Managing finances can be a daunting task, especially with the unpredictable nature of expenses. However, there are tools to help stay organized and on top of your finances. One such tool is a budget planner, and we’ve found a free printable one that also includes a mini bills tracker!

Why Use a Budget Planner?

A budget planner is a helpful tool for keeping track of your income and expenses. By creating a budget and sticking to it, you can avoid overspending and ensure that all necessary expenses are covered. It can also help you identify areas where you can save money, such as cutting back on unnecessary subscriptions or eating out less frequently.

The Benefits of a Bills Tracker

In addition to a budget planner, a bills tracker can also be incredibly useful. By keeping track of upcoming bills and due dates, you can avoid late fees and ensure that you have enough funds to cover your expenses. It can also be helpful for identifying any recurring bills that you may be able to negotiate or reduce, such as cable or internet costs.

The Free Printable Budget Planner

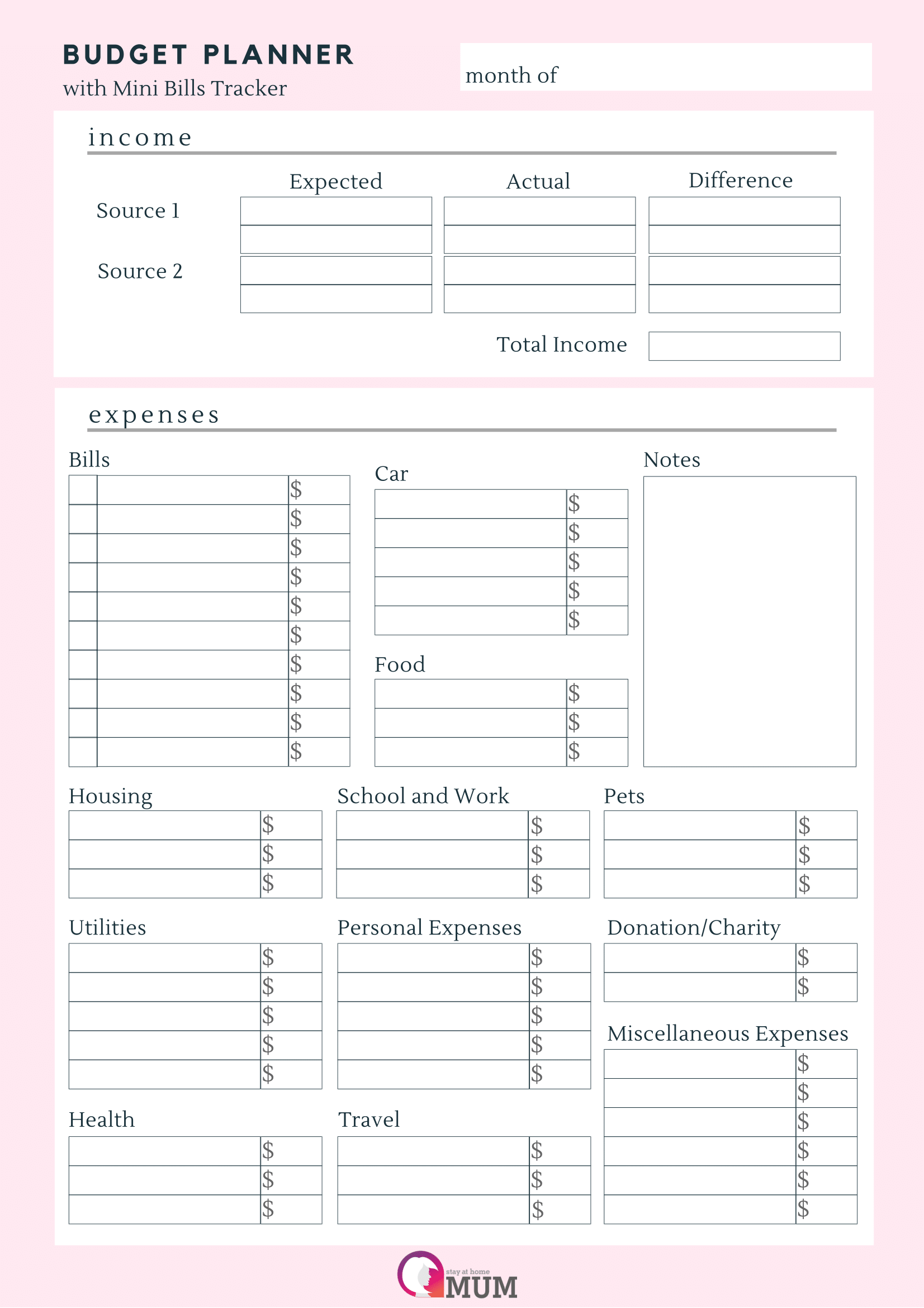

Now, let’s take a closer look at the free printable budget planner we found. The planner includes sections for both income and expenses, as well as a bills tracker. It even includes spaces for tracking savings goals and debt repayment progress.

Now, let’s take a closer look at the free printable budget planner we found. The planner includes sections for both income and expenses, as well as a bills tracker. It even includes spaces for tracking savings goals and debt repayment progress.

How to Use the Budget Planner

Using the budget planner is simple. First, list all of your sources of income, such as your salary or any side hustles. Then, list all of your expenses, such as rent or mortgage payments, utilities, and groceries. Be sure to include any upcoming bills in the bills tracker section.

Once you have listed all of your income and expenses, subtract your total expenses from your total income. The remaining amount is your disposable income, which you can save, use to pay off debt, or allocate towards other goals.

Tips for Sticking to Your Budget

Creating a budget is one thing, but sticking to it is another. Here are a few tips for ensuring that you stay on track:

- Set realistic goals: Don’t set yourself up for failure by creating a budget that is too restrictive or unrealistic. Instead, be honest with yourself and create a budget that is achievable and sustainable.

- Track your expenses: Use the bills tracker section of the budget planner to keep track of upcoming bills and due dates. Additionally, use a separate app or spreadsheet to track your daily expenses so that you can stay on top of your spending.

- Avoid impulse purchases: Before making a purchase, ask yourself if it is a necessary expense or an impulse buy. If it is the latter, consider waiting a few days before making the purchase to ensure that it is something you truly need or want.

- Use cash: For some people, using cash can be a helpful way to stick to a budget. Withdraw the amount of cash you have budgeted for the week or month, and use it for all of your purchases. When the cash is gone, you know that you have reached your spending limit.

- Reevaluate as needed: Finally, be sure to reevaluate your budget periodically to ensure that it is still working for you. If there are any areas that you consistently overspend in, consider adjusting your budget accordingly.

Conclusion

While managing finances can be intimidating, a budget planner can help make the process easier and more manageable. And with the added bonus of a mini bills tracker, the free printable one we found is definitely worth checking out. Remember, it’s never too late to start taking control of your finances and working towards your financial goals!