Hey there, saving for your future can be challenging, but it doesn’t have to be. Have you heard of the 52-week savings challenge?

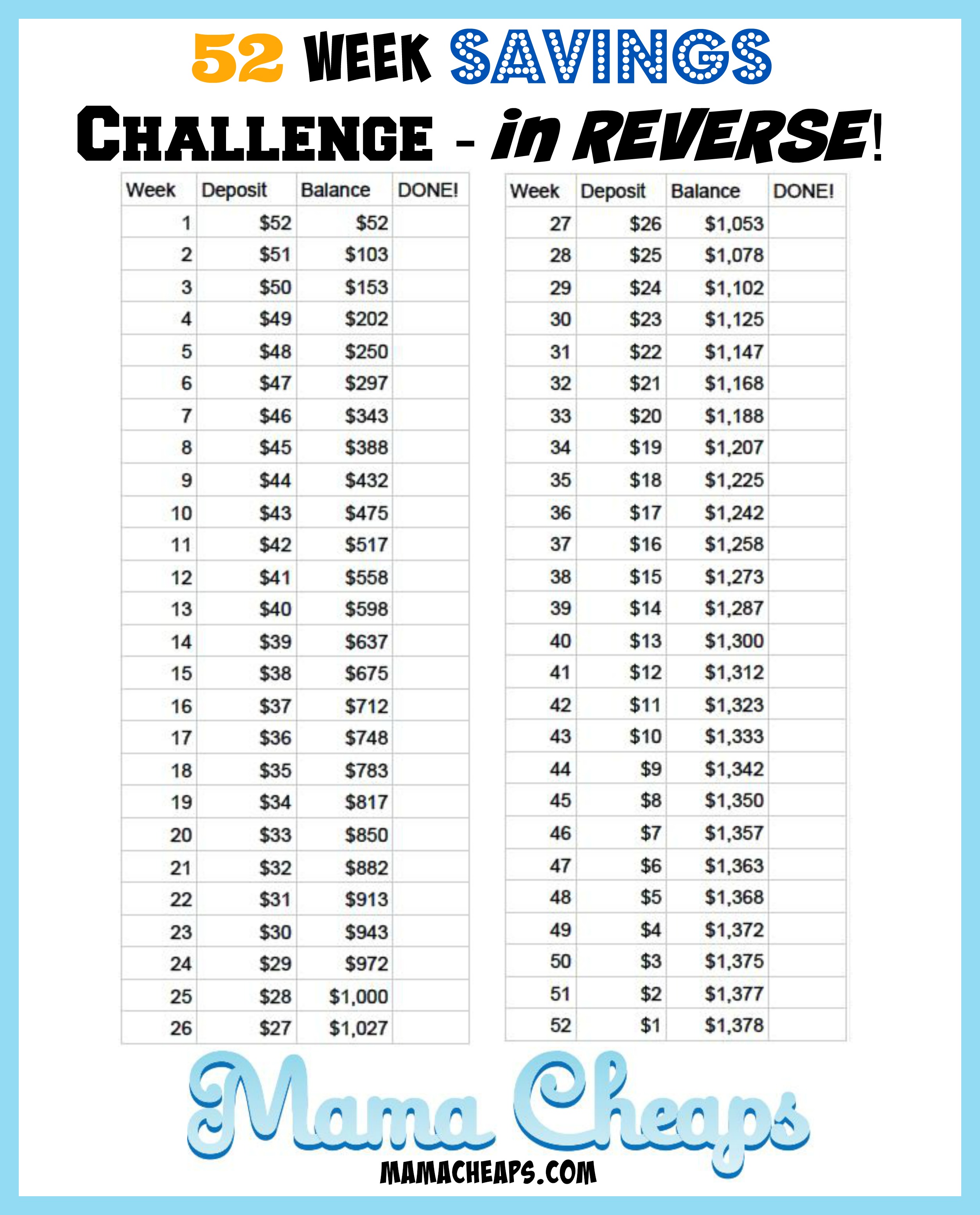

Printable Savings Plan

The 52-week savings challenge is a simple and practical way to save money over a year. The concept is easy, save a specific amount each week, and by the end of the year, you’ll have a decent sum of money.

The 52-week savings challenge is a simple and practical way to save money over a year. The concept is easy, save a specific amount each week, and by the end of the year, you’ll have a decent sum of money.

How it Works

Each week, you save a specific amount, starting from $1 in the first week, $2 in the second week, and so on, until the 52nd week, where you save $52. By the end of the challenge, you’ll have saved $1,378 - not a bad sum of money to have on hand, right?

The printable savings plan makes it easy to track your savings week by week. You can print it out and track your progress along the way. Plus, it’s a great way to visualize your progress and stay motivated to continue saving each week.

Breaking it Down

Let’s take a look at how the savings challenge works in more detail. In the first week, you save $1, which may not seem like a lot, but it’s a start. In the second week, you double the amount and save $2, bringing your total savings to $3.

By the end of the first month, your total savings will be $10. It may not seem like a lot, but you’re on your way. By the end of the second month, your total savings will be $45. Still not a massive amount, but you’re steadily increasing your savings each week.

By the end of six months, you’ll have saved $546. That’s a decent amount of money, and you’re officially halfway through the challenge.

By the end of nine months, your savings will have increased to $1,215. It’s starting to add up now, and you’ll be proud of how much you’ve saved.

Finally, by the end of the 52 weeks, you’ll have saved $1,378. You did it! You completed the 52-week savings challenge, and you’ll be proud of your achievement.

The Benefits of Saving Money

There are several benefits to saving money, and the 52-week savings challenge is an excellent way to get started.

Emergency Fund

By saving money each week, you’ll have a decent emergency fund built up. Life can throw curveballs at us at any time, and having an emergency fund can help ease the financial burden when unexpected situations arise.

Pay off Debt

If you have debt, the savings challenge can help you pay it off quicker. Even if you’re only saving a few dollars each week, it adds up over time, and you can use the money to pay off your debt faster.

Big Purchases

The savings challenge can also help you save for big purchases you’ve been putting off. It could be a new car, vacation, or anything else you’ve been wanting to buy but couldn’t afford.

Tips for Success

While the savings challenge is a great way to save money, it does require some discipline and effort. Here are some tips to help you succeed:

Set a Goal

Set a specific savings goal and write it down. Having a goal in mind will help you stay motivated and focused on saving.

Make it Automatic

Automate your savings each week. Set up an automatic transfer from your checking to your savings account each week. This will make saving a habit and remove the temptation to spend the money elsewhere.

Cut Back on Expenses

Look at your expenses and see where you can cut back. It could be as simple as making your coffee at home instead of buying it every day.

Stay Motivated

Track your progress each week and celebrate your milestones. It will help you stay motivated and on track to complete the challenge.

Final Thoughts

The 52-week savings challenge is a simple and practical way to save money over a year. It may not seem like a lot each week, but it quickly adds up, and by the end of the challenge, you’ll have a decent sum of money. Plus, it’s an excellent way to build a savings habit and improve your financial well-being.

So why not give it a try? Print out the savings plan, set your savings goal, and start saving! You’ll be proud of yourself by the end of the challenge, and your future self will thank you for it.