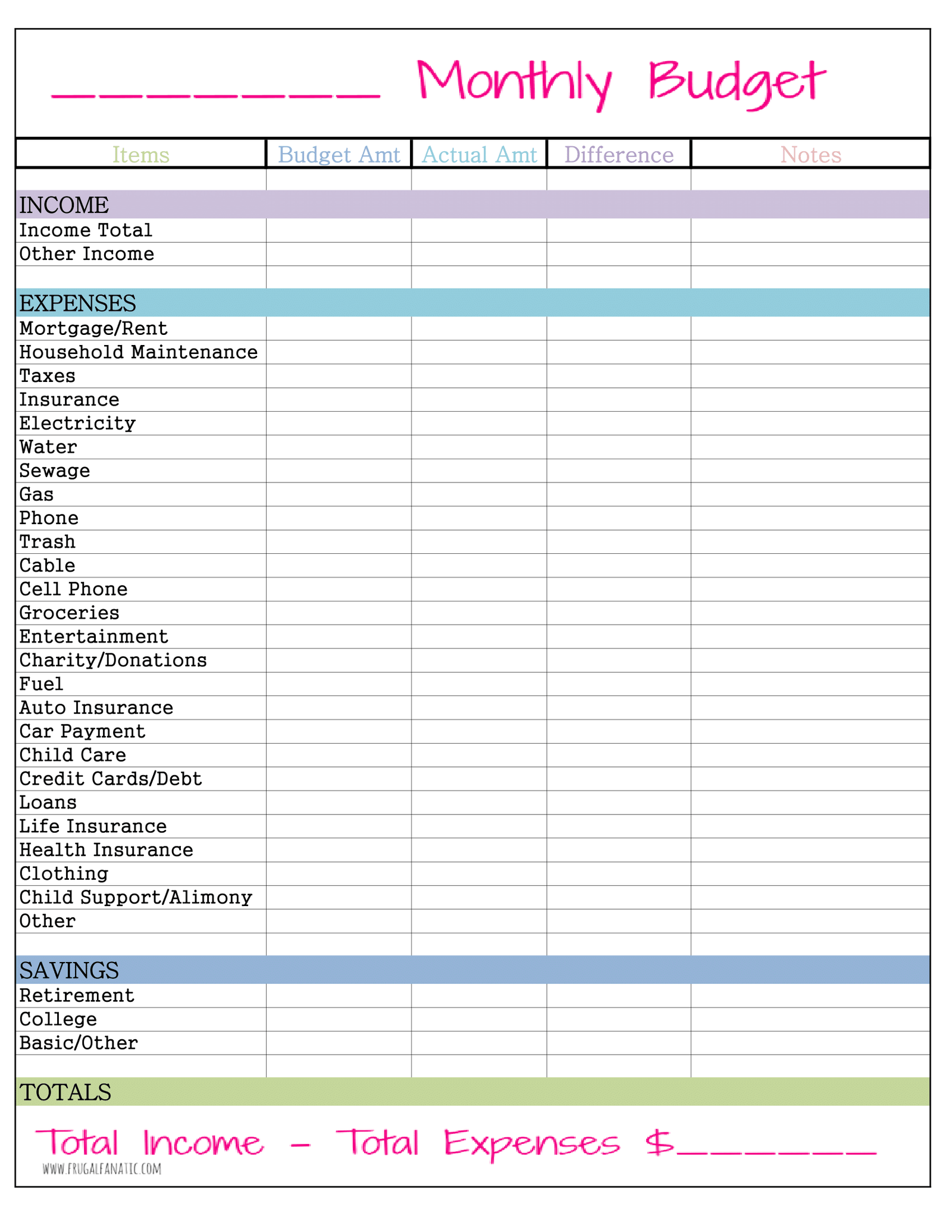

Monthly Budget Planner Form - Download FREE Template Creating a monthly budget plan is an essential part of managing your finances, whether you’re an individual or a family. It helps you keep track of your income, expenses, savings, and investments, and enables you to make informed decisions about your money. At Officewriting.com, we understand the importance of having a comprehensive and easy-to-use budget planner form. That’s why we’ve designed a FREE template that offers all the features and tools you need to manage your finances effectively. Our monthly budget planner form is available for download, and it comes with a range of customizable options that allow you to tailor it to your unique financial situation. Whether you’re looking to save money for a big purchase, pay off debt, or simply want to keep your finances in order, our form will help you achieve your goals. Getting started with our monthly budget planner form is easy. All you need to do is download it from our website, and you’re ready to go. Here’s a closer look at the features and benefits of our template: H2: Customizable Income and Expense Categories Our monthly budget planner form comes with customizable income and expense categories that allow you to track your income and spending in a detailed and organized manner. You can add or remove categories based on your individual needs, and we’ve included some popular categories to get you started.  P: Some of the categories you can include in your income section are: - Salary - Freelance/work-from-home income - Investment income - Rental income - Government benefits Some of the categories you can include in your expenses section are: - Rent/mortgage - Utilities - Transportation - Groceries - Debt payments - Entertainment By having a detailed breakdown of your income and expenses, you’ll be able to identify areas where you can cut back on spending and allocate more funds towards your financial goals. H2: Monthly Overview Section Our monthly budget planner form includes a monthly overview section that provides a snapshot of your finances for the month. This section includes your total income, expenses, and savings for the month, and helps you track your progress towards your financial goals. P: Being able to see your financial standing at a glance is incredibly valuable, as it allows you to quickly identify any discrepancies or areas where you need to make adjustments. With this information, you can make informed decisions about how to allocate your funds and prioritize your spending. H2: Customizable Savings and Investment Tracker Our monthly budget planner form includes a customizable savings and investment tracker that enables you to track your progress towards your savings goals. This section includes a breakdown of your savings and investment accounts, along with their balances. P: You can customize this section by adding or removing accounts and updating your balances as needed. By tracking your savings and investments, you’ll be able to ensure that you’re on track to meet your financial goals and make any necessary adjustments along the way. H2: Customizable Budget and Actual Expense Tracker Our monthly budget planner form includes a customizable budget and actual expense tracker that enables you to compare your planned spending to your actual spending for each category. This