When it comes to filling out a W-2 form, there are a few key things to keep in mind. Whether you’re an employer or an employee, understanding the ins and outs of this important tax document is essential for making sure everything is filed correctly and on time.

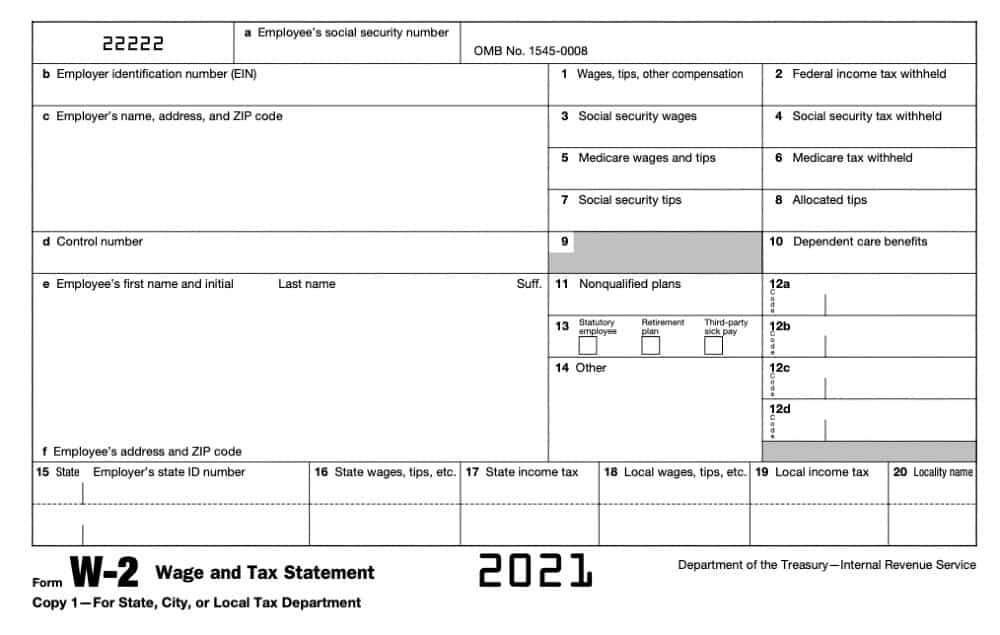

How to Fill Out a W-2 Form

First things first, let’s talk about what a W-2 form actually is. This form is used by employers to report the wages and salaries paid to their employees over the course of the year. If you’re an employee, you’ll receive a W-2 from your employer that you’ll need to use when filing your taxes.

To fill out a W-2 form, you’ll need a few key pieces of information. This includes your employer’s name, address, and Employer Identification Number (EIN), as well as your own name, address, and Social Security Number (SSN). You’ll also need to provide information about your wages and any taxes that were withheld throughout the year.

One thing to keep in mind is that there are a few different copies of the W-2 form: Copy A is sent to the Social Security Administration, Copy 1 is sent to your state or local tax department, Copy B is kept by the employee for their records, and Copy C is sent to the employee’s employer. Make sure you’re filling out the correct copy of the form based on your specific needs.

Once you have all the necessary information, filling out the form itself is fairly straightforward. You’ll need to indicate the tax year (for example, “2021” for taxes filed in 2022), as well as your employer’s EIN and other identifying information.

Once you have all the necessary information, filling out the form itself is fairly straightforward. You’ll need to indicate the tax year (for example, “2021” for taxes filed in 2022), as well as your employer’s EIN and other identifying information.

Next, you’ll need to report your wages and any tips or other compensation you received over the course of the year. This information should be broken down by federal income tax, Social Security tax, and Medicare tax.

If you had any taxes withheld from your paycheck throughout the year (such as federal income tax, Social Security tax, and Medicare tax), you’ll need to report these amounts on the form as well. This includes any additional taxes like state or local taxes that were withheld from your paycheck.

If you had any taxes withheld from your paycheck throughout the year (such as federal income tax, Social Security tax, and Medicare tax), you’ll need to report these amounts on the form as well. This includes any additional taxes like state or local taxes that were withheld from your paycheck.

