The year 2020 saw a lot of changes and one of them was the new Form W-4 release by IRS for employers to use in place of the old form. This new form is designed to help employees better estimate the amount of tax they need to withhold from their paychecks. This is great news for employers and employees alike as it makes the process smoother and more efficient. In this post, we will take a closer look at the new Form W-4 and how it affects employers and employees.

What is Form W-4?

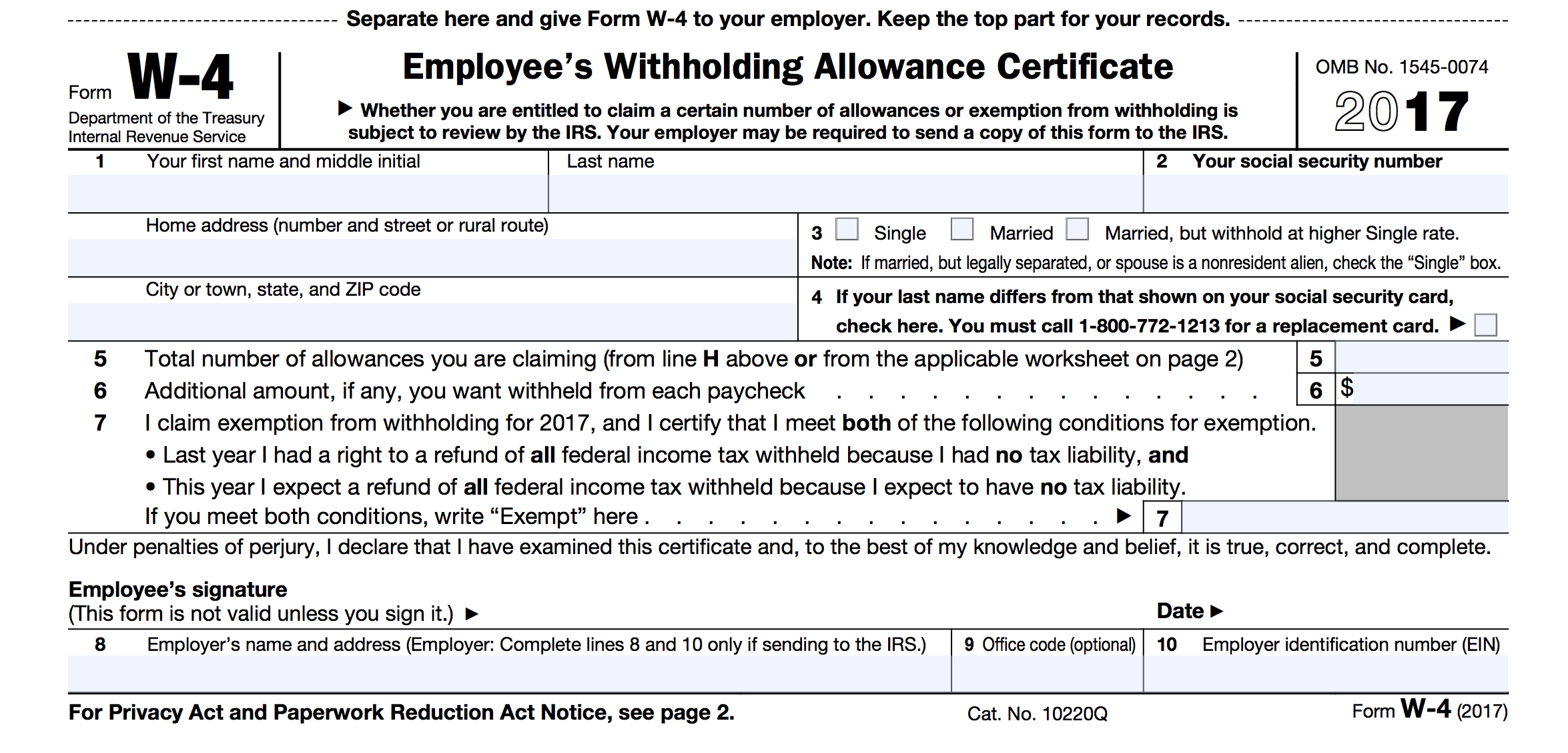

The IRS Form W-4 is an employee’s withholding certificate, which is used by an employer to determine the amount of federal income tax to withhold from an employee’s paycheck. The form includes important details like filing status, number of allowances claimed by the employee, and additional amounts the employee wants to withhold. The employer uses this information to determine how much tax should be withheld from the employee’s paycheck.

Why was a new form necessary?

The previous version of the Form W-4 was confusing, outdated, and often led to employees over- or under-paying taxes. The new form has been designed to make the process simpler and more accurate. By streamlining the information, the IRS aims to make it easier for employees to estimate the right amount of tax needed to be withheld so that they don’t owe a lot or receive a large refund in the end.

