It’s that time of year again – tax season. And as you gather your documents and receipts, don’t forget about one important form – the IRS Form W4. This form is used to determine how much federal income tax should be withheld from your paycheck.

The Basics of the IRS Form W4 2022

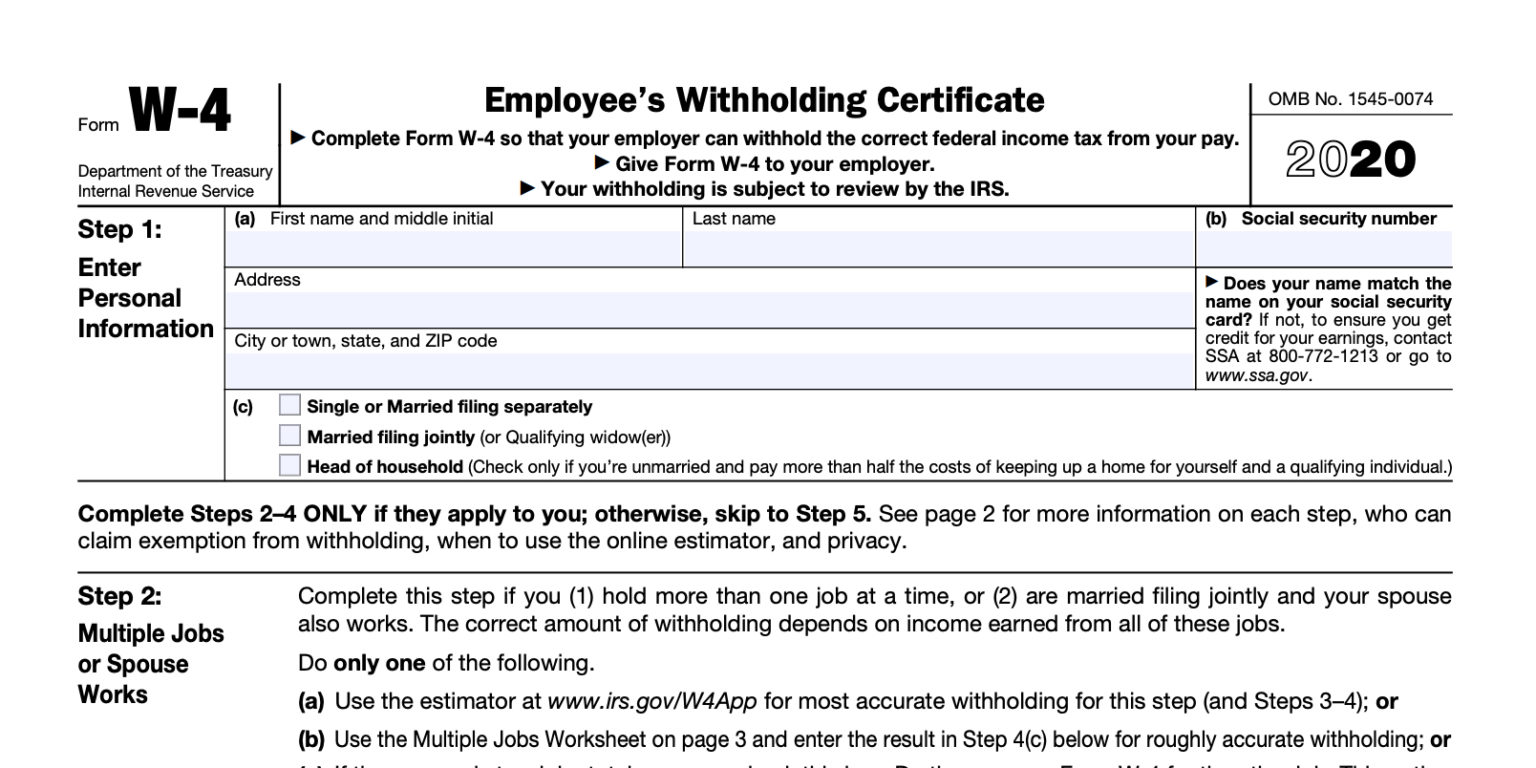

Before we dive into the details, let’s start with the basics. The IRS Form W4 is officially titled “Employee’s Withholding Certificate.” It allows you to tell your employer how much federal income tax to withhold from each paycheck.

You’ll need to fill out a new W4 form anytime your tax situation changes, such as getting a new job or having a child. Changes made on the new W4 form will not affect previous paycheck withholdings – they will only apply to future paychecks.

Now, let’s take a closer look at the sections of the form.

Personal Information

The first section of the form is for your personal information. This includes your name, address, Social Security number, and filing status. Your filing status is important because it affects your tax rate and your standard deduction. The choices for filing status are:

- Single or married filing separately

- Married filing jointly or qualifying widow(er)

- Head of household

Multiple Jobs or Two-Earner Households

The second section of the W4 form is for those who have multiple jobs, or for those who are married and both spouses work. This section helps to ensure that the correct amount of tax is withheld from your paychecks.

Claiming Dependents

The third section of the form is for those who will claim dependents on their tax return. You can claim a dependent if they are a qualifying child or a qualifying relative. To be a qualifying child, the child must:

- Be under the age of 19 (or 24 if a full-time student)

- Live with you for more than half the year

- Have a Social Security number

To be a qualifying relative, the person must:

- Be related to you (or live with you for the entire year)

- Have a gross income of less than $4,300 (in 2021)

- Not be a qualifying child of someone else

Other Adjustments

The fourth section of the W4 form is for any other adjustments you want to make to your tax withholding. This can include additional income, deductions, and extra tax you want withheld. This section is optional, but can be helpful if you have a complex tax situation.

Sign and Date

The final section of the form is for you to sign and date. Make sure to sign and date the form before giving it to your employer.

Why It’s Important to Review Your W4

Reviewing your W4 form is important because it can affect how much money you take home in each paycheck. If you withhold too much, you could be giving the government an interest-free loan. If you withhold too little, you may end up owing the IRS money at tax time.

It’s a good idea to review your W4 form anytime your tax situation changes. This can include getting married, having a child, or starting a new job. By making adjustments to your withholding, you can ensure that you are paying the correct amount of tax throughout the year.

Where to Get a W4 Form

You can get a W4 form from your employer, or you can download it from the IRS website. The form is available in both PDF and HTML formats, making it easy to access and fill out.

Conclusion

The IRS Form W4 is an important document that determines how much federal income tax is withheld from your paycheck. Reviewing and updating your form regularly can help ensure that you are paying the correct amount of tax and maximizing your take-home pay.

Get Started Today

Get Started Today

If you haven’t reviewed your W4 form recently, now is the time to do so. By taking a few minutes to fill out the form correctly, you can help ensure that you are paying the correct amount of tax and maximizing your take-home pay. As always, consult with a tax professional if you have any questions or concerns.

Thanks for reading, and happy filing!