In today’s fast-paced world, financial transactions have become an integral part of our daily lives. A promissory note is a legal document that serves as a written promise to pay a sum of money to another person or entity. Promissory notes are used for various purposes like borrowing money, buying a house or car, or starting a new business venture.

What is a Promissory Note?

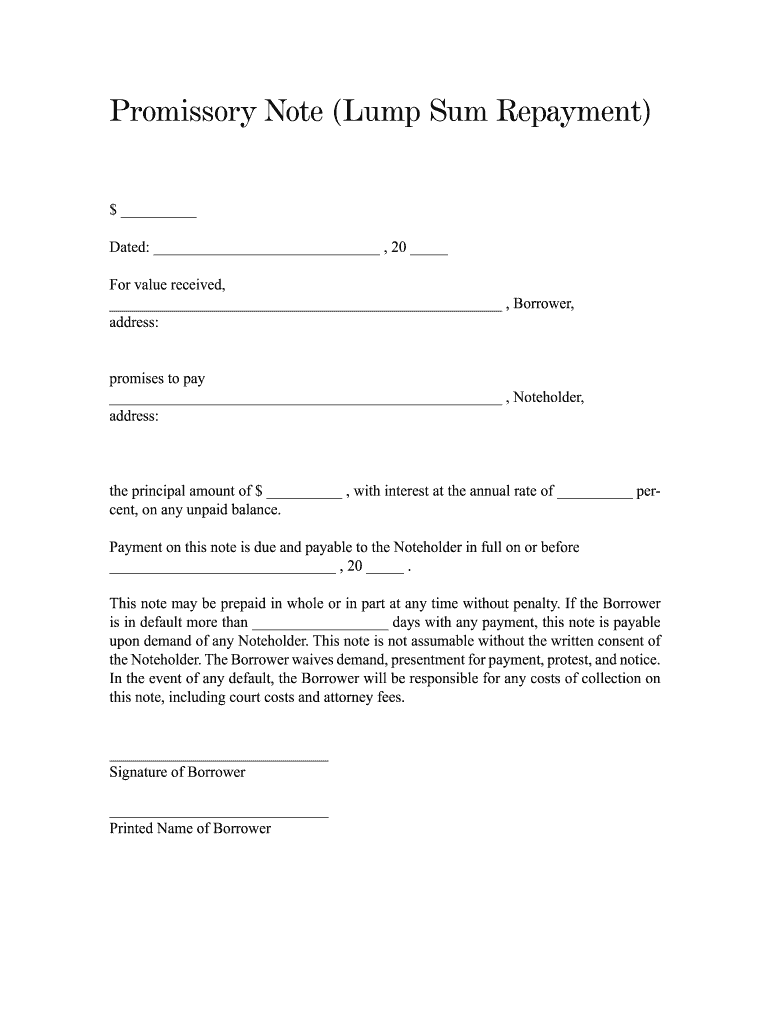

A promissory note is a written agreement between two parties which outlines the terms and conditions of a loan, including the repayment schedule, interest rate, and any other relevant information. It is a legally binding document that can be used in court if either party fails to fulfill their obligations under the agreement. A promissory note is similar to a contract, but it is a more concise and straightforward legal document.

A promissory note is a written agreement between two parties which outlines the terms and conditions of a loan, including the repayment schedule, interest rate, and any other relevant information. It is a legally binding document that can be used in court if either party fails to fulfill their obligations under the agreement. A promissory note is similar to a contract, but it is a more concise and straightforward legal document.

The Importance of Promissory Notes

Promissory notes provide several benefits to both the lender and borrower. For lenders, promissory notes provide a written record of the loan agreement, which helps to protect their interests in case of default. They can also use the promissory note as evidence in court if necessary.

For borrowers, promissory notes provide access to financing that might not otherwise be available. They can also help to establish creditworthiness and financial responsibility, which can be important when applying for other loans or credit in the future. Promissory notes can also provide a level of flexibility that traditional loans may not offer, as the terms of the loan can be negotiated between the parties.

How to Fill in a Promissory Note

If you need to borrow money or lend money to someone, a promissory note can be a useful tool to help formalize the agreement. Here’s how to fill in a promissory note:

- Begin by identifying the parties involved in the loan agreement. This should include the borrower and lender’s legal names and contact information.

- Next, specify the terms of the loan, including the amount borrowed, interest rate, and repayment schedule. Be sure to include any penalties or fees for late payments or defaults.

- Include any additional terms or conditions of the loan, such as collateral or guarantees.

- Finally, both parties should sign and date the promissory note to make it legally binding.

Conclusion

Promissory notes are an essential part of the financial landscape, providing a way for individuals and businesses to formalize loan agreements. By understanding the importance of promissory notes and how to fill them in, you can protect your interests and ensure that your financial transactions are legally binding. Take the time to carefully consider the terms of any loan agreement before signing a promissory note, and don’t hesitate to seek legal advice if you have any questions or concerns.