section includes columns for the budgeted amount, actual amount spent, and the difference between the two. P: By comparing your planned spending to your actual spending, you can identify areas where you overspent and adjust your budget for the following month. This section also helps you track your progress towards your financial goals and make informed decisions about your spending. In conclusion, our monthly budget planner form is an essential tool for anyone looking to manage their finances effectively. With its customizable options and easy-to-use interface, it provides a comprehensive solution for tracking your income, expenses, savings, and investments. Download it for FREE today and take control of your financial future!

P: Some of the categories you can include in your income section are: - Salary - Freelance/work-from-home income - Investment income - Rental income - Government benefits Some of the categories you can include in your expenses section are: - Rent/mortgage - Utilities - Transportation - Groceries - Debt payments - Entertainment By having a detailed breakdown of your income and expenses, you’ll be able to identify areas where you can cut back on spending and allocate more funds towards your financial goals. H2: Monthly Overview Section Our monthly budget planner form includes a monthly overview section that provides a snapshot of your finances for the month. This section includes your total income, expenses, and savings for the month, and helps you track your progress towards your financial goals. P: Being able to see your financial standing at a glance is incredibly valuable, as it allows you to quickly identify any discrepancies or areas where you need to make adjustments. With this information, you can make informed decisions about how to allocate your funds and prioritize your spending. H2: Customizable Savings and Investment Tracker Our monthly budget planner form includes a customizable savings and investment tracker that enables you to track your progress towards your savings goals. This section includes a breakdown of your savings and investment accounts, along with their balances. P: You can customize this section by adding or removing accounts and updating your balances as needed. By tracking your savings and investments, you’ll be able to ensure that you’re on track to meet your financial goals and make any necessary adjustments along the way. H2: Customizable Budget and Actual Expense Tracker Our monthly budget planner form includes a customizable budget and actual expense tracker that enables you to compare your planned spending to your actual spending for each category. This section includes columns for the budgeted amount, actual amount spent, and the difference between the two. P: By comparing your planned spending to your actual spending, you can identify areas where you overspent and adjust your budget for the following month. This section also helps you track your progress towards your financial goals and make informed decisions about your spending. In conclusion, our monthly budget planner form is an essential tool for anyone looking to manage their finances effectively. With its customizable options and easy-to-use interface, it provides a comprehensive solution for tracking your income, expenses, savings, and investments. Download it for FREE today and take control of your financial future!