As the year draws to a close, it’s important to start thinking about taxes and preparing for the upcoming tax season. One crucial aspect of this preparation is filling out your W-4 form correctly. Luckily, there are numerous printable options available to make this task easier. Here are ten options for W-4 forms you can print out and use for the 2022 tax season.

2022 IRS W-4 Form | HRdirect

This W-4 form is provided by HRdirect and features the 2022 IRS W-4 form. The form includes space for your personal information, allowances, deductions, and additional income. The accompanying instructions also provide helpful guidance as you fill out the form.

This W-4 form is provided by HRdirect and features the 2022 IRS W-4 form. The form includes space for your personal information, allowances, deductions, and additional income. The accompanying instructions also provide helpful guidance as you fill out the form.

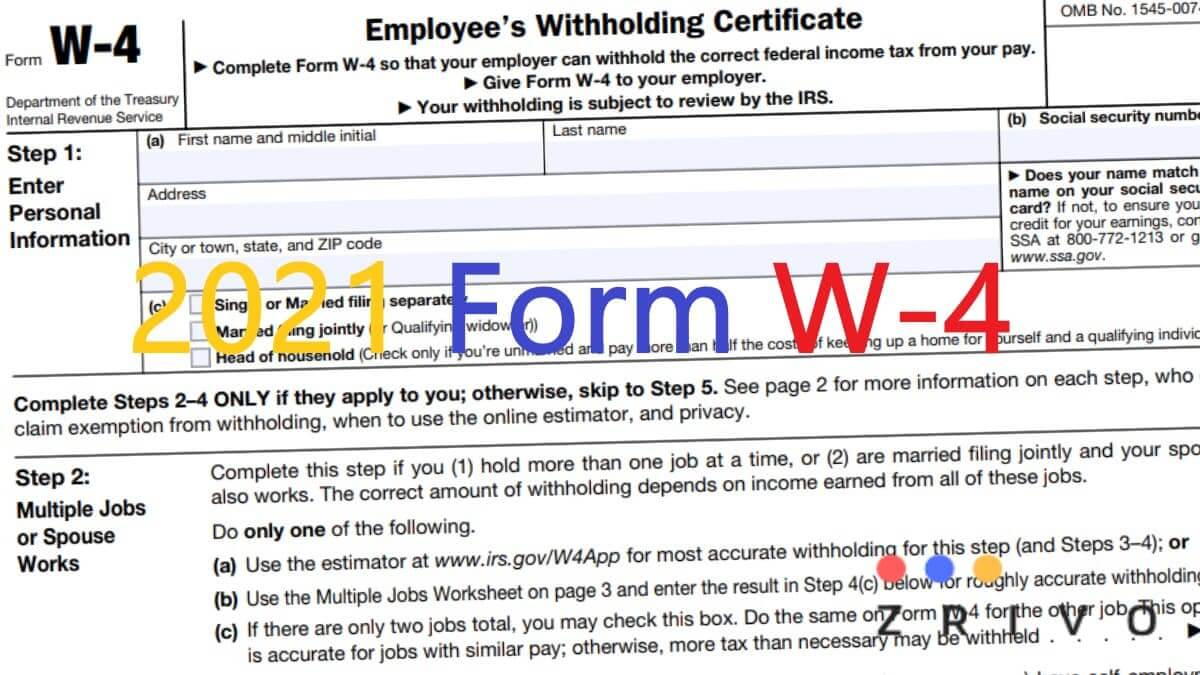

2021 W-4 Form Printable | Calendar Template Printable Monthly Yearly

This printable W-4 form is provided by Calendar Template Printable Monthly Yearly and features the 2021 version of the form. The form includes space for personal information, allowances, and additional withholding amounts. The instructions are printed directly on the form for added convenience.

This printable W-4 form is provided by Calendar Template Printable Monthly Yearly and features the 2021 version of the form. The form includes space for personal information, allowances, and additional withholding amounts. The instructions are printed directly on the form for added convenience.

