Money is always a topic of concern for everyone - no matter how old or young they are, what profession they are in, or what their family background is. One of the most popular methods of saving money is the 52-week savings challenge. It’s simple, effective, and can help you save a decent amount of money over the course of a year.

52-Week Savings Challenge

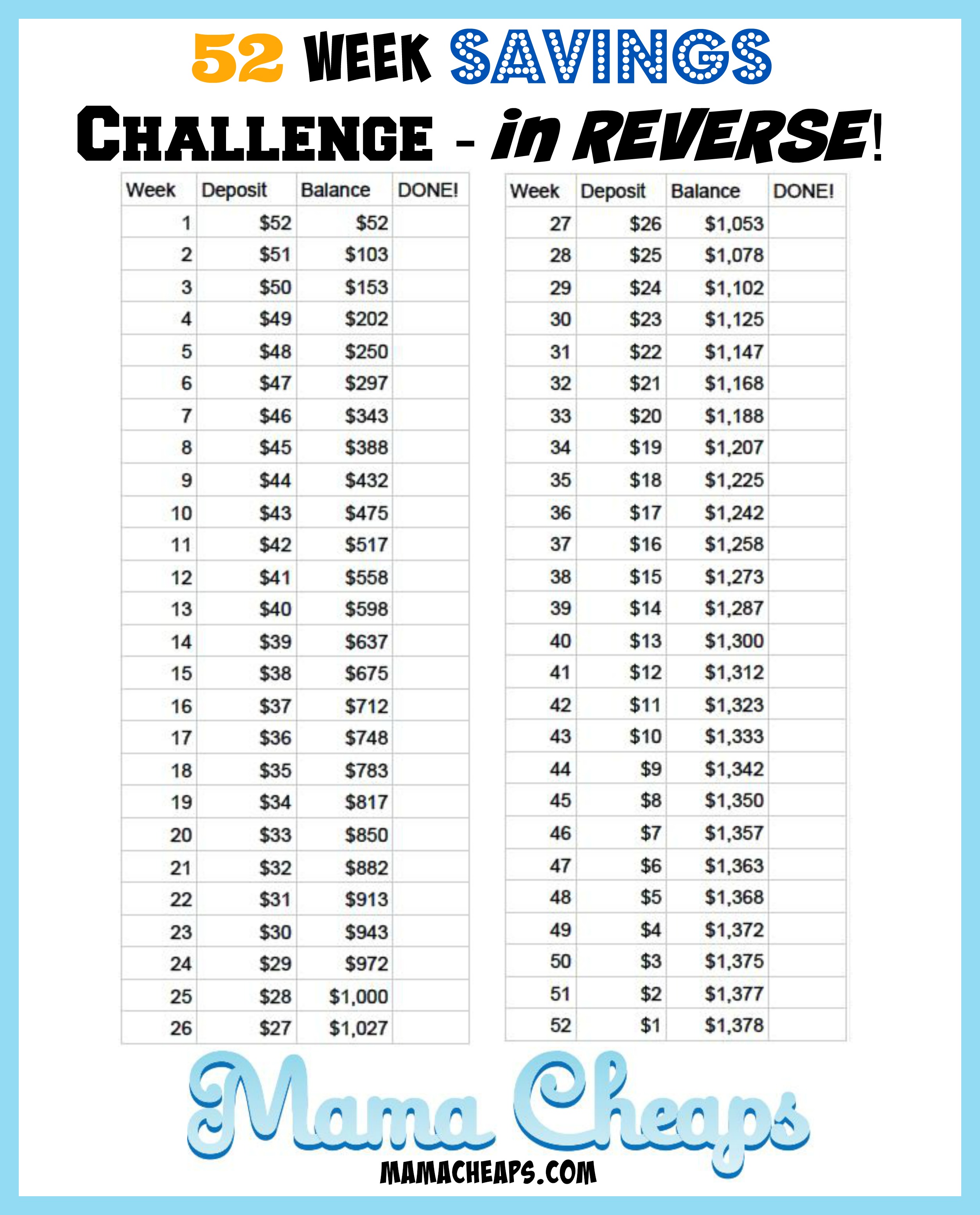

The 52-week savings challenge is a simple plan where you save a fixed amount of money each week, for 52 weeks. The amount of money you save each week increases incrementally - starting from $1 in the first week and increasing by $1 every week.

This means by the end of the 52nd week, you would have saved $1,378! Sounds exciting, right?

The best part about this plan is that it is flexible; you can start with any amount and at any time of the year. The goal is to save as much as you can within a year, but even if you can’t complete it, at least you would have saved a significant amount of money.

The best part about this plan is that it is flexible; you can start with any amount and at any time of the year. The goal is to save as much as you can within a year, but even if you can’t complete it, at least you would have saved a significant amount of money.

The Benefits of the 52-Week Savings Challenge

So, why should you take up this challenge?

- Develop a Savings Habit: The challenge helps you get into the habit of saving regularly, making it easier for you to set aside money for other future goals.

- Build Emergency Funds: The money you save can be used as an emergency fund to protect you against unexpected crises or to fund unexpected expenses.

- Save for a Specific Goal: If you have a specific goal in mind, such as buying a car or going on a vacation, you can use the challenge to save money for it.

- Less Pressure: The challenge is less daunting as it takes a gradual approach to saving, making it easier to achieve your goals.

How to Get Started:

Getting started with the 52-week savings challenge is simple.

- Download and print the 52-week savings plan printable. You can find several free printables online that you can use.

- Decide on a starting point. You can start with any amount that makes sense for you. If you can’t save as much in the beginning, don’t worry - start with a smaller amount of $5 or $10.

- Decide on a savings method. You can save money in cash or use a savings account. If you use a savings account, you might earn interest on the amount you save.

- Set aside some time to review your progress every week. This will help you stay on track and motivate you to keep going.

- Stick to your plan, no matter what. Don’t give up, even if you miss a week or two. You can always make up for it in the next few weeks.

Tips for Saving More:

The 52-week savings challenge is just the beginning; there are several other ways to save money throughout the year. Here are a few tips:

- Track Your Spending: Use a budget tracker to see where your money goes every month. This will help you identify areas where you can cut back and save some extra cash.

- Eliminate Excessive Expenses: Cut back on expenses such as eating out, entertainment, and unnecessary subscriptions that you don’t use often.

- Avoid Impulse Purchases: Before making a purchase, ask yourself if you need it or if it’s just an impulse. You can also wait a few days before making a purchase to see if it’s something you really need.

- Automate Your Savings: Consider setting up automatic transfers to your savings account each week. This will make it easier to save, and you won’t have to worry about forgetting to transfer money.

- Use Coupons and Discounts: Before making a purchase, search for coupons and discount codes online to save extra cash.

Conclusion:

The 52-week savings challenge is a simple, effective, and flexible method to save money. It can help you get into the habit of saving regularly and can build an emergency fund or help you achieve certain goals. Remember, the goal is not to save a set amount of money in a year, but to start saving money regularly and to continue doing so over time.

Good luck on your savings journey!