How does the new Form W-4 work?

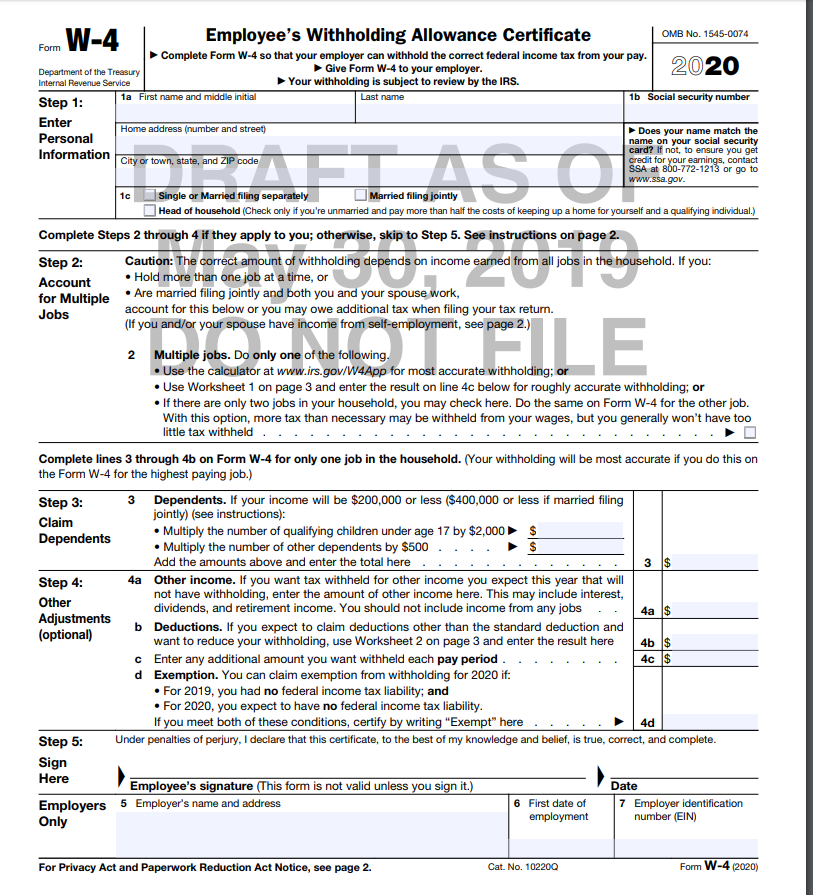

The new Form W-4 uses a five-step process that helps employees determine their withholdings more accurately:

Step 1: Personal information

The first step requires employees to enter basic personal details like name, address, filing status and dependents.

The first step requires employees to enter basic personal details like name, address, filing status and dependents.

Step 2: Multiple jobs or spouse works

Employees with multiple jobs or those who are married to someone who works need to enter their estimated salaries for each job and other income. This information will help the IRS adjust the withholding amounts more accurately.

Employees with multiple jobs or those who are married to someone who works need to enter their estimated salaries for each job and other income. This information will help the IRS adjust the withholding amounts more accurately.

Step 3: Claiming dependents

Employees who have dependents need to enter additional information about them like their age, whether they are eligible for Child Tax Credit, and other details that can help reduce their taxable income.

Employees who have dependents need to enter additional information about them like their age, whether they are eligible for Child Tax Credit, and other details that can help reduce their taxable income.

Step 4: Other adjustments

Under this section, employees can enter additional amounts they want to withhold, like an extra amount each pay period, or an estimated amount of tax they are likely to owe at the end of the year.

Step 5: Signatures

The final step requires employees to sign and date the form, which is then submitted to the employer who takes care of the rest.

The final step requires employees to sign and date the form, which is then submitted to the employer who takes care of the rest.

What do these changes mean for employers?

The new Form W-4 may require more work on the employer’s part to ensure the right amount of federal income tax is being withheld each pay period. Employers may need to do a lot of math to get the formulas right, especially if their employees are claiming multiple jobs or dependents. However, the new form also gives employers the opportunity to educate their employees on better budgeting and tax planning.

What do these changes mean for employees?

The new Form W-4 is easier to understand and helps employees estimate the right amount of federal tax they need to withhold from their paycheck. By getting this right, employees can avoid an unwanted surprise at the end of the year, like a bill for unexpected taxes owed or a reduced refund. It also provides more flexibility to employees who want to adjust their withholdings during the year.

Conclusion

The new Form W-4 is a big improvement over the old one, and it offers a simpler, more accurate way for employees to determine the right amount of tax to withhold from their paychecks. Employers will need to put in a bit more effort, but this is a small price to pay for better accuracy, transparency, and flexibility. We hope you found this guide useful and that it helps you understand the new Form W-4 better.