W 4 2022 Form Printable - W4 Form 2022 Printable

This W-4 form printable is provided by W4 Form 2022 Printable and features the 2022 version of the form. The form includes space for personal information, allowances, and additional withholding amounts. The instructions are provided separately on the website.

This W-4 form printable is provided by W4 Form 2022 Printable and features the 2022 version of the form. The form includes space for personal information, allowances, and additional withholding amounts. The instructions are provided separately on the website.

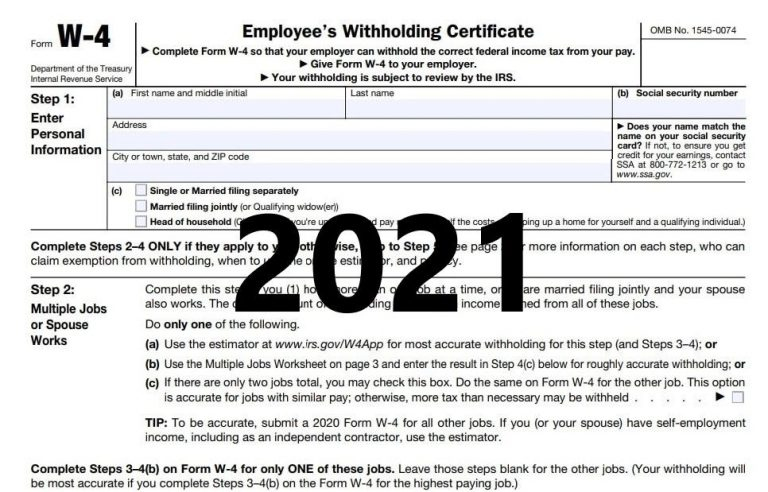

Printable W 4 Forms Employee 2021 - 2022 W4 Form

This printable W-4 form is provided by W4 Form Printable and features both the 2021 and 2022 versions of the form. The form includes space for personal information, allowances, additional withholding amounts, and filing status. The instructions are also included on the form for added convenience.

This printable W-4 form is provided by W4 Form Printable and features both the 2021 and 2022 versions of the form. The form includes space for personal information, allowances, additional withholding amounts, and filing status. The instructions are also included on the form for added convenience.

