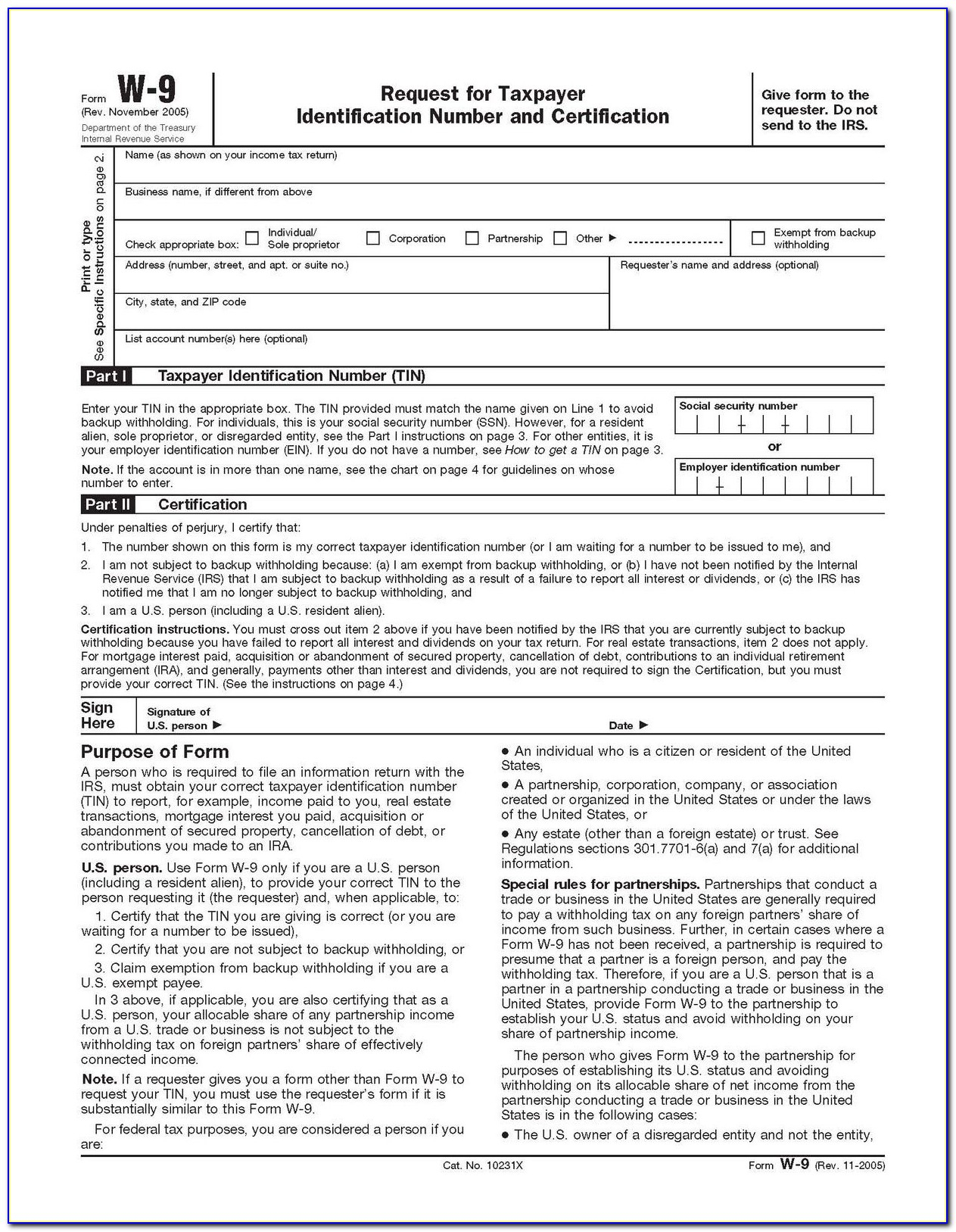

Image 1: W-9 Form 2019 Printable - Irs W-9 Tax Blank In Pdf - Free Printable W9

First things first - what is a W-9 form? It’s a tax form used by businesses to collect information from independent contractors and other freelancers they work with. The form asks for your name, address, Social Security number or employer identification number, and other details. This information is used to report your earnings to the IRS and prepare tax documents.

First things first - what is a W-9 form? It’s a tax form used by businesses to collect information from independent contractors and other freelancers they work with. The form asks for your name, address, Social Security number or employer identification number, and other details. This information is used to report your earnings to the IRS and prepare tax documents.

There are a few things you need to keep in mind when filling out a W-9 form:

- Make sure all information is accurate and up to date. You don’t want any mistakes on your tax documents!

- If you’re self-employed, you’ll need to list your business name and EIN.

- If you’re not a U.S. citizen, you’ll need to provide additional information.