Once you’ve filled out all the relevant information, make sure to double-check everything for accuracy. Any mistakes or discrepancies could delay the processing of your tax return or result in penalties from the IRS.

Free Printable W-2 Form 2021

If you’re looking for a free printable W-2 form for 2021, there are a few different options available online. For example, eFile.com offers a free printable W-2 form that you can download and fill out on your own.

Another option is to use a paid tax preparation software like TurboTax or H&R Block. These programs will guide you through the process of filling out your W-2 form and ensure that everything is filed correctly.

Another option is to use a paid tax preparation software like TurboTax or H&R Block. These programs will guide you through the process of filling out your W-2 form and ensure that everything is filed correctly.

Regardless of which option you choose, make sure to keep a copy of your completed W-2 form for your own records. This will come in handy if you need to refer back to it later or if there are any discrepancies with your tax return.

How to Download Employee W-2 Withholding Form using Deskera People?

If you’re an employer looking to download an employee W-2 withholding form, Deskera People is a great option. This cloud-based HR management system offers a range of features and tools designed to make it easier to manage your workforce and stay compliant with tax laws.

To download an employee W-2 withholding form using Deskera People, simply follow these steps:

To download an employee W-2 withholding form using Deskera People, simply follow these steps:

- Login to Deskera People and click on the “Payroll” tab in the main menu.

- Click on the “Reports” tab and select “W-2 Forms” from the dropdown menu.

- Select the tax year and employee whose W-2 form you’d like to download.

- Review the information in the form to ensure that it’s accurate, then click “Download” to save the form to your computer.

With Deskera People, downloading employee W-2 withholding forms is quick and easy. Plus, you can rest easy knowing that all of your HR and payroll data is stored securely in the cloud.

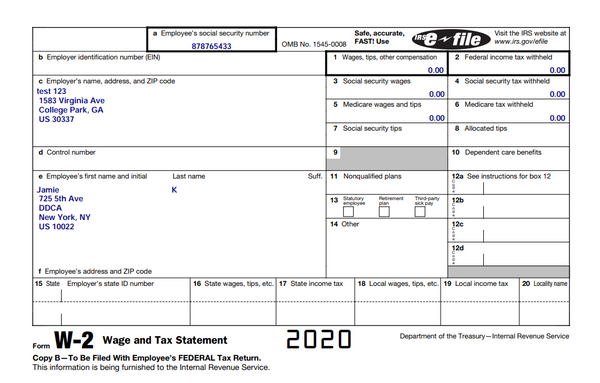

Free W2 Form Generator

If you’re an employer looking to generate W-2 forms for your employees, there are a few different online tools that can help. For example, Amulette Jewelry offers a free W2 form generator that you can use to create professional-looking W-2 forms in just a few minutes.

To use the Amulette Jewelry W2 form generator, simply enter your employee and employer information, choose the tax year, and select any relevant deductions or withholdings. The tool will generate a customized W-2 form that you can download and print out for your records.

To use the Amulette Jewelry W2 form generator, simply enter your employee and employer information, choose the tax year, and select any relevant deductions or withholdings. The tool will generate a customized W-2 form that you can download and print out for your records.

Using a free W2 form generator like this can save you time and effort when it comes to managing your payroll and tax obligations. Just make sure to double-check the accuracy of the forms before distributing them to your employees.

