It’s that time of year again - tax season! As we prepare to file our taxes and report our income, it’s important to familiarize ourselves with the necessary forms, including the 1099 forms. Don’t worry if you’re not sure what these forms are or how to fill them out - we’re here to help!

What is a 1099 form?

A 1099 form is a tax form used to report various types of income that are not considered wages, salaries, or tips. This includes income from self-employment, freelance work, rental properties, and investments, among others. There are several different types of 1099 forms, each used to report a different type of income.

Types of 1099 forms

Here are some of the most common types of 1099 forms:

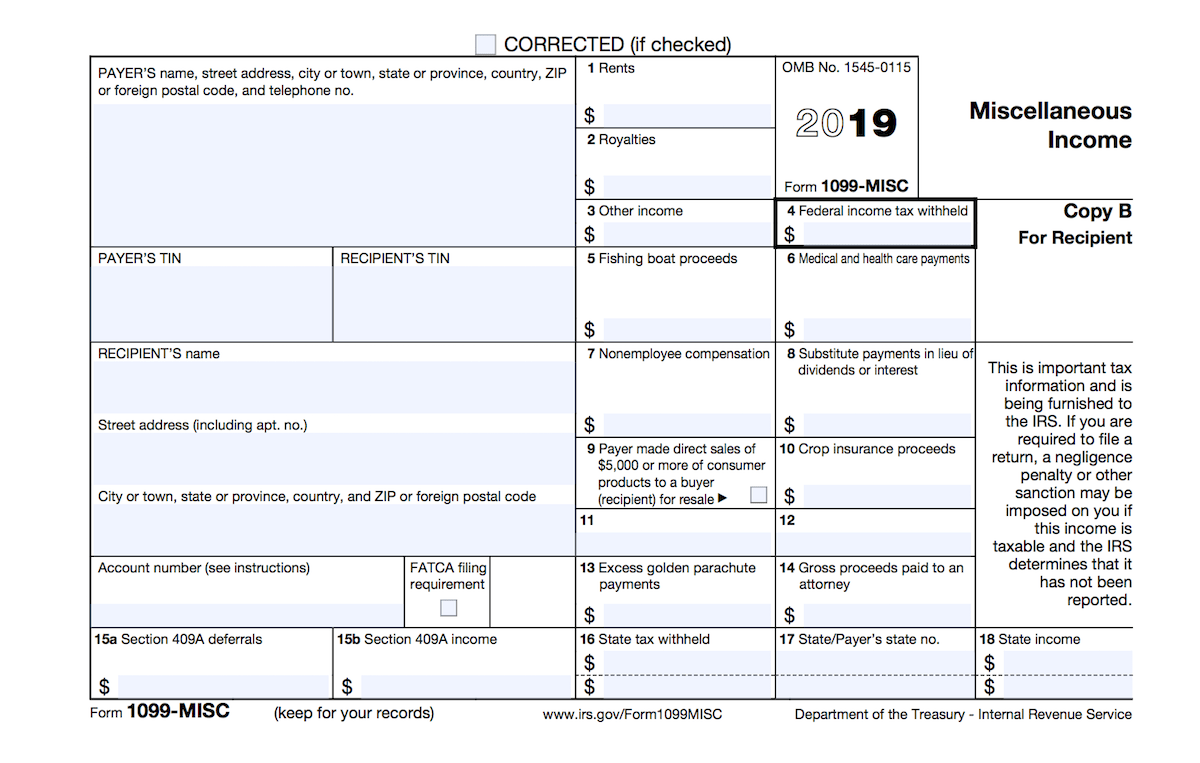

1099-MISC

The 1099-MISC form is used to report miscellaneous income, such as payments made to independent contractors, rent payments, and royalty payments.

