Managing your company’s finances is a crucial part of running a business, and one important tool for doing so is the general ledger sheet. This document helps you keep track of all the transactions that occur within your company, including income, expenses, assets, and liabilities. By maintaining an accurate and up-to-date general ledger, you can gain a better understanding of your company’s financial health, make informed decisions, and comply with legal and accounting requirements.

Free Printable Ledger Balance Sheets

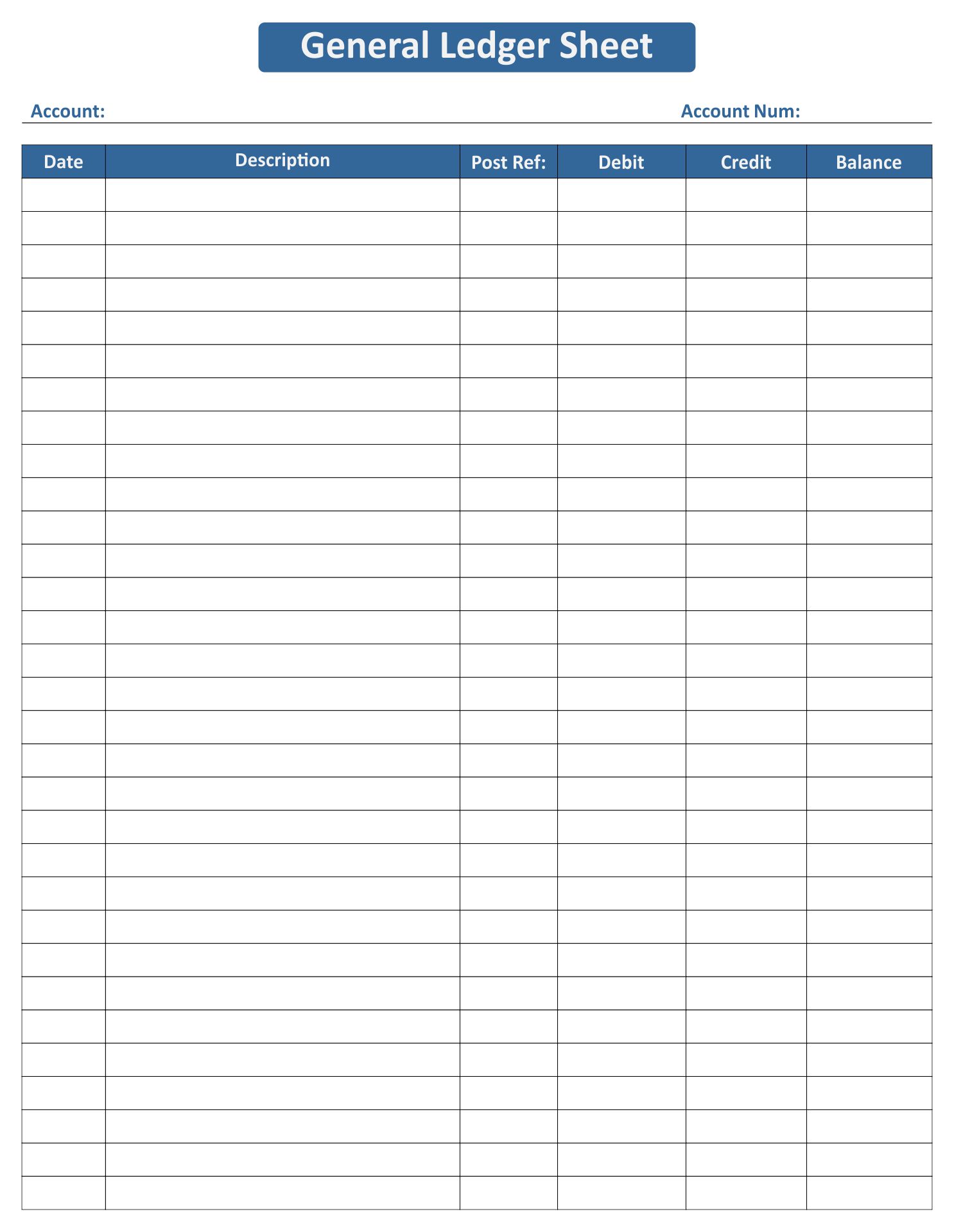

One of the best ways to get started with a general ledger is by using a free printable ledger balance sheet. These sheets are available online and can be downloaded and printed for your convenience. There are many different types of ledger balance sheets available, so you can choose the one that best fits your needs.

One of the best ways to get started with a general ledger is by using a free printable ledger balance sheet. These sheets are available online and can be downloaded and printed for your convenience. There are many different types of ledger balance sheets available, so you can choose the one that best fits your needs.

When selecting a ledger balance sheet, it’s important to ensure that it includes all the necessary sections and columns to help you manage your finances effectively. Some key sections to look for include:

- Account names: This section should list all the accounts you expect to use in your general ledger, such as cash, accounts receivable, accounts payable, inventory, and so on.

- Debit and credit columns: These columns are used to record the amount of money that has been debited or credited to each account. This information is essential for keeping track of your company’s financial transactions.

- Date and description columns: These columns are used to record the date and description of each transaction. This information helps you keep track of when and why each transaction occurred.

- Balance column: This column is used to record the balance of each account after each transaction has been recorded. This allows you to quickly see the current balance of each account and track changes over time.

Using a General Ledger

Once you have a general ledger sheet in place, it’s important to use it correctly in order to get the most out of it. Here are some tips for using your general ledger effectively:

Once you have a general ledger sheet in place, it’s important to use it correctly in order to get the most out of it. Here are some tips for using your general ledger effectively:

- Record all transactions: Be sure to record all financial transactions that occur within your company, no matter how small. This could include purchases, sales, expenses, and payments, among others.

- Use accurate account names: Make sure to use accurate and specific account names when recording transactions. This will help you categorize and track your finances more effectively.

- Record transactions promptly: Record transactions as soon as they occur, rather than waiting until the end of the month or quarter. This will help you keep your records up-to-date and avoid errors.

- Reconcile accounts regularly: Reconcile your accounts regularly to ensure that your ledger is accurate and up-to-date. This includes comparing your ledger to other financial documents, such as bank statements and invoices, to ensure that they match.

- Keep records organized: Keep your records organized and easy to access in case you need to reference them later. This could include creating separate folders for each type of financial document, such as receipts or invoices.

The Benefits of Using a General Ledger

Using a general ledger provides many benefits for your company, including:

- Improved accuracy: A general ledger helps you keep track of all financial transactions accurately and efficiently, reducing the risk of errors or inaccuracies in your records.

- Better decision-making: By having a clear understanding of your company’s financial situation, you can make better-informed decisions about investments, expenses, and other financial matters.

- Compliance with legal requirements: Keeping accurate financial records is essential for complying with legal and accounting requirements, such as tax filings and audits.

- Greater transparency: By maintaining accurate records and providing regular financial reports to stakeholders, you can increase transparency and build trust with customers, investors, and other stakeholders.

Overall, a general ledger is an essential tool for managing your company’s finances effectively. By using a free printable ledger balance sheet and following best practices for recording, reconciling, and organizing financial transactions, you can gain a clear understanding of your company’s financial health and make informed decisions with confidence.