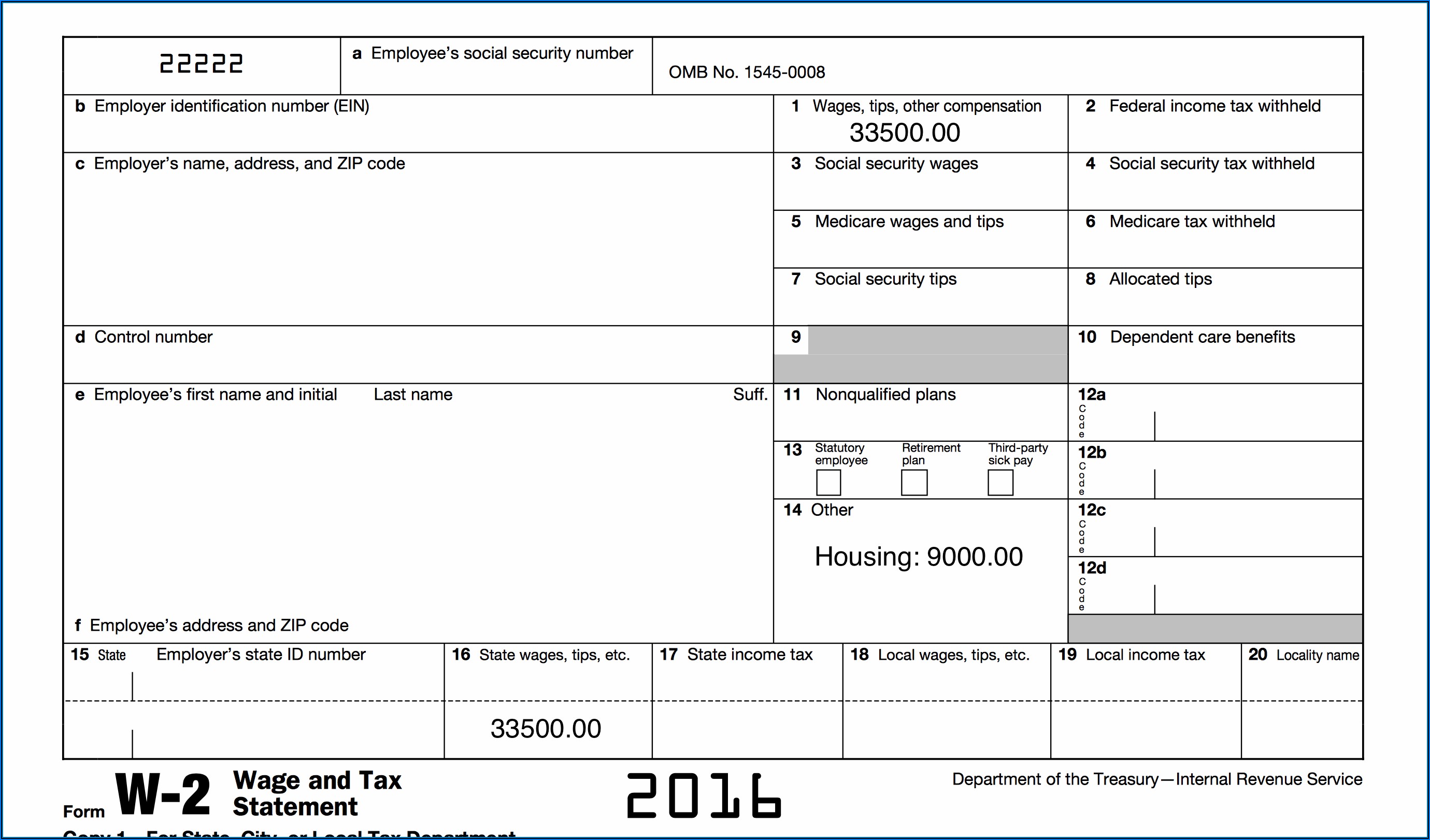

Fillable W-2 Form 2019 Free

Finally, if you’re looking for a free fillable W-2 form for 2019 (or any other year), there are a few different options available online. For example, Contraposition Magazine offers a free fillable W-2 form that you can download, fill out, and print for your records.

Another option is to use a paid tax preparation software like TurboTax or H&R Block. These programs will guide you through the process of filling out your W-2 form and ensure that everything is filed correctly.

Another option is to use a paid tax preparation software like TurboTax or H&R Block. These programs will guide you through the process of filling out your W-2 form and ensure that everything is filed correctly.

When it comes to filling out W-2 forms, having the right tools and resources at your disposal is key. Whether you’re an employer or an employee, taking the time to understand the ins and outs of this important tax document can help ensure that your taxes are filed correctly and on time.