### 1099-INT

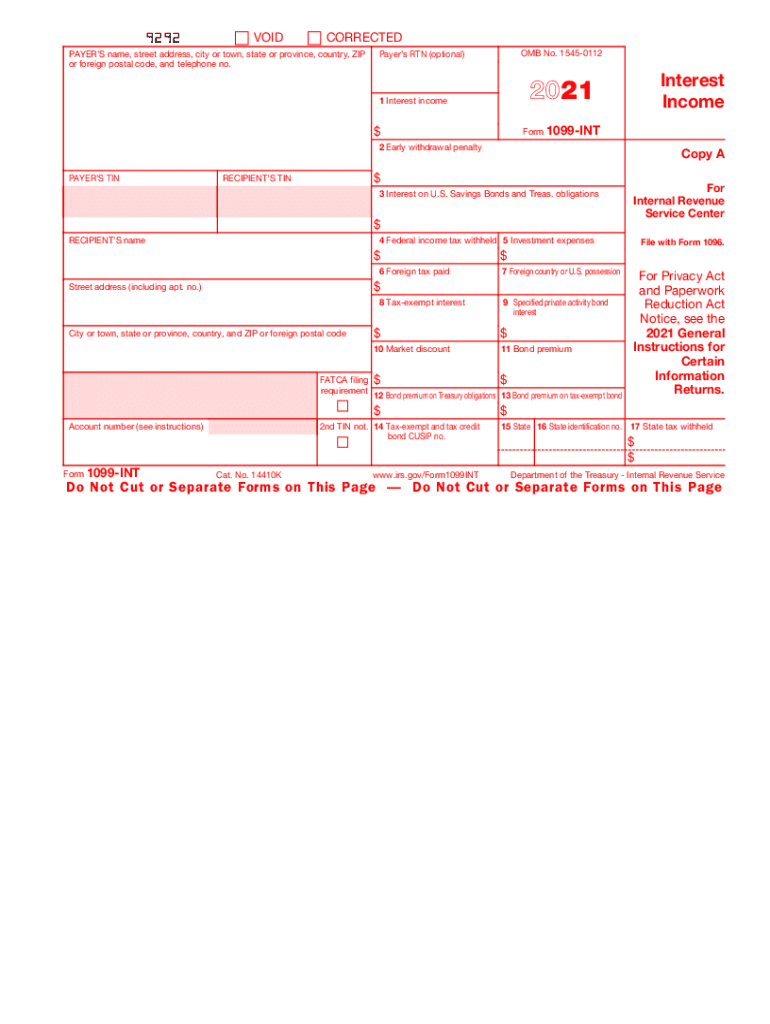

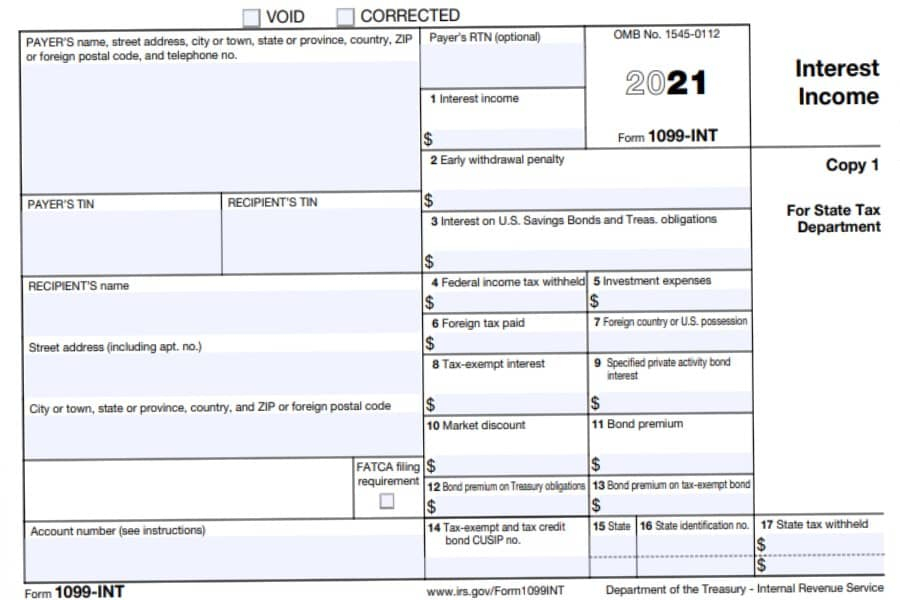

### 1099-INT

The 1099-INT form is used to report interest income of $10 or more, such as interest earned on a savings account or investment.

### 1099-DIV

### 1099-DIV

The 1099-DIV form is used to report dividends and other distributions on stock investments.

### 1099-R

### 1099-R

The 1099-R form is used to report distributions from pensions, annuities, and other retirement plans.

:max_bytes(150000):strip_icc()/1099r-eda9fdcb4d82449da27f9f30a318aaa3.jpg) How to fill out a 1099 form

How to fill out a 1099 form

If you received income that requires you to file a 1099 form, you’ll need to fill out the form and send it to both the recipient and the IRS. Here are the steps:

- Gather your information: You’ll need to know the amount of income you received, as well as the recipient’s name, address, and tax identification number.

- Fill out the form: Each 1099 form will have different fields to fill out, so make sure you read the instructions carefully. You’ll need to provide your name and address, as well as the recipient’s information and the amount of income you paid them.

- Send the form: Once you’ve completed the form, send a copy to the recipient and a copy to the IRS. The deadline for sending out 1099 forms is January 31st.

It’s important to keep accurate records of your income and expenses throughout the year to make tax season easier. If you’re unsure about anything related to your taxes, consider consulting a tax professional.

Where to find 1099 forms

If you need to file a 1099 form, you can find them online or at most office supply stores. Some websites also offer the ability to file 1099 forms electronically.

IRS website

The IRS website offers a variety of resources for taxpayers, including downloadable 1099 forms. You can access these forms for free at www.irs.gov.

Office supply stores

You can also find 1099 forms at most office supply stores, such as Staples or Office Depot. These forms typically come in packets that include instructions and multiple copies of the form.

### Online filing services

### Online filing services

Several websites offer the ability to file 1099 forms electronically, which can save time and reduce errors. Some popular options include Tax1099 and eFileMyForms.

Conclusion

Understanding the different types of 1099 forms and knowing how to fill them out is an important part of tax season. If you received income that requires you to file a 1099 form, make sure to do so accurately and on time. And remember, keeping thorough records of your income and expenses throughout the year can make tax season a lot less stressful!