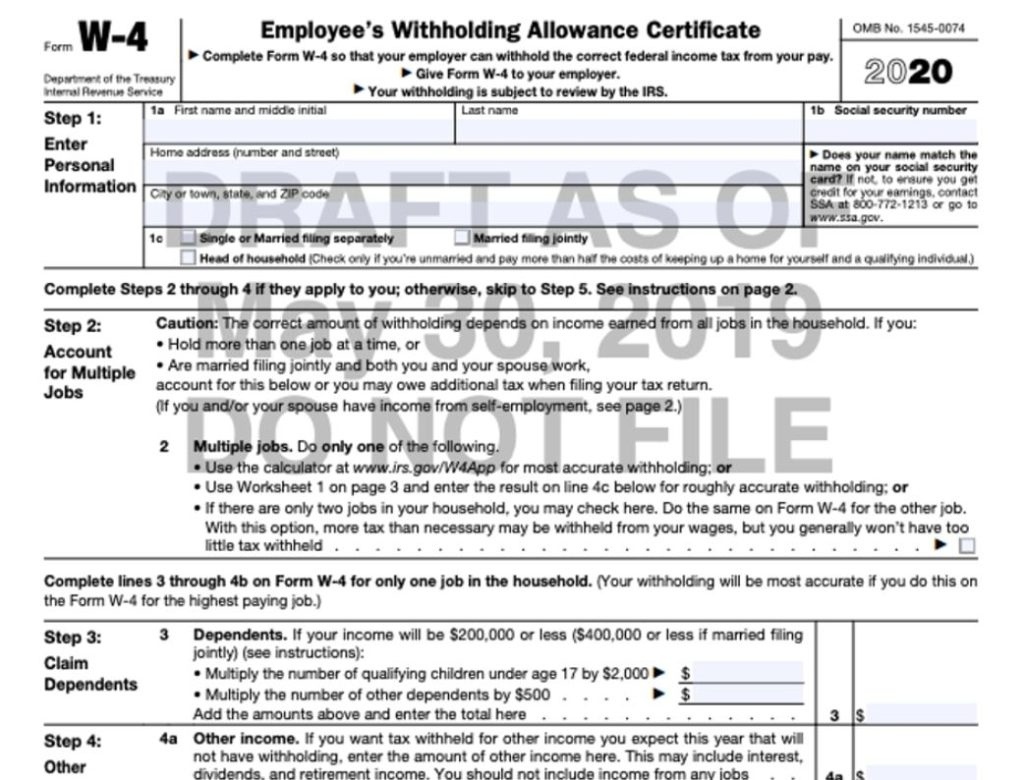

Blank W4 Form 2021 - 2022 W4 Form

This W-4 form is provided by W4 Forms Printable and features both the 2021 and 2022 versions of the form. The form is blank, allowing you to fill in your personal information, allowances, additional withholding amounts, and filing status. The instructions are also provided on the website.

This W-4 form is provided by W4 Forms Printable and features both the 2021 and 2022 versions of the form. The form is blank, allowing you to fill in your personal information, allowances, additional withholding amounts, and filing status. The instructions are also provided on the website.

Blank W 4 Form 2021 Printable - 2022 W4 Form

This printable W-4 form is provided by W4 Forms Printable and features both the 2021 and 2022 versions of the form. The form is blank, allowing you to fill in your personal information, allowances, additional withholding amounts, and filing status. The instructions are also included on the form for added convenience.

This printable W-4 form is provided by W4 Forms Printable and features both the 2021 and 2022 versions of the form. The form is blank, allowing you to fill in your personal information, allowances, additional withholding amounts, and filing status. The instructions are also included on the form for added convenience.

