Managing your finances can be just as important as managing your health. In fact, being financially secure can have a positive impact on your overall well-being. That’s why it’s so important to have a budget and stick to it. Fortunately, we’ve found a cute and free budget planner just for you!

Budget Planner

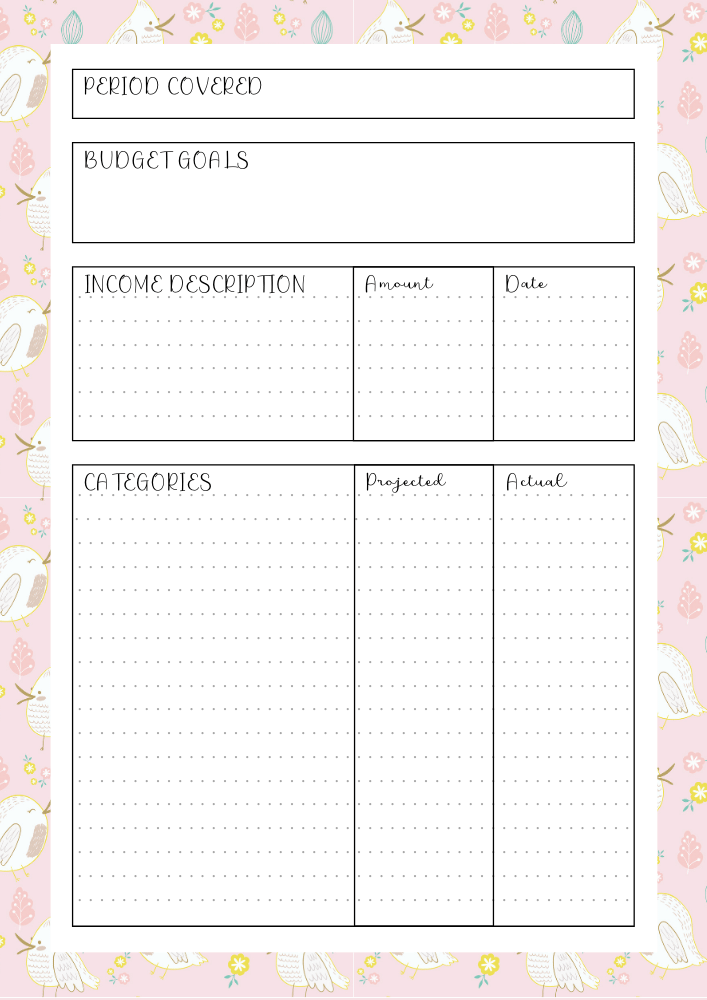

This budget planner is a great way to keep track of your income and expenses. It features spaces for your monthly income, expenses, and savings. You can even write down your financial goals and keep track of your progress.

This budget planner is a great way to keep track of your income and expenses. It features spaces for your monthly income, expenses, and savings. You can even write down your financial goals and keep track of your progress.

How to Use the Budget Planner

Using the budget planner is easy. First, fill in your monthly income. This can include your salary, investments, and any other sources of income you have. Next, write down your monthly expenses. This can include rent, utilities, groceries, and any other expenses you have. Subtract your expenses from your income to determine your available income.

You can then decide how much you want to save each month. You can put this money into a savings account or use it to pay off debt. It’s up to you!

You can then decide how much you want to save each month. You can put this money into a savings account or use it to pay off debt. It’s up to you!

Benefits of Having a Budget

Having a budget can have many benefits. For one, it can help you stay on track and avoid overspending. It can also help you save money and prepare for emergencies. Plus, it can help you achieve your financial goals, whether that’s paying off debt, buying a house, or saving for retirement.

Conclusion

We hope you find this budget planner useful. Remember, creating and sticking to a budget can be a key part of financial success. Good luck!