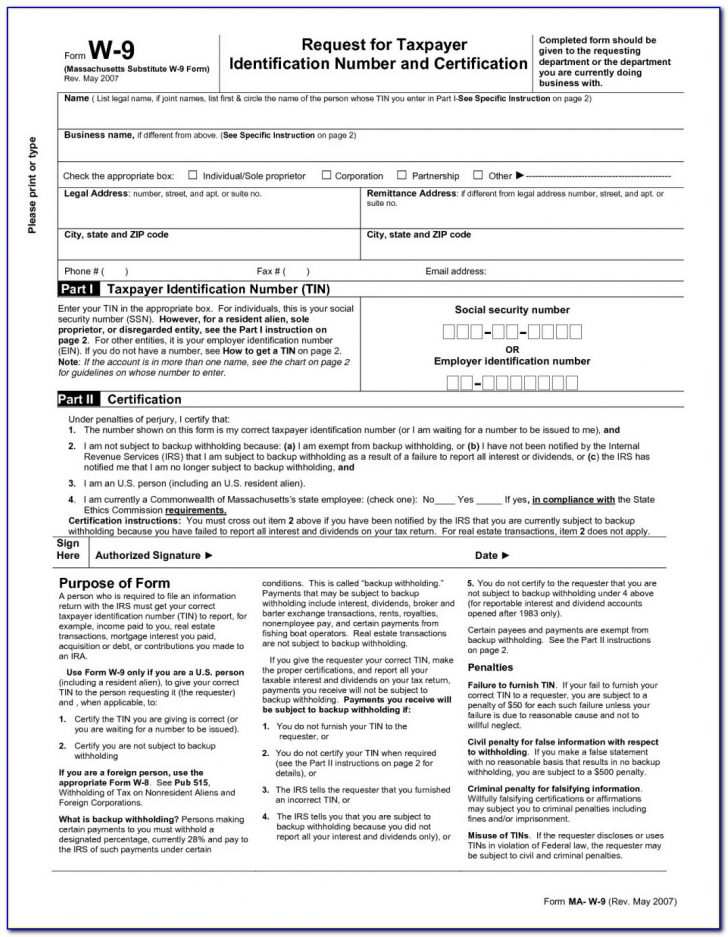

Image 2: Blank W9 Form Business Templates W 9 Colorado Printable In Printable

It’s important to remember that your W-9 form is not your tax return. It’s simply a way for businesses to collect the information they need to prepare accurate tax documents. You’ll still need to file your own tax return and pay any taxes owed.

It’s important to remember that your W-9 form is not your tax return. It’s simply a way for businesses to collect the information they need to prepare accurate tax documents. You’ll still need to file your own tax return and pay any taxes owed.

One thing to keep in mind is that when you work as an independent contractor, you’re considered self-employed in the eyes of the IRS. This means you’ll be responsible for paying your own taxes, including self-employment tax. Make sure you set aside enough money to cover your tax bill come tax time.

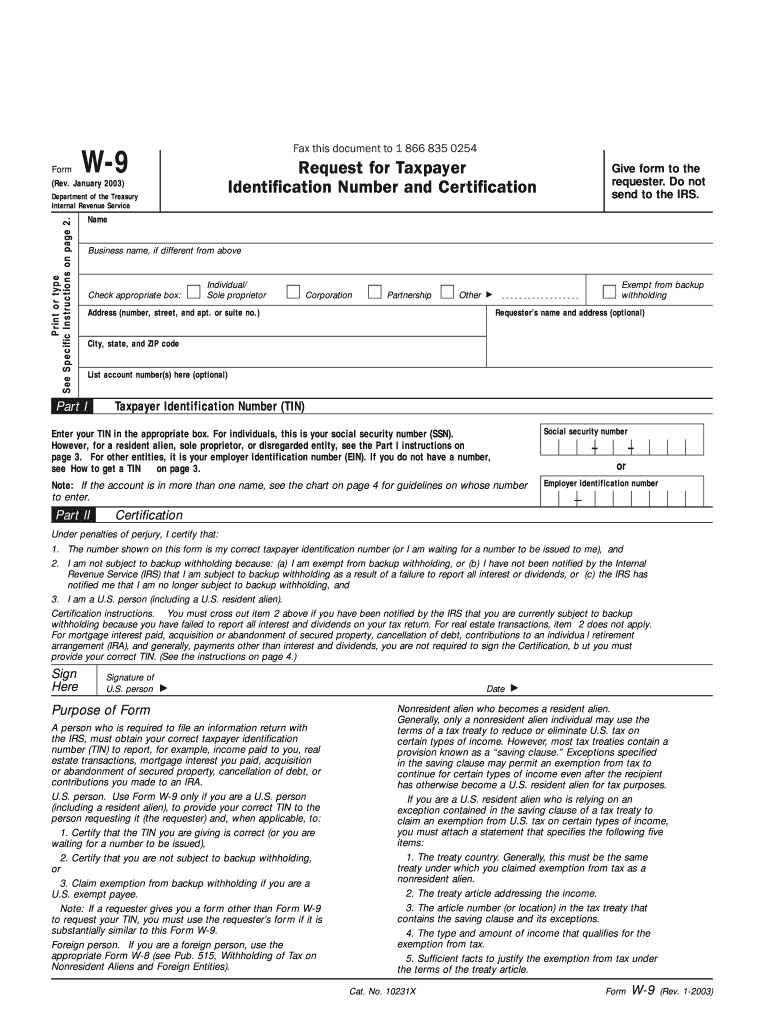

Image 3: Downloadable W 9 Form W9 Form Mascot Junction In 2020 with Free

If you’re unsure about any aspect of the W-9 form or your tax obligations as an independent contractor, don’t be afraid to seek out advice. You can talk to a tax professional or financial advisor to get the help you need to stay on top of your tax situation.