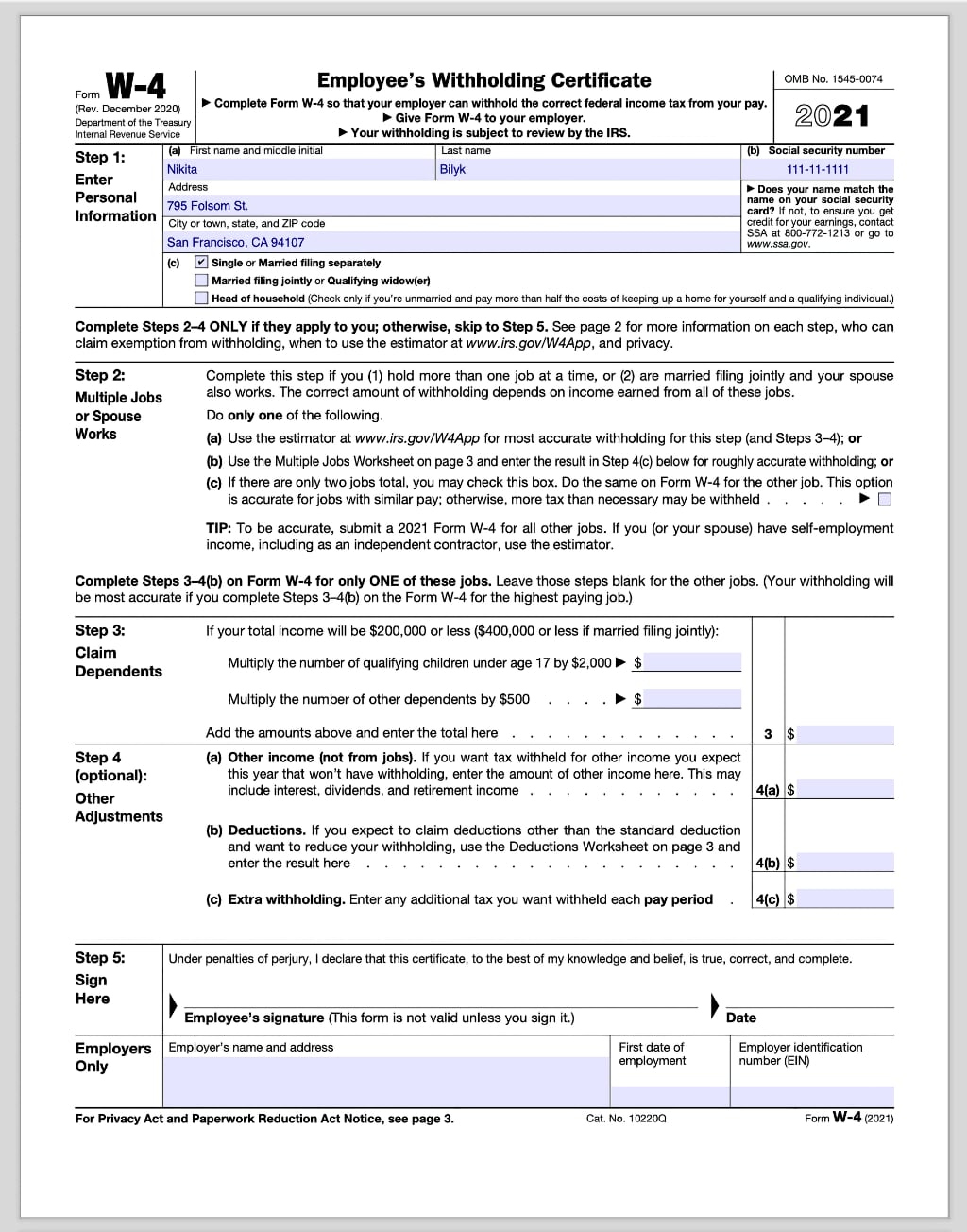

W4 Form 2021 - W-4 Forms - TaxUni

This printable W-4 form is provided by TaxUni and features the 2021 version of the form. The form includes space for personal information, allowances, and additional withholding amounts. The instructions are also included on the form for added convenience.

This printable W-4 form is provided by TaxUni and features the 2021 version of the form. The form includes space for personal information, allowances, and additional withholding amounts. The instructions are also included on the form for added convenience.

Michigan W 4 2021 - 2022 W4 Form

This Michigan W-4 form is provided by W4 Forms Printable and features both the 2021 and 2022 versions of the form. The form includes space for personal information, allowances, additional withholding amounts, and filing status. The instructions are also provided on the website.

This Michigan W-4 form is provided by W4 Forms Printable and features both the 2021 and 2022 versions of the form. The form includes space for personal information, allowances, additional withholding amounts, and filing status. The instructions are also provided on the website.

W4 Form 2022 Printable

This W-4 form printable is provided by W4 Form 2022 Printable and features the 2022 version of the form. The form includes space for personal information, allowances, and additional withholding amounts. The instructions are provided separately on the website.

This W-4 form printable is provided by W4 Form 2022 Printable and features the 2022 version of the form. The form includes space for personal information, allowances, and additional withholding amounts. The instructions are provided separately on the website.

NC W-4 Form Instructions | W-4 Form Printable

This printable W-4 form is provided by W4 Form Printable and features the NC W-4 form. The form includes space for personal information, allowances, and additional withholding amounts. The instructions are also included on the form for added convenience.

This printable W-4 form is provided by W4 Form Printable and features the NC W-4 form. The form includes space for personal information, allowances, and additional withholding amounts. The instructions are also included on the form for added convenience.

No matter which of these printable W-4 forms you choose, it’s important to make sure that you fill out the form correctly and completely. Be sure to double-check your information and calculations before submitting the form to your employer. By taking the time to fill out the form correctly, you can ensure that your tax withholding is accurate and that you don’t encounter any unpleasant surprises come tax season.