If you’re unsure about any aspect of the W-9 form or your tax obligations as an independent contractor, don’t be afraid to seek out advice. You can talk to a tax professional or financial advisor to get the help you need to stay on top of your tax situation.

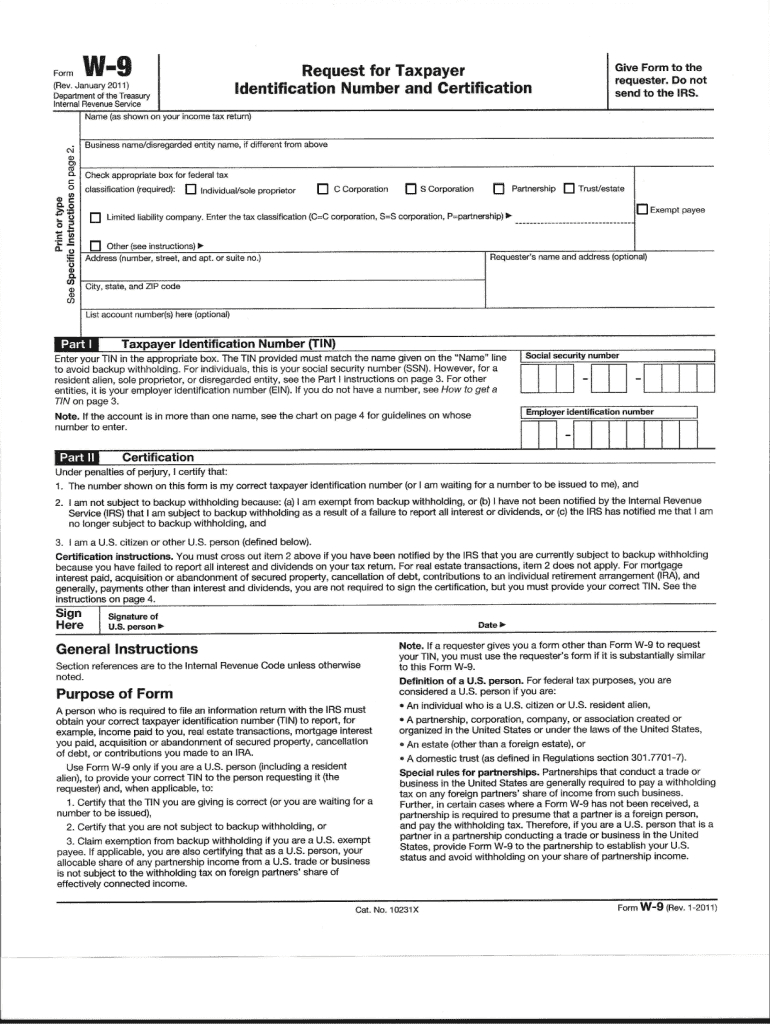

Image 4: 2003 Form IRS W-9 Fill Online, Printable, Fillable, Blank - pdfFiller

One thing you might be wondering is whether you need to fill out a W-9 form for every company you work with. The answer is yes - any business that pays you more than $600 over the course of a year is required by law to issue a 1099 tax form listing your earnings. To do that, they need your correct information, which you provide on the W-9 form.

One thing you might be wondering is whether you need to fill out a W-9 form for every company you work with. The answer is yes - any business that pays you more than $600 over the course of a year is required by law to issue a 1099 tax form listing your earnings. To do that, they need your correct information, which you provide on the W-9 form.

Image 5: Irs Free Printable W-9 Form 2020 | Example Calendar Printable

Another question you might have is whether you can refuse to fill out a W-9 form. The answer is no - businesses are required by law to collect this information from you. If you refuse to provide it, they may simply choose not to work with you. It’s better to comply with the law and make sure you’re paid for your work.

Another question you might have is whether you can refuse to fill out a W-9 form. The answer is no - businesses are required by law to collect this information from you. If you refuse to provide it, they may simply choose not to work with you. It’s better to comply with the law and make sure you’re paid for your work.

Image 6: 2022 Blank W9 Form | PapersPanda.com

One final thing to keep in mind is that you’ll need to keep track of your earnings and expenses as an independent contractor. This includes things like invoices, receipts, and any other documentation of your work and expenses. This information will come in handy when you file your tax return.

One final thing to keep in mind is that you’ll need to keep track of your earnings and expenses as an independent contractor. This includes things like invoices, receipts, and any other documentation of your work and expenses. This information will come in handy when you file your tax return.

So there you have it - everything you need to know about the W-9 form and your tax obligations as an independent contractor. Remember, staying on top of your taxes is important for your financial stability and future success. Don’t be afraid to seek out help if you need it, and keep good records of your earnings and expenses. Good luck out there!